In this KuCoin Review, we’ll dive deep into what makes KuCoin one of the top exchanges in the cryptocurrency space. Whether you’re a beginner or a seasoned investor, KuCoin offers features that cater to all experience levels. Keep reading this review from CoinReviews to explore KuCoin’s strengths, its key features, and whether it’s the right platform for your crypto trading needs.

KuCoin General Information

| Website | Visit KuCoin |

| Main Location | Seychelles |

| Parent Company | Mek Global Limited |

| Supported Pairs | 700 |

| Has token | Yes |

| Fees | Low |

| Supported Fiat | USD, EUR, GBP, AUD + |

| Daily Volume | 8297.5 BTC |

What Is KuCoin?

KuCoin, established in 2017, stands as a prominent global cryptocurrency exchange that enables users to engage in buying, selling, and trading a vast array of digital assets. Known for prioritizing user experience and pioneering innovations, KuCoin has rapidly attracted millions of traders from around the world, solidifying its reputation as a preferred platform. To ensure accessibility on the go, the KuCoin app is available for both iOS and Android, allowing users to manage their accounts and execute trades seamlessly from their mobile devices.

Central to KuCoin’s mission is a commitment to offering a secure, transparent, and efficient trading environment. The exchange supports a broad spectrum of cryptocurrencies, spanning from major players like Bitcoin, Ethereum, and Litecoin to a wide range of lesser-known altcoins, which attracts both beginner and seasoned investors alike. By presenting such a diverse array of digital assets, KuCoin provides traders and investors with ample opportunities to diversify and customize their portfolios, enhancing its appeal within the ever-expanding crypto market.

[button url=”https://www.kucoin.com/r/rf/QBAPFKFQ” target=”blank” style=”3d” background=”#49ef2d” color=”#FFFFFF” size=”10″ wide=”no” center=”yes” radius=”auto” icon=”icon: mail-forward” icon_color=”#FFFFFF” text_shadow=”none”]Visit KuCoin[/button]How Does KuCoin Work?

Since KuCoin operates without a formal license in the United States, the platform offers only a limited selection of services to U.S.-based users. American investors can open and use unverified accounts to conduct certain transactions, such as selling cryptocurrencies, managing existing trades, closing futures and margin positions, and redeeming ETFs along with specific earning products.

However, U.S. users are restricted from purchasing new cryptocurrencies, as well as accessing features like staking, spot trading, API services, derivatives, margin trading, and loan services. While some U.S.-based KuCoin users attempt to bypass these restrictions using VPNs to reach restricted features, this method is inconsistent, carries risks, and may result in account restrictions or even a full account lock.

When it comes to withdrawing funds, U.S. account holders must first transfer assets to a Funding account before initiating the withdrawal process. This extra step is necessary due to the platform’s limited operational capabilities in the United States.

KuCoin Review: Key Features

KuCoin has emerged as a prominent cryptocurrency exchange, proudly serving a vast community of over 30 million crypto investors across the globe. The platform has crafted a comprehensive range of crypto services, including a fiat onramp, futures and margin trading, passive income options like staking and lending, a peer-to-peer (P2P) marketplace, an Initial Exchange Offering (IEO) launchpad for crypto crowdfunding, non-custodial trading, and numerous other features designed to cater to diverse trading needs.

Key features that distinguish KuCoin include:

- Access to Over 700 Cryptocurrencies at Low Fees: KuCoin allows users to buy and sell a large variety of digital assets, with trading fees as low as 0.1% per trade and minimal fees for futures transactions. This extensive range of assets and low costs make it one of the most accessible platforms globally.

- Fiat Purchases with Major Currencies: Users can purchase cryptocurrencies using popular fiat currencies like USD, EUR, CNY, GBP, CAD, AUD, among others. KuCoin supports fiat-to-crypto purchases through various options, including P2P trading, credit or debit card transactions via Apple Pay, Simplex, Banxa, and its Fast Buy service, enabling swift purchases of Bitcoin (BTC), Tether (USDT), and more.

