In the fast-evolving world of cryptocurrency, BitMEX stands out as a pivotal platform for traders seeking advanced tools and high leverage in derivatives trading. Launched in 2014, BitMEX has solidified its position as a leader by offering up to 100x leverage and a range of sophisticated features tailored for professional traders. Its focus on security and deep liquidity has earned it a reputation as one of the go-to platforms for crypto derivatives.

In this BitMEX Review, CoinReviews provides you with accurate, fact-checked, and comprehensive insights into why BitMEX continues to be a dominant force in the cryptocurrency trading landscape. Whether you’re a seasoned trader looking to maximize your gains or someone exploring the world of crypto derivatives, this in-depth review will equip you with the knowledge you need to make confident and well-informed trading decisions on BitMEX.

What is BitMEX?

BitMEX (Bitcoin Mercantile Exchange) is a cryptocurrency trading platform founded in 2014, specializing in derivatives trading. It allows experienced traders to speculate on the price of cryptocurrencies like Bitcoin, Ethereum, and Litecoin using futures and perpetual contracts. What makes BitMEX unique is its high leverage feature, offering up to 100x leverage, giving traders the ability to control large positions with a smaller investment.

BitMEX also focuses on providing a secure, efficient trading environment with fast trade execution and deep liquidity. Additionally, the platform has introduced the BMEX token, which offers trading fee discounts and exclusive rewards for users. BitMEX review is a platform designed for professional traders who need advanced tools and security for large-scale, high-leverage trading.

[button url=”https://www.bitmex.com/app/register/WURam0″ target=”blank” style=”3d” background=”#49ef2d” color=”#FFFFFF” size=”10″ wide=”no” center=”yes” radius=”auto” icon=”icon: mail-forward” icon_color=”#FFFFFF” text_shadow=”none”]Visit BitMEX[/button]BitMEX Review: Company Overview

BitMEX, short for Bitcoin Mercantile Exchange, was founded in 2014 by Arthur Hayes, Samuel Reed, and Ben Delo, originally based in Hong Kong but now headquartered in Seychelles. The platform is operated by HDR Global Trading Limited, a structure often chosen for its tax advantages by many cryptocurrency businesses.

BitMEX operates as a margin trading exchange, allowing traders to engage in leveraged trading with the potential for substantial profits, albeit with significant risks. With leverage options of up to 100x, BitMEX offers traders the ability to amplify their positions. This feature enables users to short cryptocurrencies, allowing them to profit from falling asset prices.

Unlike many exchanges, BitMEX does not accept fiat currency deposits; users can only fund their accounts in Bitcoin and withdraw in the same cryptocurrency. Additionally, all trades and positions are denominated in Bitcoin, even for altcoin trades. This means that profits from trading altcoins will also be realized in Bitcoin, which cannot be withdrawn in other cryptocurrencies.

In 2016, BitMEX launched perpetual swap contracts, a significant innovation in the crypto derivatives market. These contracts allow traders to speculate on Bitcoin’s price with leverage and no expiration date, contributing to BitMEX’s status as one of the highest-volume Bitcoin exchanges globally.

Despite its advanced trading features, BitMEX has faced legal challenges and controversy over allegations of market manipulation, money laundering, and non-compliance with international regulations. In 2020, the Commodity Futures Trading Commission (CFTC) charged BitMEX with operating illegally and allowing U.S. customers to trade on its platform.

As of 2023, BitMEX is working to improve its reputation and establish itself as the leading regulated crypto derivatives exchange. The platform has introduced identity verification for all users, marking a significant step toward compliance and enhancing user trust.

BitMEX Security Overview: Is BitMEX Safe?

When choosing a cryptocurrency exchange, security is a paramount consideration. So, how does BitMEX stack up in this regard?

Security Track Record

BitMEX has maintained a solid reputation for security, with no reported hacks to date. This strong track record can be attributed to their rigorous security measures, which are detailed on their FAQ page.

Wallet Security

The exchange employs multi-signature wallets for deposits and withdrawals, ensuring that funds stored in cold wallets require multiple authorizations before any withdrawal can occur. To further enhance security, BitMEX uses an external service to verify that all deposit addresses are controlled by the exchange’s founders. If any discrepancies are detected, trading is immediately halted.

Personal Security Features

For individual users, BitMEX provides the option of two-factor authentication (2FA) to add an extra layer of protection. In the event of a security breach, the exchange also employs hand-processed withdrawals, which offers additional security for account holders.

Infrastructure and Trading Engine

BitMEX’s server infrastructure is powered by Amazon Web Services (AWS), which requires multiple forms of authentication along with hardware tokens. Given the inherent risks associated with a highly leveraged trading environment, BitMEX has established stringent policies to ensure that all orders are accurately matched. Any discrepancies trigger an immediate suspension of trading activity.

Communication Security

For those concerned about communication privacy, BitMEX allows users to enable PGP encryption for automated emails. To activate this feature, you can simply enter your PGP public key in your account settings. This ensures that any correspondence from BitMEX’s support team remains secure.

Proof of Reserves

In light of recent industry events, including the collapse of exchanges like FTX, demonstrating the security of client funds has become crucial. BitMEX has adopted a Proof-of-Reserves (PoR) model, a transparency measure that shows the assets held on-chain relative to the liabilities owed to users. They disclose their on-chain addresses to platforms like Glassnode, which helps verify their solvency.

Merkle Tree Structure

BitMEX utilizes a Merkle Tree for their PoR scheme, balancing user privacy with transparency. They initially considered publishing only part of the tree to maintain anonymity but later chose to provide a comprehensive list of their Bitcoin reserves. As of November 2022, BitMEX holds more Bitcoin than what clients have deposited, which is a positive indicator of their financial health.

Real-Time Audits

While BitMEX conducts bi-weekly audits—a proactive approach compared to many exchanges—these snapshots represent a moment in time, leaving questions about the movement of funds outside of these intervals. Despite this, the frequency of their audits provides an added layer of reassurance for traders.

While no exchange is without risk, BitMEX has implemented robust security measures to protect user funds. Their commitment to transparency through Proof of Reserves and a solid track record of security makes them a safer choice among cryptocurrency trading platforms. However, it is always advisable for you to remain vigilant and use additional personal security measures when trading.