- 24/7 Customer Support: KuCoin provides reliable customer service around the clock via multiple channels, including its website, email, and ticketing system, ensuring help is readily available.

- Advanced Security Measures: KuCoin safeguards user assets with bank-level security, including cold, warm, and hot wallet storage, multisignature technology, and dedicated risk control departments that maintain stringent daily security protocols.

- Futures and Margin Trading: Users can leverage up to 125x on their trades, enabling them to go long or short on preferred cryptocurrencies and potentially amplify their returns.

- Passive Income Opportunities: KuCoin offers various ways to earn, including crypto lending, staking, soft staking, and the KuCoin Shares (KCS) bonus, giving users multiple options to put their assets to work and earn returns.

- User-Friendly Interface: KuCoin’s design and functionality prioritize ease of use, making it an inviting platform for both beginners and experienced traders.

In summary, KuCoin provides a robust trading experience with high liquidity, a large user base, and a comprehensive selection of supported assets and services, all while maintaining some of the lowest trading fees in the market, making it an excellent choice for cryptocurrency investors.

KuCoin History And Background

Although KuCoin officially launched in mid-2017, its founders had been exploring blockchain technology as early as 2011. The technical foundation of the platform was established in 2013, with years spent refining it to create the smooth trading experience KuCoin offers today.

Funding for KuCoin’s development was achieved through an Initial Coin Offering (ICO) that ran from August 13 to September 1, 2017. During this period, KuCoin issued its native KuCoin Shares (KCS) tokens, allowing holders to access exclusive benefits, such as trading fee discounts and a share of the exchange’s profits. The ICO raised nearly $20 million USD in Bitcoin, in exchange for 100 million KCS tokens at an ICO price of 0.000055 BTC per token.

KuCoin is headquartered in Seychelles and employs over 700 people worldwide. The platform saw major advancements in 2019, beginning in February with the release of Platform 2.0, which introduced a fresh interface and new functionalities like advanced order types and an enhanced API. In June, the company launched KuMEX, which later rebranded as KuCoin Futures, and by the end of the year, it introduced margin trading with leverage up to 10x.

KuCoin continued to expand its ecosystem throughout 2020. Notable developments included the Pool-X Liquidity Trading Market, a one-stop exchange solution known as KuCloud, and an instant exchange service. The platform also significantly increased the range of fiat currencies supported for crypto purchases via bank cards, enhancing accessibility for global users.

Today, KuCoin provides its services in most regions worldwide, including countries like Turkey, India, Japan, Canada, the United Kingdom, Singapore, and many more. To cater to its international user base, the KuCoin website is available in 17 languages, including English, Russian, Korean, Dutch, Portuguese, Chinese (both simplified and traditional), German, French, Spanish, Vietnamese, Turkish, Italian, Malay, Indonesian, Hindi, and Thai.

For account security, KuCoin implemented a Know Your Customer (KYC) verification process on November 1, 2018, to strengthen protections against criminal activity and money laundering. In June 2020, KuCoin reinforced its compliance efforts through a partnership with Chainalysis, a crypto on-chain analytics and surveillance company. Most recently, in August 2023, KuCoin introduced a mandatory KYC requirement for all new users, underscoring its commitment to regulatory compliance and user safety.

KuCoin Fees Overview

KuCoin is recognized for its low trading fees among altcoin exchanges, with a straightforward and user-friendly fee structure.

Spot Trading Fees

The standard fee for spot trading on KuCoin is 0.1% for both maker and taker transactions. However, traders can lower this rate depending on their 30-day trading volume or KuCoin Shares (KCS) holdings, which grant access to additional discounts. Users can also utilize KCS Pay, allowing them to pay trading fees using KCS tokens, which further reduces costs.