Key Features and Type of BitMEX

BitMEX offers a range of powerful features that cater to the diverse needs of cryptocurrency traders, from spot trading to advanced derivatives. Here’s a breakdown of its key features:

Spot Trading

BitMEX’s spot trading feature allows users to buy and sell popular cryptocurrencies like Bitcoin, Ethereum, and Dogecoin at current market prices. It’s ideal for those who want to directly own digital assets rather than speculate on price movements. BitMEX’s platform ensures seamless execution for spot traders, providing a straightforward way to purchase tokens without the complexities of derivatives trading.

Futures Trading

BitMEX is widely recognized for its futures contracts, enabling traders to speculate on the future price of cryptocurrencies. These contracts come in various forms—inverse, quanto, and linear payouts—giving traders flexibility. The platform uses advanced price marking techniques to ensure fair pricing and prevent market manipulation. BitMEX’s futures trading is particularly appealing for those looking to hedge positions or trade on specific price forecasts.

Perpetual Contracts

BitMEX pioneered the perpetual swap, a contract that operates like a futures contract but with no expiration date. These contracts track the underlying cryptocurrency price closely and allow traders to use leverage up to 100x. This product is popular for traders looking to capitalize on market volatility without worrying about contract expiration.

Trading Tools and Options

BitMEX provides a comprehensive suite of tools to enhance the trading experience:

- Advanced Order Types: Traders can set stop-loss, limit, and market orders to manage risks effectively.

- Options Trading: BitMEX also supports European-style options, allowing traders to strategically manage risk or speculate on asset price volatility.

- Trading Bots: The platform supports trading bots that automate various strategies, giving users more flexibility and control over their trades.

BMEX Token and Staking

BitMEX offers its native utility token, BMEX, which enhances the user experience by offering discounts on trading fees and access to exclusive promotions. Users can stake BMEX and other assets like Ethereum to earn rewards, with yields reaching up to 8% APY, making BitMEX a hub for both active trading and passive income generation.

Customizable Trading Interface

The platform features a highly customizable interface, enabling users to tailor their trading dashboard with widgets, charts, and multi-chart views. This flexibility allows traders to build a workspace that fits their trading style, enhancing both usability and efficiency.

Institutional Services

For larger traders, BitMEX provides institutional-grade services such as over-the-counter (OTC) trading, ensuring access to deep liquidity for significant trades.

Community and Guilds

BitMEX also fosters a trading community through its Guilds feature, where traders can team up, share strategies, and participate in trading challenges for rewards. This collaborative aspect helps traders learn from one another while competing in a fun and engaging way.

Each trading option on BitMEX, whether spot, futures, or perpetual contracts, comes with specific details such as trading pairs, margin requirements, and leverage limits, all outlined in their respective specifications. This comprehensive information empowers crypto traders to make informed decisions and tailor their strategies to meet their unique trading goals.

What is BMEX Token?

BMEX is the utility token designed to enhance the BitMEX ecosystem, providing a range of benefits for its holders. This token plays a pivotal role in the platform, offering various incentives that cater to both traders and investors. Key Benefits of Holding BMEX:

Trading Fee Discounts: One of the primary advantages of staking BMEX is the ability to enjoy substantial discounts on trading fees, reaching up to 15%. This feature can significantly reduce your trading costs, making it an attractive option for active traders.

Exclusive Privileges: BMEX holders gain access to exclusive benefits, including early access to new products and services, as well as VIP treatment. Additionally, holders can participate in exciting swag raffles, adding an element of community engagement.

Withdrawal Fee Refunds: Holding BMEX also allows users to receive refunds on withdrawal fees, enhancing the overall trading experience. This benefit helps to offset costs when moving funds off the platform.

Enhanced Staking Rewards: Through the BitMEX Earn program, BMEX holders can enjoy enhanced staking rewards. This program provides an opportunity to earn passive income while holding the token.

Use as Collateral: BMEX can be utilized as collateral for trading on the BitMEX platform, further integrating the token into your trading activities. This feature allows traders to leverage their holdings for enhanced trading strategies.

Dynamic Ecosystem: The BMEX token operates within a vibrant ecosystem characterized by regular token burns, aimed at sustaining its growth and maintaining its utility. This approach ensures that the token remains relevant and valuable over time.

BMEX is more than just a token; it’s a fundamental part of the BitMEX experience, offering a multitude of benefits that enhance trading, engagement and community participation. Whether you’re an active trader or a long-term investor, holding BMEX can unlock significant advantages on the BitMEX platform.

BitMEX Review: Crypto Asset Portfolio Overview

As a prominent futures exchange, BitMEX offers a unique trading environment primarily focused on derivative products. While the only asset available for spot trading on BitMEX is Bitcoin (BTC), the platform opens up a broader array of options in the futures market. Here’s a closer look at the crypto assets you can trade on BitMEX:

Available Cryptocurrency Assets

BitMEX supports a selection of 10 different cryptocurrency assets for futures trading, allowing you to diversify your trading strategies. These assets include:

- Bitcoin (BTC)

- Dash (DASH)

- Ethereum (ETH)

- Ethereum Classic (ETC)

- Litecoin (LTC)

- Monero (XMR)

- Ripple (XRP)

- Tezos (TEZ)

- Zcash (ZEC)

- Cardano (ADA)

While this selection may appear limited compared to other exchanges like Bittrex and Poloniex, it’s important to note that BitMEX specializes in cryptocurrency margin trading rather than the direct purchase of physical coins. This specialization means that liquidity for smaller-cap altcoin futures may be more challenging to find.

Derivative Trading Options: Perpetual Swaps vs. Futures

At BitMEX, traders have access to two primary types of derivative instruments: Perpetual Swaps and traditional Futures.

What is a Perpetual Swap? A perpetual swap is a unique financial instrument that does not have an expiry date, allowing for ongoing trading without the need for contract renewal. In contrast, traditional futures contracts are settled at a predetermined future date and often come with specific settlement terms.

Perpetual swaps function similarly to Contracts for Difference (CFDs) or spread betting, as they are continuously marked to market on a daily basis. Essentially, trading a perpetual swap allows you to engage with the asset as if you were trading its spot price, with the potential for enhanced gains or losses due to leverage.

BitMEX offers a distinctive trading environment for cryptocurrency derivatives, focusing on futures and perpetual swaps. While the range of supported assets is narrower than some competitors, the platform’s emphasis on margin trading provides unique opportunities for experienced traders seeking to leverage their positions. As always, it’s crucial to understand the risks involved, especially when trading with high leverage.

Understanding BitMEX Leverage for Better Trading

BitMEX leverage refers to the ability of traders to amplify their positions using borrowed funds when trading cryptocurrency derivatives on the BitMEX platform. This feature allows you to control larger positions than their actual investment, potentially increasing both profits and risks.

Maximum Leverage Offered

For Bitcoin instruments, BitMEX allows a maximum leverage of up to 100x. This means that for every $1 in your account, you can control a position worth $100. However, it’s important to approach such high leverage cautiously.

Pro Tip ✔️: Leverage can start as low as 1x. If you are new to leveraged trading, it’s wise to begin with lower leverage and gradually increase it as you gain experience. High leverage is incredibly risky and should only be employed by traders who are well-versed in its implications.

Leverage for Other Cryptocurrency Assets

While Bitcoin offers the highest leverage, other cryptocurrencies on BitMEX come with varying maximum leverage limits, which are influenced by the required initial margin. Here are the maximum leverage options for select altcoins:

- Ethereum (ETH): 50x

- Litecoin (LTC): 33x

- Ripple (XRP): 20x

- Bitcoin Cash (BCH): 20x

- Cardano (ADA): 20x

- Monero (XMR): 25x

- Ethereum Classic (ETC): 20x

- Zcash (ZEC): 5x

Types of Margin Trading: Isolated vs. Cross-Margin

BitMEX provides two margin trading options: Isolated Margin and Cross Margin.

- Isolated Margin: This option allows you to specify the exact amount of funds from your wallet that will be used for a particular position. This approach can help limit your risk to only the capital allocated for that trade.

- Cross Margin: In this case, all available funds in your account are considered for margin. This means that if you have multiple positions open, the total equity in your account can be used to support any position that is losing money, which can be beneficial but increases your exposure to risk.

The Risk of Leverage: Margin Calls and Liquidation

Utilizing high leverage and cross-margin trading can lead to significant risks, especially if market movements are not in your favor. When a trade moves against you, BitMEX may trigger a margin call, which can result in the automatic liquidation of your positions. This occurs when your account balance falls to the maintenance margin level, meaning the platform will either draw from your funds or liquidate your positions to cover potential losses.

Trading with leverage on BitMEX offers the potential for amplified profits, but it requires a strong understanding of the associated risks. Whether you choose to employ high leverage or opt for a more cautious approach, being informed about the mechanics of leverage, margin types, and potential pitfalls is essential for navigating the volatile world of cryptocurrency trading successfully. Always trade responsibly and consider starting small as you familiarize yourself with the market dynamics.

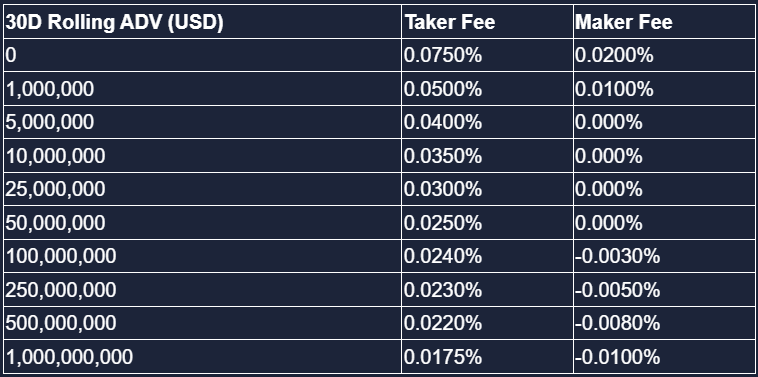

BitMEX Fees: A Comprehensive Overview

When trading on BitMEX, it’s essential to grasp how their fee structure operates, particularly since it involves leveraged instruments. The trading fees consist of “maker” and “taker” fees, which are determined by your role in the trade.

Maker vs. Taker Fees

Taker Fees: If you execute an order that matches an existing one on the order book, you’re classified as a taker. This action removes liquidity from the market, leading to a taker fee.

Maker Fees: Conversely, if you place a limit order that does not match any current orders (such as a buy limit below the current price or a sell limit above it), you add liquidity to the market and earn a rebate.

Fee Structure

For Tezos (XTZ) and ZCash (ZEC):

- Maker Fee (Rebate): 0%

- Taker Fee: 0.25%

- Settlement Fee: 0.25%

For All Other Assets:

- Maker Fee (Rebate): 0.075%

- Taker Fee: 0.025%

- Settlement Fee: 0.05%

Hidden Orders

If you choose to place hidden orders, the fee structure differs slightly. Initially, you will incur the taker fee until the order is fully executed. After execution, you’ll receive the maker rebate.

Deposits and Withdrawals

One of the appealing aspects of BitMEX is that they do not charge fees for depositing or withdrawing funds. However, you will need to pay a minimum network fee for transactions, making it advisable to conduct larger withdrawals to optimize your costs.

Understanding the fee structure at BitMEX is crucial for maximizing your trading efficiency. By knowing the difference between maker and taker fees, as well as the potential rebates available, you can make more informed trading decisions while minimizing your costs.

BitMEX Review: Registration and Trading

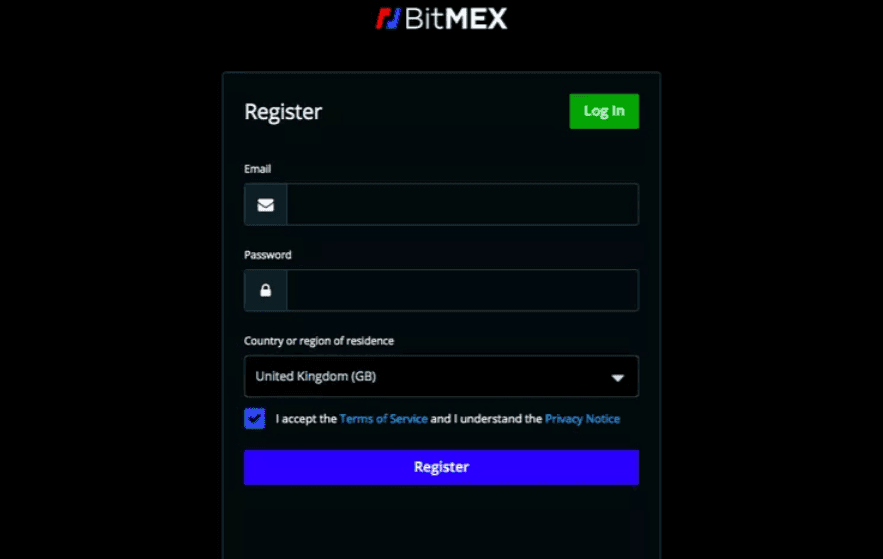

Getting started with BitMEX is a simple and efficient process. By following these steps, you can quickly open an account and begin your trading journey.