| Tier | Amount of KCS Held | 30-day Trade Volume in BTC | Maker/Taker Fee | KCS Pay Fees |

| LV0 | 0<50 | <50 | 0.1% / 0.1% | 0.08% / 0.08% |

| LV1 | ≥1,000 | ≥50 | 0.09% / 0.1% | 0.072% / 0.08% |

| LV2 | ≥10,000 | ≥200 | 0.07% / 0.09% | 0.056% / 0.072% |

| LV3 | ≥20,000 | ≥500 | 0.05% / 0.08% | 0.04% / 0.064% |

| LV4 | ≥30,000 | ≥1,000 | 0.03% / 0.07% | 0.024% / 0.056% |

| LV5 | ≥40,000 | ≥2,000 | 0% / 0.07% | 0% / 0.056% |

| LV6 | ≥50,000 | ≥4,000 | 0% / 0.06% | 0% / 0.048% |

| LV7 | ≥60,000 | ≥8,000 | 0% / 0.05% | 0% / 0.04% |

| LV8 | ≥80,000 | ≥15,000 | -0.005% / 0.045% | -0.005% / 0.036% |

| LV9 | ≥80,000 | ≥25,000 | -0.005% / 0.04% | -0.005% / 0.032% |

| LV10 | ≥90,000 | ≥40,000 | -0.005% / 0.035% | -0.005% / 0.028% |

| LV11 | ≥100,000 | ≥60,000 | -0.005% / 0.03% | -0.005% / 0.024% |

| LV12 | ≥150,000 | ≥80,000 | -0.005% / 0.025% | -0.005% / 0.02% |

Fee Comparison with Other Exchanges

| Exchange | Altcoin Pairs | Trade Fees |

| KuCoin | 700+ | 0.1% |

| Binance | 539 | 0.1% |

| HitBTC | 773 | 0.1% / 0.25% |

| Poloniex | 92 | 0.2% |

KuCoin Futures Fees

Similar to spot trading, KuCoin’s futures fees follow a tiered system based on trading volume and KCS holdings.

| Tier | Min. KCS Holding (30 days) | 30-day Trade Volume in BTC | Maker/Taker Fee |

| LV0 | 0 | <50 | 0.02% / 0.06% |

| LV1 | ≥1,000 | ≥50 | 0.015% / 0.06% |

| LV2 | ≥10,000 | ≥200 | 0.015% / 0.06% |

| LV3 | ≥20,000 | ≥500 | 0.01% / 0.05% |

| LV4 | ≥30,000 | ≥1,000 | 0.01% / 0.04% |

| LV5 | ≥40,000 | ≥2,000 | 0% / 0.04% |

| LV6 | ≥50,000 | ≥4,000 | 0% / 0.038% |

| LV7 | ≥60,000 | ≥8,000 | 0% / 0.035% |

| LV8 | ≥80,000 | ≥15,000 | -0.003% / 0.032% |

| LV9 | ≥80,000 | ≥25,000 | -0.006% / 0.03% |

| LV10 | ≥90,000 | ≥40,000 | -0.009% / 0.03% |

| LV11 | ≥100,000 | ≥60,000 | -0.012% / 0.03% |

| LV12 | ≥150,000 | ≥80,000 | -0.015% / 0.03% |

Futures funding fees vary, adjusting every 8 hours to match the rate between base and quote currencies, which can lead to 0% funding fees under normal conditions.

Deposit and Withdrawal Fees

KuCoin offers free deposits. Withdrawal fees vary by currency, generally remaining competitive with other exchanges like Binance.

| Coin | KuCoin Withdrawal Fee |

| BTC | 0.001 BTC + Amount * 0% |

| ETH | 0.005 ETH + Amount * 0% |

| LTC | 0.005 LTC + Amount * 0% |

| DASH | 0.016 DASH + Amount * 0% |

| XRP | 0.703 XRP + Amount * 0% |

| EOS | 0.669 EOS + Amount * 0% |

| TRX | 2 TRX + Amount * 0.25% |

| USDT | 25 USDT (ERC20) / 1.5 USDT (TRC20) |

| NEO | Free |

Fiat Purchases

KuCoin allows fiat purchases through various methods, including Simplex, Banxa, and ApplePay, charging 3.5–7% depending on the method.