Step 1: Registration

To initiate the registration process, visit the BitMEX homepage and click on the Register button located in the upper right corner. You’ll need to provide:

[button url=”https://www.bitmex.com/app/register/WURam0″ target=”blank” style=”3d” background=”#49ef2d” color=”#FFFFFF” size=”10″ wide=”no” center=”yes” radius=”auto” icon=”icon: mail-forward” icon_color=”#FFFFFF” text_shadow=”none”]Visit BitMEX[/button]- Valid Email Address: Make sure this email is active, as you will need it to confirm your account and manage withdrawals.

- Strong Password: Create a secure password to protect your account.

Step 2: Identity Verification

Although BitMEX allows for a certain level of anonymity by not requiring KYC (Know Your Customer) documentation, it’s essential to complete the identity verification process to ensure compliance and enhance security. Here’s what you need to provide:

- Government-Issued ID: Submit a clear photo of your ID.

- Selfie or Video Verification: Capture a video or selfie to confirm your identity.

- Location Information: Provide your current location.

- Citizenship Declaration: Indicate your citizenship.

- Funding Information: Share details on how you intend to fund your account.

Completing this verification helps maintain a secure trading environment on BitMEX.

Step 3: Start Trading

Once you have successfully verified your identity, you can explore the diverse trading features and products offered on BitMEX. The platform provides various tools to enhance your trading experience, from advanced charting to leveraged trading options.

Mobile App Access

If you prefer to trade on the go, BitMEX also offers a mobile app. The registration and verification process remains the same, ensuring that you can manage your account and execute trades conveniently from your mobile device.

By following these straightforward steps, you can establish your BitMEX account quickly and start trading with confidence. The platform’s user-friendly design and comprehensive features make it an excellent choice for both novice and experienced traders looking to engage in cryptocurrency trading.

BitMEX USA Registrations: What You Need to Know

If you’re based in the United States, you might be wondering whether you can trade on BitMEX. The straightforward answer is that it’s highly unlikely you can do so legally.

Regulatory Status

BitMEX operates as an offshore, unregulated futures exchange, lacking the necessary licenses from the U.S. Securities and Exchange Commission (SEC) to provide services to American citizens. This regulatory gap poses significant risks for U.S.-based traders.

KYC and User Verification

One of the notable features of BitMEX is its minimal KYC (Know Your Customer) requirements, which means they don’t necessitate thorough identification from their traders. While this may attract some traders seeking anonymity, it also means that BitMEX cannot accurately verify who is trading on their platform.

Despite this leniency, BitMEX has been taking measures against U.S.-based clients who attempt to use the platform. They have implemented IP blocking to restrict access, although many traders circumvent these measures using VPN software, which can hide their true location.

Increased Scrutiny and Account Closures

The SEC’s increasing scrutiny of offshore exchanges has prompted BitMEX to take more stringent actions. Recently, the platform has begun closing accounts suspected of being U.S.-based, starting with notable cryptocurrency figures like Tone Vays. This indicates a shift towards stricter enforcement of their terms and conditions.

What This Means for U.S. Traders?

If you are a U.S. trader with a BitMEX account, you should be cautious. Currently, you might continue to trade anonymously, but this is not guaranteed to last. The evolving regulatory landscape suggests that it may become increasingly difficult for U.S. residents to use such exchanges without facing repercussions.

It’s important to note that while BitMEX is not actively pursuing U.S. traders at this time, the potential for compulsory KYC requirements is real. If this occurs, existing accounts may be at risk if they cannot provide the required identification.

Alternatives for U.S. Traders

If you’re looking for a viable alternative that allows for crypto margin trading without the complications associated with BitMEX, consider platforms like Kraken. Kraken provides a more compliant environment for U.S.-based traders while still offering a range of trading features.

If you’re based in the U.S. and considering trading on BitMEX, it’s advisable to proceed with caution and explore compliant alternatives to safeguard your trading experience.

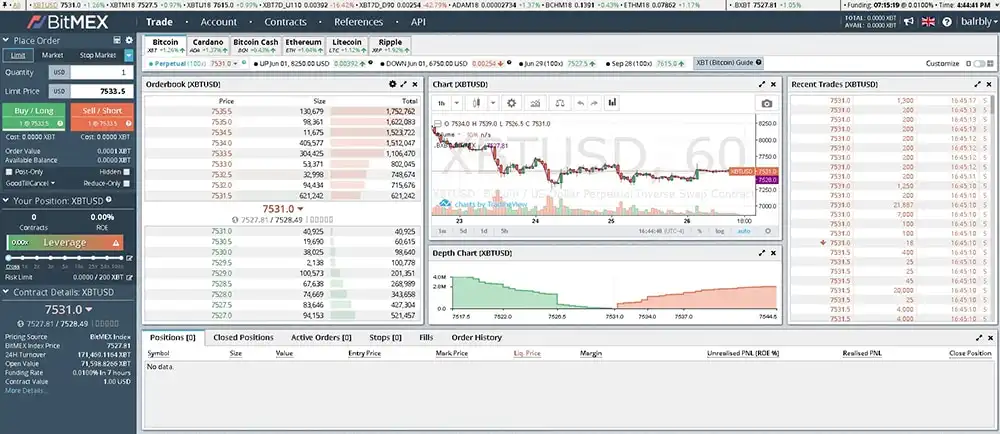

BitMEX Review: Trading Platform Overview

Diving into the heart of BitMEX, the trading platform stands out for its robust technology and user-friendly interface. Founded by former investment bankers and traders, BitMEX has developed a reputation for its efficient matching engine, making it a preferred choice for many cryptocurrency enthusiasts.

User Interface and Features

After confirming your email and logging into BitMEX, you’re greeted with a sleek trading platform. The layout features a comprehensive list of tradable instruments at the top, which facilitates easy navigation. Once you select a specific instrument, the interface provides essential trading tools including order books, price charts, recent orders, and your current positions.

A unique aspect of BitMEX is its advanced order form, which allows you to customize leverage and specific order details. Notably, the platform is highly customizable; you can rearrange widgets and alter the interface to fit your trading style.

You can also take advantage of full-screen charting options, utilizing TradingView charts that offer a wide array of studies and indicators. This enhances your ability to conduct thorough technical analysis and make informed trading decisions.

Advanced Trading Features

For traders looking for more sophisticated functionalities, BitMEX provides an advanced layout that can be activated within your dashboard. This is particularly beneficial for professional traders who require more complex features.

BitMEX’s trading engine is built with cutting-edge software employed by high-frequency trading firms on Wall Street, utilizing the kdb+ language. This technology boasts impressive throughput rates, capable of executing up to 1,000,000 trades per second, ensuring that your orders are processed with exceptional speed.

Order Types Available

BitMEX offers a diverse range of order types that cater to various trading strategies, making it suitable for both novice and experienced traders:

- Market Order: Executed at the current market price.

- Limit Order: Set to execute at a specified price.

- Stop Limit Order: Triggers a limit order once a designated stop level is reached.

- Stop Market Order: Executes a market order as soon as the stop level is reached.

- Trailing Stop Order: Follows the market price at a specified distance, adjusting automatically.

- Take Profit Limit Order: Closes a position to secure profits at a chosen limit price.

- Take Profit Market Order: Similar to a stop market order, but designed to lock in profits once a specific price is hit.

Additionally, BitMEX features specialized order types such as:

- Hidden Order: A limit order that remains off the public order books, ideal for traders seeking confidentiality.

- Iceberg Order: A variation of the hidden order where only a portion is visible to the market, helping large traders manage significant positions without impacting the order book unduly.

The BitMEX trading platform combines cutting-edge technology with user-centric features, creating a compelling environment for cryptocurrency trading. Whether you’re a casual trader or a seasoned professional, BitMEX’s intuitive interface, extensive order types, and high-speed execution capabilities offer the tools you need to enhance your trading experience. Just remember, with the power of leverage comes significant risk, so trade wisely.

BitMEX Liquidation Risks: The Dangers of High Leverage

When trading on BitMEX, one of the most critical aspects to grasp is the inherent risk of liquidation, especially when utilizing high leverage. For those who are familiar with cryptocurrency trading, the concept of liquidation can be daunting, and it’s essential to be aware of the potential consequences of your trading decisions.

The Impact of High Leverage

BitMEX offers leverage of up to 100x, allowing traders to control large positions with a relatively small amount of capital. While this can amplify potential profits, it also significantly increases the risk of liquidation. Liquidation occurs when the value of your position drops to the “liquidation price.” At this point, BitMEX will automatically close your position to prevent further losses, even if you still have initial margin funds available.

For example, if you enter a position with high leverage and the market moves against you, the chances of hitting the liquidation threshold rise dramatically. This risk is exacerbated by the volatility of cryptocurrency markets, where rapid price swings can trigger liquidations unexpectedly.

Understanding Liquidation Prices

The maintenance margin level (MML) is crucial when trading on BitMEX. This is the minimum amount of equity you need to maintain your open positions. With high leverage, such as 100x, the MML can be nearly 50% of your initial margin. Conversely, when trading with lower leverage, like 10x, the MML drops to below 5%. This means that high-leverage trades leave little room for error and can lead to rapid liquidations if market conditions shift.

A Cautionary Note

It’s important to remember that BitMEX is as efficient at liquidating losing positions as it is at facilitating initial trades. Traders should exercise caution when determining their leverage. Many analysts suggest that keeping your leverage below 25x is prudent, especially for beginners. Lower leverage allows for greater flexibility and a more manageable risk profile.

If you’re new to BitMEX or trading with leverage, it’s advisable to approach your trades with a clear risk management strategy. This includes:

- Using Lower Leverage: Start with lower leverage to mitigate the risk of liquidation.

- Setting Stop-Loss Orders: Protect your capital by setting stop-loss orders to exit positions at predetermined levels.

- Monitoring Market Conditions: Stay informed about market trends and volatility that can impact your positions.

While BitMEX provides the allure of high leverage, it’s essential to be acutely aware of the risks associated with liquidation. By understanding the mechanics of margin requirements and approaching trading with caution, you can better navigate the challenges of trading on BitMEX. Always prioritize risk management to protect your investments in this volatile trading environment.

BitMEX Review: Deposits and Withdrawals

Understanding how to deposit and withdraw funds on BitMEX is essential for effective trading. As a crypto-only exchange, BitMEX does not support funding your account with fiat currencies, so you’ll need to navigate its processes specifically designed for cryptocurrencies. Here’s a comprehensive guide on managing deposits and withdrawals.

Depositing Funds

Crypto-Only Funding: BitMEX exclusively accepts deposits in Bitcoin (BTC). To fund your account, you will need to transfer Bitcoin from your personal wallet to your BitMEX account. This process is straightforward and allows you to maintain your trading capital in a secure environment.

Minimum Deposit Requirements: The minimum amount required for a deposit is 0.001 BTC. This low threshold allows traders of all levels to engage with the platform without needing substantial capital upfront.

No Deposit Fees: BitMEX does not charge any fees for deposits, making it cost-effective for traders to move their funds onto the platform.

How to Deposit Bitcoin?

Create a BitMEX Account: If you don’t already have an account, go to the BitMEX website and complete the registration process by providing the required information and verifying your email.

Navigate to the Wallet Section: Log in to your BitMEX account, and click on the “Wallet” option in the main menu.

Generate a Deposit Address: Select “Deposit” to generate your unique Bitcoin deposit address. Make sure to copy this address accurately.

Transfer Bitcoin:

- Use your personal Bitcoin wallet to send the desired amount of BTC to the deposit address you just created. Remember, the minimum deposit amount is 0.001 BTC.

- It’s a good practice to send a small test amount first to confirm the process is working correctly.

Confirm Deposit: Once the transaction is completed, you can check the “Balances” section in your BitMEX account to confirm that your Bitcoin has been credited. Deposits are processed automatically and typically appear quickly.

Withdrawing Funds

Initiating Withdrawals: To withdraw your funds, simply select the “Balances” tab on the BitMEX platform. You can specify the amount of Bitcoin you wish to withdraw and enter the destination wallet address.