KuCoin Shares (KCS) Token Benefits

KCS holders enjoy daily cryptocurrency dividends, discounts on trading fees, and exclusive perks. Holding at least 1,000 KCS grants a 1% discount, which scales up to 30% for 30,000 KCS holders. KCS holders also earn a share of the platform’s profits, receive exclusive offers, and can participate in certain trading pairs.

KuCoin Design and Usability

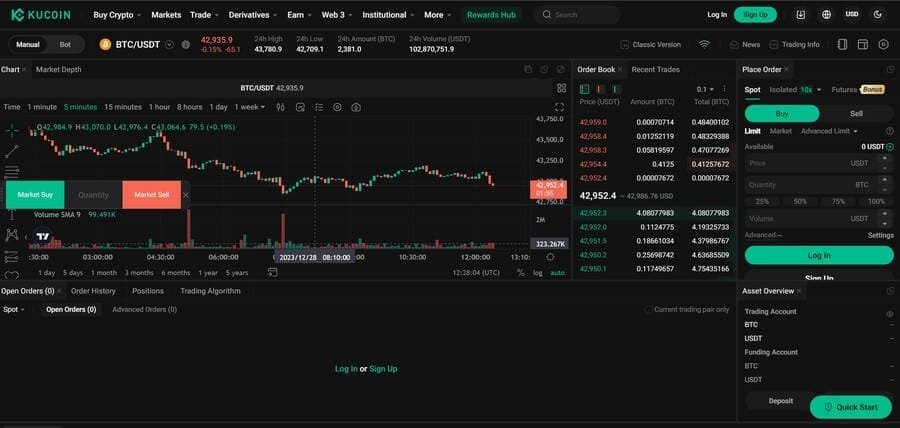

KuCoin is a user-friendly platform suitable for beginners and experienced traders alike, featuring a modern and intuitive interface on both its website and mobile app. The layout is consistent across all sections, enhancing ease of use and supported by a high-performance API interface. At its core, KuCoin employs an advanced trading engine capable of handling millions of transactions per second (TPS), ensuring swift, reliable trading.

Switchable Interface

KuCoin allows users to toggle between the classic and new trading interface, letting each trader choose their preferred layout. Both interfaces are optimized for seamless trading, giving users flexibility without sacrificing ease of use.

Spot Trading and Low Fees

A standout feature of KuCoin is its spot trading system, which supports over 200 tokens and cryptocurrencies with competitive fees. Spot trades are charged a flat rate of 0.1% for both makers and takers. For each trade, navigate to the “Markets” tab, search for the desired asset pair, and access the trading window. To enhance security, a trading password is required before entering the trading interface.

Within the trading screen, users will find:

- Advanced TradingView charts for technical analysis (TA)

- Order options, including Limit, Market, Stop Limit, and Stop Market, with advanced conditions like Post-Only, Hidden, and Time-in-Force options (Good Till Cancelled, Good Till Time, Immediate Or Cancel, Fill or Kill).

- Markets selection allows rapid switching between pairs, including 10x leveraged pairs in margin trading.

- Order book displaying current buy and sell orders.

- Recent trades and market depth insights.

- Personal trading history, displaying open orders, stop orders, and completed trades.

- News panel for the latest updates from KuCoin and cryptocurrency markets.

For beginners, this setup may initially appear intricate, but experienced traders should find it highly efficient. For those who prefer to trade on the go, KuCoin also offers a mobile app available on both Android and iOS.

KuCoin Futures Platform

KuCoin launched its Futures platform (formerly KuMEX) in 2019, offering users the ability to trade Bitcoin and Tether-margined contracts with leverage up to 100x, allowing trades of up to USD 10,000 with only USD 100 in the account. KuCoin Futures offers both Lite and Pro versions:

Lite interface is designed for beginners, with support for USDT-margined BTC and ETH contracts as well as BTC-margined BTC contracts.

Pro interface provides advanced options for experienced traders with several types of contracts, such as USDT-margined BTC perpetual, ETH perpetual, BTC Quarterly, and BTC-margined BTC contracts.

The spot price on KuCoin Futures is calculated by averaging prices from top exchanges, such as Kraken, Coinbase Pro, and Bitstamp, to ensure accuracy.