Manual Withdrawal Process: Withdrawals at BitMEX are processed manually, which may slightly extend the time required for the funds to arrive. However, this approach enhances security, allowing for verification of each withdrawal to detect any unauthorized activities.

Network Fees: While BitMEX does not impose withdrawal fees, there is a minimum network fee that applies based on the current load on the Bitcoin blockchain. These fees are typically minor and vary depending on network conditions.

No Withdrawal Limits: There are no restrictions on how much Bitcoin you can withdraw at one time, giving you the flexibility to manage your funds according to your trading strategy.

How to Withdraw Bitcoin?

Access the Balances Tab: To initiate a withdrawal, navigate to the “Balances” tab on the BitMEX platform.

Select Withdrawal Option: Click on the “Withdraw” button to start the withdrawal process.

Enter Withdrawal Details: Input the amount of Bitcoin you wish to withdraw and the wallet address where you want the funds sent. Be extremely careful when entering the wallet address to avoid any loss of funds.

Review Security Prompt: Since withdrawals are processed manually for security reasons, BitMEX may prompt you to confirm the withdrawal via email. Check your email and follow the instructions to verify your withdrawal request.

Monitor the Withdrawal Status:

- After confirming, your withdrawal request will be processed manually. While this may take some time, it enhances security by allowing for a thorough review.

- You can track the status of your withdrawal in the “Withdrawals” section of your account.

Check for Network Fees: Be aware that while BitMEX does not charge withdrawal fees, a minimum network fee applies based on the current load on the Bitcoin blockchain. This fee is deducted from your withdrawal amount.

No Withdrawal Limits: There are no restrictions on how much Bitcoin you can withdraw at any given time, providing you with the flexibility to manage your funds according to your trading strategy.

Supported Currencies

In addition to Bitcoin, BitMEX also allows deposits in various cryptocurrencies, which serve as collateral for trading contracts. The supported currencies include:

- Bitcoin (XBT)

- Bitcoin Cash (BCH)

- Ethereum (ETH)

- Ethereum Classic (ETC)

- Litecoin (LTC)

- Ripple Token (XRP)

- Monero (XMR)

- Dash (DASH)

- Zcash (ZEC)

- Cardano (ADA)

- Tron (TRX)

- EOS Token (EOS)

Security Considerations

The manual nature of the withdrawal process acts as a safeguard for your funds, allowing for a thorough review before any transactions are completed. This extra layer of security is crucial in today’s crypto landscape, where safeguarding your investments is paramount.

Managing deposits and withdrawals on BitMEX is designed to be simple and secure. With a focus on Bitcoin transactions and a manual withdrawal process, you can confidently navigate your trading journey. Always ensure you are sending Bitcoin to the correct wallet address and keep an eye on network conditions to minimize any potential fees.

BitMEX Customer Support

When it comes to trading platforms, robust customer support is essential for a smooth trading experience. BitMEX, known for its advanced trading features, offers a support system designed to assist users around the clock. Here’s what you need to know about their customer service options.

24/7 Support Availability

BitMEX provides 24/7 customer support, ensuring that help is available whenever you need it. You can reach out to their support team through email or by submitting support tickets directly on the platform.

Feedback from users suggests that the response time is generally quite efficient, with most inquiries receiving attention within an hour. This quick turnaround is particularly valuable in the fast-paced world of cryptocurrency trading, where timely assistance can significantly impact your trading decisions.

Utilizing the Knowledge Base

Before reaching out to customer support, it’s a good idea to explore BitMEX’s Knowledge Base. This resource is well-organized and contains a wealth of information covering various topics related to trading, account management, and platform features.

The Knowledge Base is designed to address common questions and issues, making it easy for you to find answers without needing to contact support directly. This self-service option can save you time and provide you with the information you need to navigate the platform more effectively.

Pro Tip for Efficient Support

If you’ve submitted a support ticket and haven’t received a response within a reasonable timeframe, you can follow up via BitMEX’s social media channels, such as Reddit and Twitter. Engaging on these platforms can sometimes expedite the process, as it allows for more direct communication with the support team.

BitMEX’s customer support is considered reliable compared to many other exchanges. With 24/7 availability, a responsive team, and a comprehensive Knowledge Base, traders can feel confident that they will receive the assistance they need. Whether you have a specific question or are looking for general information, BitMEX strives to provide a supportive environment for all its users.

BitMEX Review: Trading Chats

BitMEX offers an engaging social feature known as the “Trollbox,” which facilitates communication among traders on the platform. This group chat function is increasingly popular among various trading platforms, enabling users to share insights and perspectives about the market in real time. The Trollbox supports multiple languages, including English, Russian, Spanish, Japanese, and Chinese, making it accessible to a diverse range of traders.

While the Trollbox can be entertaining, it often skews towards light-hearted banter and trolling rather than serious discussions. For traders seeking more substantial market analysis and insights, BitMEX provides an alternative through IRC (Internet Relay Chat) channels, where you can engage in more focused conversations with other traders.

The trading chats on BitMEX, particularly the Trollbox, can enhance your trading experience by connecting you with fellow traders. However, it’s essential to approach the conversations with a discerning mindset, as the quality of discussions can vary widely.

BitMEX Review: Countries Supported

BitMEX as a globally recognized cryptocurrency derivatives exchange, caters to a diverse international user base. Here’s a detailed overview of the countries supported by BitMEX and the factors influencing access to the platform:

Supported Countries

BitMEX is accessible to traders in many countries around the world, allowing them to engage in cryptocurrency trading and derivatives without the need for fiat currency. Some of the regions where BitMEX operates include:

- North America: Although BitMEX primarily targets international users, it does not allow users from the United States and certain other jurisdictions due to regulatory concerns.

- Europe: Many European countries can access BitMEX, providing traders with opportunities to trade various cryptocurrency derivatives.

- Asia: Users from several Asian countries, including Japan, South Korea, and Singapore, can use the platform for their trading activities.

- Oceania: Countries like Australia and New Zealand are also part of BitMEX’s user base.

- Latin America: Traders from various Latin American countries can participate in trading on BitMEX, though some restrictions may apply.

Restrictions Countries

Some notable restrictions include:

- United States: Users from the U.S. are prohibited from using BitMEX, which has affected its market presence in one of the largest cryptocurrency trading regions.

- Regulated Jurisdictions: Certain countries with stringent regulations on cryptocurrency trading may face restrictions on using BitMEX. This is often a precautionary measure to avoid legal issues.