Margin Trading with High Leverage

KuCoin also provides margin trading directly on the spot exchange, enabling users to leverage positions with up to 125x on market pairs for popular assets like BTC, ETH, LTC, XRP, EOS, and others. Margin trading is straightforward as it integrates directly with KuCoin’s spot exchange.

KuCoin P2P Trading

KuCoin’s peer-to-peer (P2P) marketplace offers an easy way to buy and sell cryptocurrencies like BTC, ETH, and USDT directly with other users. Supported payment methods include wire transfers, Interact, and popular fiat options such as USD, CNY, IDR, VND, and CAD. Account verification is required to use the P2P marketplace, adding a layer of security to trades.

KuCoin Instant Exchange

Partnered with HFT, KuCoin Instant Exchange allows fast, free crypto-to-crypto swaps for Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC), and XRP for Tether (USDT) and Bitcoin. The service checks multiple sources for the best exchange rates, making it an efficient option for immediate swaps.

Fast Buy Feature

KuCoin’s Fast Buy feature is ideal for quick cryptocurrency purchases, allowing users to buy BTC, USDT, and other tokens using fiat payment methods like WeChat, Alipay, and bank cards.

KuCoin Earn Options

KuCoin also offers KuCoin Earn, allowing users to generate passive income through options like KuCoin Lend and Earn (formerly Pool-X). KuCoin Lend allows users to lend assets like BTC, USDC, USDT, and many others, with terms of 7, 14, or 28 days and interest rates up to 12% annually. Earn allows flexible and fixed-term staking on various assets, providing a chance for higher returns.

KuCoin Spotlight for IEOs

KuCoin also runs an initial exchange offering (IEO) platform, KuCoin Spotlight, where users can invest in emerging projects vetted by KuCoin. To participate, users need to complete account verification. Many Spotlight IEOs use KuCoin Shares (KCS) as the main currency, benefiting KCS holders directly.

In summary, KuCoin provides an extensive range of trading and earning options while remaining accessible to all user levels, positioning itself as a versatile and competitive platform among crypto exchanges.

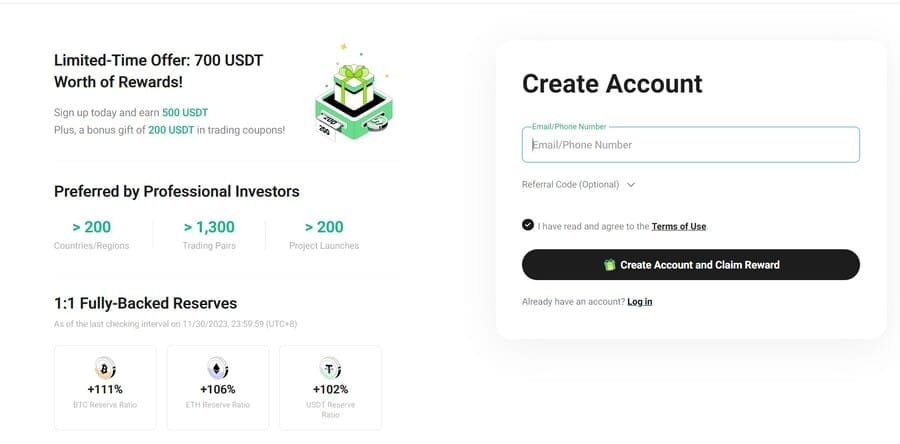

How To Open A KuCoin Account?

To create a KuCoin account, follow these steps:

Step 1: Go to the KuCoin website and click on “Sign Up.”

[button url=”https://www.kucoin.com/r/rf/QBAPFKFQ” target=”blank” style=”3d” background=”#49ef2d” color=”#FFFFFF” size=”10″ wide=”no” center=”yes” radius=”auto” icon=”icon: mail-forward” icon_color=”#FFFFFF” text_shadow=”none”]Visit KuCoin[/button]Step 2: Enter your information:

- Provide your email address or phone number.