BitMEX offers a broad array of opportunities for traders across many countries. By adhering to regulatory guidelines, BitMEX ensures a secure trading environment while accommodating a diverse international community. If you’re considering using BitMEX, be sure to familiarize yourself with the specific regulations applicable to your country.

BitMEX API: Advanced Tools for Developers

The BitMEX API is a set of programming interfaces that allow developers to interact with the BitMEX cryptocurrency exchange platform programmatically. This API enables users to automate trading processes, access market data, and manage their accounts without needing to manually execute trades on the website. Here’s a breakdown of its key features and components:

Comprehensive Functionality

The BitMEX API exposes every function available on the website, granting developers unparalleled flexibility in building automated trading applications. Whether you are looking to create custom trading strategies or implement real-time market analysis, the API equips you with the necessary tools.

WebSocket API: Real-Time Data Access

One of the standout features of the BitMEX API is the WebSocket API, which utilizes the WebSocket protocol for fast and flexible data streaming. This API is particularly suited for developers focused on real-time market data.

Live Market Data: The WebSocket API allows you to receive live updates from the exchange without the need for authentication. This feature is ideal for applications that require immediate access to market data, such as price feeds and order book updates.

No Rate Limiting for Market Data: Unlike traditional APIs, the WebSocket connection does not impose rate limits, enabling you to fetch the most current information as frequently as needed. However, if you want to access account-specific data, you will need to authenticate by generating an API key.

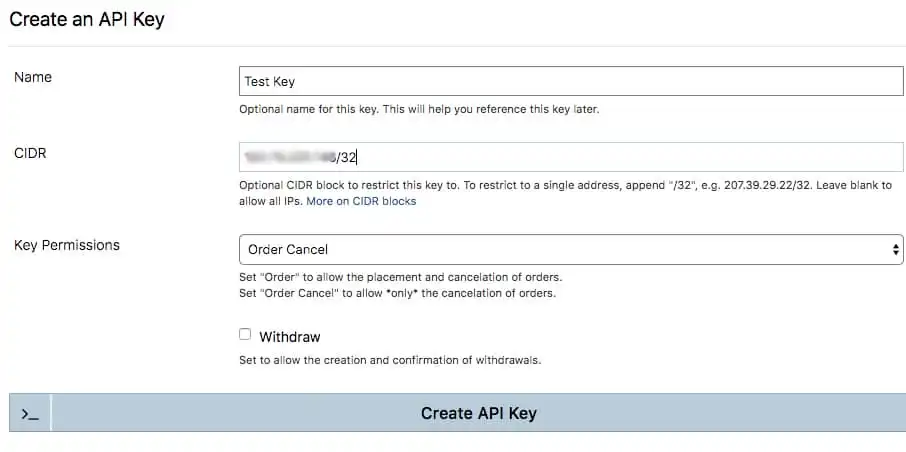

Generating an API Key

To utilize account-specific information through the WebSocket connection, you must create an API key:

- Log into Your Account: Access the API key generation section within your BitMEX account.

- Fill Out the Form: You will be prompted to name your key and define the permissions it will have. For added security, consider restricting access to specific IP addresses.

- Create the Key: Once you complete the form, click the “Create API Key” button to generate your unique key. This key will enable you to stream account-specific data securely.

REST API: Full Trading Functionality

While the WebSocket API is excellent for real-time data, the REST API provides a complete suite of trading functionalities:

Order Execution: The REST API allows you to place orders, manage existing positions, and withdraw funds from your account. It’s crucial to handle wallet withdrawals carefully, as they do not require email confirmation.

Rate Limits: Be mindful of the rate limits associated with the REST API. Logged-in users can make up to 300 requests every 5 minutes, while non-authenticated requests are limited to 150 per 5 minutes. If you find these limits too restrictive, you can request an increase by contacting BitMEX support at support@bitmex.com, provided your application meets specific requirements outlined in their documentation.

Important Considerations

While leveraging the BitMEX API, it’s essential to familiarize yourself with the platform’s guidelines, including limits on outstanding orders and order sizes. The comprehensive API documentation provides detailed information to ensure you make the most of these powerful tools.

The BitMEX API is an invaluable resource for developers looking to enhance their trading experience through automation and real-time data access. With its robust functionalities, including the WebSocket and REST APIs, BitMEX empowers you to create sophisticated trading applications tailored to your unique strategies.

BitMEX Review: Pros and Cons

BitMEX Review: Pros

Professional Derivatives Trading Platform

BitMEX is designed for serious traders, offering an institutional-grade crypto derivatives trading experience developed by industry veterans. This platform is tailored to meet the needs of both professional traders and institutions.

High Leverage Options

Traders on BitMEX can utilize leverage ranging from 20x to 100x on Bitcoin and Ethereum, enabling the potential for substantial gains from small price movements. This flexibility attracts traders looking for high-risk, high-reward opportunities.

Deep Liquidity for Bitcoin Perpetuals

BitMEX is recognized for its deep liquidity in Bitcoin perpetual futures contracts, ensuring smooth trading and minimal slippage even during high-volume transactions.

Low Trading Fees

With competitive trading fees and a maker fee rebate, BitMEX makes it cost-effective for traders to execute their strategies without incurring excessive costs.

No KYC for Small Withdrawals

BitMEX allows limited withdrawals without the need for Know Your Customer (KYC) verification. This feature offers privacy and convenience for smaller traders who prefer not to disclose personal information.

Advanced Tools and Features

The platform offers a range of advanced trading tools and features, making it well-suited for experienced traders seeking comprehensive market analysis and strategies.

Strong Security Measures

With a robust emphasis on security and cold storage, BitMEX has never been hacked, providing traders with peace of mind regarding their funds.

BitMEX Review: Cons

Only Crypto-to-Crypto Trading

BitMEX operates solely on cryptocurrency deposits, meaning traders cannot fund their accounts with fiat currencies, which may limit accessibility for some users.

Not Available to U.S. Customers

Due to regulatory issues, BitMEX is unavailable to U.S. residents, restricting access for a significant portion of potential users.

Risky for Beginners

The high leverage available can be daunting for inexperienced traders, emphasizing the importance of understanding the risks associated with margin trading.

Complex Interface

While advanced features are beneficial for seasoned traders, the platform’s interface may be overwhelming for newcomers, making the learning curve steeper.

BitMEX offers a robust trading platform with numerous advantages for experienced traders, particularly those interested in derivatives trading. However, potential users should carefully consider the associated risks and limitations, especially if they are new to the crypto trading landscape.

Customer Reviews 2024 – What Do Customers Say About BitMEX?

BitMEX has garnered mostly positive feedback from its user base, particularly from seasoned traders who value the platform’s robust features. The advanced trading tools, such as high-leverage options and futures contracts, have been highlighted as major advantages. Experienced traders also appreciate the liquidity for Bitcoin perpetuals, which allows for efficient order execution even with larger trades.

In terms of support, BitMEX’s customer service has received praise for being prompt and helpful, providing reliable assistance when needed. However, some concerns arise among new traders, primarily about the complexity of the platform. The interface and advanced tools, while powerful, may feel overwhelming for those unfamiliar with derivatives trading.

Despite the learning curve, BitMEX continues to be a go-to choice for professional traders seeking a sophisticated trading environment. The combination of high liquidity, advanced features, and responsive customer service ensures that BitMEX remains a trusted platform in the crypto trading space.

By focusing on these strengths, the platform retains its reputation as a reliable choice for experienced traders looking to maximize their returns with advanced tools.

BitMEX in 2024 and Beyond: Is It Worth Investing Now?

Current Status of BitMEX

2024 marks a significant period for BitMEX. The platform has undergone numerous changes and reforms following past legal issues and is now actively working to rebuild its reputation. With improvements in security, user experience, and customer support, BitMEX is gradually restoring trust within the investor community.

Future Trends

Expansion of Trading Products: BitMEX has the potential to broaden its trading offerings, from new derivatives to accepting a wider range of assets.

Enhanced Security Features: In light of the increase in cyberattacks, BitMEX is committed to continuing its investment in security measures to protect users’ assets.

User Education and Support: The platform will provide more educational resources and support to help users better understand derivatives trading and risk management.

Should You Invest in BitMEX Now?

High Trading Opportunities: BitMEX allows leverage of up to 100x, providing opportunities for investors looking to profit from small price movements.

High Liquidity: The platform boasts some of the highest liquidity for Bitcoin futures contracts, facilitating easier trading.

High Risk: High leverage comes with significant risks, especially for inexperienced investors.

Legal Issues: While some past legal challenges have been resolved, the lack of regulatory clarity may still impact future operations.

Investing in BitMEX in 2024 and beyond depends on your risk tolerance and understanding of the derivatives market. If you are an experienced investor with a clear grasp of derivatives trading, BitMEX could be an attractive option. However, if you are just starting or lack confidence in risk management, it may be wise to consider safer alternatives.

[button url=”https://www.bitmex.com/app/register/WURam0″ target=”blank” style=”3d” background=”#49ef2d” color=”#FFFFFF” size=”10″ wide=”no” center=”yes” radius=”auto” icon=”icon: mail-forward” icon_color=”#FFFFFF” text_shadow=”none”]Visit BitMEX[/button]BitMEX Review – Frequently Asked Questions

What is the Mark Price?

The Mark Price is a calculated price used for liquidation and margin requirements, designed to reflect the fair value of a contract by taking into account the last traded price and the underlying index price.

What is Lot Size?

Lot Size on BitMEX refers to the smallest quantity of a contract that can be traded. For example, the lot size for Bitcoin contracts is typically 1 contract.

Does BitMEX have any market makers?

Yes, BitMEX employs market makers to enhance liquidity and ensure efficient trading by providing buy and sell orders in the order book.

What is Maintenance Margin?

Maintenance Margin is the minimum amount of equity that must be maintained in a trading account to keep a position open. If the account balance falls below this level, the position may be liquidated.

Can I go bankrupt?

While you cannot go bankrupt in a traditional sense on BitMEX, you can lose all your invested capital if your trades are not managed properly, especially with high leverage.

Do you socialize losses?

BitMEX does not socialize losses; each trader is responsible for their own losses. However, in extreme market conditions, some positions may be liquidated, affecting other traders.

What is Auto-Deleveraging?

Auto-Deleveraging is a mechanism that reduces the leverage of certain positions automatically during periods of high volatility or low liquidity to protect the overall system.

Is there a fee to deposit Bitcoin?

No, BitMEX does not charge a fee for depositing Bitcoin.

Is there a fee to deposit Ether, Tether, and other ERC-20 coins?

BitMEX does not charge fees for depositing Ether and Tether; however, withdrawal fees may apply.

Conclusion

The BitMEX Review highlights how this platform stands out as an exceptional trading venue for experienced traders seeking advanced derivatives trading opportunities and high leverage. With its robust liquidity and various trading tools, it caters well to those familiar with the complexities of the crypto market. However, novices should approach with caution, given the inherent risks associated with high-leverage trading and the platform’s complex interface.

This review has been thoroughly vetted and verified by CoinReviews, ensuring that you can trust the information presented here. We strive to provide accurate and reliable content to empower our readers in making informed trading decisions.

Read more:

- Binance Review: Features, Supported Cryptos and Fees!

- Bybit Review: Pros, Cons and Key Features

- OKX Review: Pros, Cons, Future Potential & More

- HTX Review: Fees, Security, Pros & Cons

- Bitget Review: Pros & Coins, Fees & More

- Bitfinex Review: Is It Secure or Scam?

- Kucoin Review: Social Trading, Fees, Pros & Cons

- Crypto.com Review: Is the Exchange Safe or Scam?

- BingX Review: Verified Reviews, Pros & Cons

- LBank Review: Should You Use It?

- bitFlyer Review: Pros & Cons and Ratings

- ProBit Review: Is It the Right Crypto Exchange for You?

- P2B Review: Fees, Features, Safety, Pros & Cons

- Pionex Review: Pros, Cons & All You Need to Know

- Phemex Review: Is It a Good Crypto Exchange?

- BTSE Review: Is It Safe & Reliable?

- CoinEx Review: Is This Crypto Exchange Safe?

- Poloniex Review: Features, Regulation & Risks

- BITFLEX Review: Features, Safety, Pros & Cons

- CoinJar Review: Is It the Right Exchange for You?

- Paymium Review: Pros, Cons, Key Features & Fees

- LBank Review: Is It the Right Exchange for You?

- MEXC Review: Latest Pros, Cons, Key Features & Fees

- BitMart Review: Reviews, Trading Fees & Cryptos