- Create a strong password with uppercase and lowercase letters, as well as numbers, to secure your account.

- If you have a referral code, enter it in the designated field (Cryptonews KuCoin referral code is: f7MKe6).

Step 3: Verify your account:

- Click “Create Account” to complete the registration.

- Check your email or phone for a verification code sent by KuCoin.

- Enter the code to activate your account and finish the sign-up process.

Step 4: Fund and secure your account:

- Once your account is set up, you can deposit funds by transferring crypto or using KuCoin’s “Buy Crypto” feature to start trading.

- To enhance security, activate two-factor authentication (2FA), set up security questions, and create anti-phishing phrases. KuCoin recommends enabling all available security options for maximum account protection.

If you need further assistance, you can check the KuCoin FAQ section or contact their support desk for help.

How to Buy and Store KuCoin in Account?

To get started with purchasing KuCoin Tokens (KCS) on KuCoin, follow these simple steps:

- Create a Free KuCoin Account: Sign up on KuCoin using your email or mobile number, and secure your account with a strong password.

- Enhance Account Security: For additional protection, set up Google 2FA, an anti-phishing code, and a trading password.

- Verify Your Identity: Complete identity verification by providing personal information and uploading a valid ID document.

- Add a Payment Method: Once verified, add your bank account or credit/debit card to fund your purchases.

- Buy KuCoin Tokens (KCS): Choose from multiple payment methods to buy KCS on KuCoin. For new users, buying with a credit/debit card is the quickest method, but you can also use bank transfers, P2P transactions, or third-party payment processors, depending on what’s available in your region. Alternatively, if you already hold stablecoins, you can trade them directly for KCS in KuCoin’s Spot Market.

Once your purchase is complete, your KuCoin Tokens (KCS) will be stored securely in your KuCoin Trading Account, ready for your next steps.

KuCoin Deposits and Withdrawals

KuCoin operates exclusively as a crypto-to-crypto exchange, meaning it does not support direct fiat deposits. However, you can still purchase cryptocurrency using fiat through third-party services such as Simplex and Banxa, which are integrated into KuCoin’s platform. Although KuCoin does not offer fiat trading pairs or direct fiat deposits, it has progressively added more fiat payment options for its crypto purchasing services.

Deposits on KuCoin are fee-free, but withdrawal fees vary based on the specific cryptocurrency. Typically, the withdrawal process is efficient, as most transactions are confirmed within one hour, reaching user wallets within about 2 to 3 hours. For larger withdrawals, which require manual processing for added security, users may experience a slightly longer wait time, generally between 4 and 8 hours. Processing times also depend on the individual blockchain of each cryptocurrency, which may occasionally lead to delays.

KuCoin Security

As of December 2023, KuCoin experienced a Twitter account breach earlier in the year and a security incident within the exchange back in 2021. Fortunately, most users affected by these events were compensated for any losses incurred.

To safeguard its platform, KuCoin implements extensive security measures across both system and operational levels. From a systems perspective, KuCoin was built in line with finance industry security standards, utilizing bank-grade encryption and data protection mechanisms. On the operational side, KuCoin employs dedicated risk management teams responsible for enforcing rigorous protocols on data handling and access controls.

For users, KuCoin offers multiple security options to help protect their accounts:

- Two-factor authentication (2FA)

- Security questions

- Anti-phishing safety phrase

- Login safety phrase

- Trading password

- Phone verification

- Email notifications

- IP restriction for login (recommended for holdings of at least 0.1 BTC)

While these features enhance account security, it’s generally advised not to keep a substantial amount of cryptocurrency on any exchange to mitigate potential risks. Only store funds on exchanges that you are comfortable risking, with more significant amounts preferably stored in personal wallets.

On the customer support front, KuCoin provides 24/7 assistance through various channels:

- KuCoin Help Center

- FAQ section

- Live chat on the website

- Mobile app support

KuCoin also maintains active social media channels, where users can engage with both the exchange’s support team and its community. These include:

- Facebook (available in English, Vietnamese, Russian, Spanish, Turkish, and Italian)

- Telegram (available in multiple languages, including English and Chinese)

- Twitter (multilingual support including English, Vietnamese, and Spanish)

- Reddit, YouTube, Medium, and Instagram

Overall, KuCoin’s support team is known for its prompt responsiveness, generally addressing queries within a few hours. The community forums and social media channels also offer quick access to peer support and up-to-date information about the platform.

Regulatory and Legal Aspects of KuCoin

KuCoin places a high priority on ensuring the safety and protection of its users’ assets through multiple robust measures, including:

- Advanced encryption technology to safeguard user data and transactions.

- Routine and comprehensive security audits that help maintain the integrity of its systems.

- Cold storage solutions that securely hold the majority of users’ funds offline, minimizing exposure to online threats.

- Compliance with regulatory standards in numerous regions, helping the platform operate securely and responsibly.

Despite encountering security incidents, including a notable breach in 2020, KuCoin has proven its commitment to user protection. In response to that event, the exchange took swift action to fully reimburse impacted users, further solidifying its dedication to asset security and user trust.

Comparing Binance Coin to Other Cryptocurrencies

KuCoin vs. Coinbase

Coinbase is among the leading cryptocurrency exchanges in the United States, offering a vast array of digital assets, retirement account options, live order books, and advanced charting tools for traders of all experience levels.

KuCoin and Coinbase share many similarities in terms of services, such as crypto trading, staking, and robust tools for analysis. However, one key difference is that KuCoin is not licensed to operate in the U.S. For those unable to access KuCoin, Coinbase presents a compelling alternative, offering similar features with added regulatory backing. It’s important to note, though, that Coinbase is currently under investigation by the U.S. Securities and Exchange Commission (SEC), which might impact its operations.

KuCoin vs. Kraken

Kraken is another prominent name in the cryptocurrency exchange space, well-regarded for its stringent security protocols and responsive customer support. Like KuCoin, Kraken provides diverse features, including opportunities to earn interest through staking, access to NFT trading, and a futures market for more advanced investors. Additionally, Kraken is licensed in the U.S., making it accessible to American investors.

For those U.S.-based traders looking for alternatives to KuCoin, Kraken stands out as an excellent option. Its platform boasts relatively low trading fees, especially through its Pro version, and offers comprehensive asset management solutions. Furthermore, Kraken provides a wealth of educational resources designed to help beginners navigate the often-complex world of cryptocurrency trading.

However, residents of New York and Washington should be aware that Kraken is not available in these states.

Should You Join KuCoin in 2025?

With the cryptocurrency market continuing to expand, choosing the right exchange is crucial for both novice and experienced traders. KuCoin, launched in 2017, has positioned itself as a global leader among crypto exchanges, offering a variety of features, a broad range of cryptocurrencies, and competitive fees. But does it still hold up as a top choice in 2025?

KuCoin’s robust offerings make it a solid contender for anyone looking to trade or invest in digital assets. With over 700 coins available, including popular and niche tokens, users have plenty of options. Additionally, KuCoin’s low trading fees—starting at 0.1% and reduced even further with its native token KCS—make it highly appealing for cost-conscious traders.

In 2025, KuCoin continues to enhance its security features, responding to past challenges by integrating advanced security protocols, such as multi-factor authentication and cold storage. Its extensive suite of tools, like futures and margin trading, caters to different trading styles, while passive income options like staking and lending provide extra earning potential for holders.

KuCoin also offers a user-friendly interface, multilingual support, and a growing ecosystem, making it suitable for both beginners and seasoned investors alike. However, it’s important to consider your specific needs, including your preferred level of security, available cryptocurrencies, and the types of trading you plan to do, before committing to the platform.

If you’re looking for a comprehensive and evolving crypto exchange in 2025, KuCoin could be a great fit for you.

[button url=”https://www.kucoin.com/r/rf/QBAPFKFQ” target=”blank” style=”3d” background=”#49ef2d” color=”#FFFFFF” size=”10″ wide=”no” center=”yes” radius=”auto” icon=”icon: mail-forward” icon_color=”#FFFFFF” text_shadow=”none”]Visit KuCoin[/button]KuCoin Review – Frequently Asked Questions

Is KuCoin a Trustworthy Exchange?

Yes, KuCoin is considered a reliable cryptocurrency exchange that has been in operation since 2017. Over the years, it has gained a solid reputation for offering an extensive range of digital assets and advanced trading features. However, as with any financial platform, it’s wise to do thorough research and check user feedback before using the exchange to ensure it meets your needs and security standards.

How to Purchase Cryptocurrency Using the KuCoin App

To buy cryptocurrency via the KuCoin app, you’ll first need to set up an account and go through the identity verification process. Once your account is verified, you can deposit funds into your account—either by using fiat currency or transferring cryptocurrency. After the funds are in your account, head over to the trading section of the app, select the trading pair for the currency you want to purchase, and execute your buy order. The app provides a seamless experience for both beginner and advanced traders.

Does KuCoin Report Transactions to the IRS?

Since KuCoin is not a U.S.-based exchange and doesn’t hold a license to operate in the U.S., it does not directly report user transactions to the Internal Revenue Service (IRS). However, it’s crucial for U.S. users to keep detailed records of all their trades and transactions, as they are legally required to report them to the IRS and pay any applicable taxes.

Where is KuCoin Located?

KuCoin is headquartered in Seychelles, a nation made up of islands in the Indian Ocean. Although the platform is not officially licensed in the U.S., it continues to operate globally, offering services to users from numerous countries, including the U.S., though with some restrictions in place.

What Fees Does KuCoin Charge?

KuCoin’s fee structure is competitive, with trading fees ranging from 0.1% to 0.3% for makers and takers. The platform follows a maker/taker model, meaning the fees depend on whether you’re adding liquidity to the market or taking it. Fees also vary based on the specific cryptocurrency being traded and the user’s trading volume. Additionally, KuCoin offers discounts for users who hold its native KCS tokens or for those who trade in higher volumes. The platform also imposes withdrawal and transfer fees, which differ by asset. For a more detailed breakdown of KuCoin’s fee schedule, check out our full KuCoin review.

Wrapping Up

In summary, KuCoin stands out as a versatile exchange with a wide range of cryptocurrencies, low fees, and various trading options for all levels of traders. Whether you’re looking to trade, earn passive income, or explore advanced features like futures and margin trading, KuCoin has a lot to offer in 2024. However, it’s important to assess how its features align with your personal trading goals. For a more in-depth analysis of KuCoin’s strengths and weaknesses, be sure to read the full KuCoin review on CoinReviews, where we provide a detailed breakdown to help you make an informed decision.

Read more:

- Binance Review: Features, Supported Cryptos and Fees!

- Bybit Review: Pros, Cons and Key Features

- OKX Review: Pros, Cons, Future Potential & More

- HTX Review: Fees, Security, Pros & Cons

- Bitget Review: Pros & Coins, Fees & More

- Bitfinex Review: Is It Secure or Scam?

- Crypto.com Review: Is the Exchange Safe or Scam?

- BingX Review: Verified Reviews, Pros & Cons

- LBank Review: Should You Use It?

- bitFlyer Review: Pros & Cons and Ratings

- ProBit Review: Is It the Right Crypto Exchange for You?

- P2B Review: Fees, Features, Safety, Pros & Cons

- Pionex Review: Pros, Cons & All You Need to Know

- BitMEX Review: Fees, Trading, Staking & More

- Phemex Review: Is It a Good Crypto Exchange?

- BTSE Review: Is It Safe & Reliable?

- CoinEx Review: Is This Crypto Exchange Safe?

- Poloniex Review: Features, Regulation & Risks

- BITFLEX Review: Features, Safety, Pros & Cons

- CoinJar Review: Is It the Right Exchange for You?

- Paymium Review: Pros, Cons, Key Features & Fees

- LBank Review: Is It the Right Exchange for You?

- MEXC Review: Latest Pros, Cons, Key Features & Fees

- BitMart Review: Reviews, Trading Fees & Cryptos