When choosing an online trading platform, safety and trustworthiness are at the top of every trader’s list. Since 2006, AvaTrade Review has not only pioneered online Forex and CFD trading but has become a leading global broker, offering top-tier trading experiences to clients worldwide. Known for its longevity in the market, AvaTrade stands out not only for its extensive history but also for its unparalleled reputation, backed by nine regulatory licenses from trusted financial bodies around the globe, ensuring peace of mind for every trader.

While new brokers may appear enticing, AvaTrade’s well-established reputation, coupled with transparent operations and strong regulatory backing, make it an unmissable choice for serious investors. In this AvaTrade review, CoinReviews provides a thorough look at all the reasons why millions around the world continue to trust AvaTrade as their trading platform of choice.

What is AvaTrade?

AvaTrade is an internationally recognized online broker specializing in Contracts for Difference (CFDs) that gives you access to a broad range of trading options, including forex, stocks, commodities, cryptocurrencies, bonds, ETFs, options, and indices. Founded in 2006 as part of the AVA Group, AvaTrade has built a solid reputation for offering secure and reliable trading platforms backed by nine different regulatory bodies worldwide—giving you added peace of mind when you trade.

One of AvaTrade’s greatest strengths is its flexibility. You’ll find support for popular platforms like MetaTrader 4 and MetaTrader 5, as well as AvaTrade’s own mobile app, which makes trading on the go seamless. This range of tools allows both manual and automated trading options, so you can manage your portfolio across devices with ease, whether you’re new to trading or have years of experience.

AvaTrade also provides a diverse selection of CFDs, including major cryptocurrencies like Bitcoin, which appeals to those of you looking to explore new and innovative markets. The platform’s commitment to an award-winning experience extends to a rich library of educational resources, which is especially helpful if you’re just starting out or want to broaden your trading skills. By combining advanced tools with straightforward, user-friendly features, AvaTrade makes it easy for you to trade with confidence and diversify your portfolio.

AvaTrade Review: Company Overview

AvaTrade has achieved significant growth, now boasting over 300,000 clients and facilitating over 3 million trades each month. The broker continually enhances its platform, introducing innovative features like AvaSocial and AvaProtect to benefit its users.

Global Presence and Recognition

While its main headquarters are in Ireland, AvaTrade operates through several entities worldwide, enhancing its credibility. Notably, AvaTrade was the first forex broker to receive a 3A license in Abu Dhabi, allowing it to offer both retail and professional trading services.

Diverse Asset Range

AvaTrade offers an extensive selection of assets, with over 1,250 individual assets available for trading, including:

- More than 50 forex pairs

- 17 CFDs on commodities

- Equity indices, bonds, ETFs, cryptocurrencies

- Over 500 individual share CFDs

Additionally, AvaTrade stands out by offering options trading on forex pairs, a feature that is not commonly found among its competitors in the online forex and CFD market.

Background and history

Founded in 2006, AvaTrade Review is one of the oldest and most trusted names in online trading. Headquartered in Dublin, Ireland, AvaTrade has grown into a global broker with offices in regions such as Australia, Chile, China, Japan, Italy, Mexico, Poland, South Africa, and the United Arab Emirates.

A key component of AvaTrade’s reputation lies in its dedication to strict regulatory compliance, which provides a high level of security and peace of mind for traders globally. AvaTrade operates under multiple respected regulatory bodies, such as:

- Europe: AvaTrade is licensed by the Central Bank of Ireland (License No. C53877), a respected regulatory authority within the European Union, ensuring high standards of financial conduct and client protection.

- British Virgin Islands: Here, AvaTrade is regulated by the B.V.I. Financial Services Commission (License No. SIBA/L/13/1049), adding an additional layer of oversight.

- Australia: In Australia, the broker operates under the Australian Securities and Investments Commission (ASIC, License No. 406684), recognized for its stringent financial guidelines.

- Japan: AvaTrade is authorized by both the Financial Services Agency (FSA, License No. 1662) and the Financial Futures Association (License No. 1574), ensuring its operations meet Japanese market standards.

- South Africa: AvaTrade is licensed by the Financial Sector Conduct Authority (FSCA, License No. 45984), providing access to the growing South African trading community.

- Middle East: In the Middle East, AvaTrade operates under the Financial Regulatory Services Authority of Abu Dhabi Global Markets (License No. 190018), which enhances the platform’s each within the Gulf region.

AvaTrade welcomes clients from a wide range of countries, including the United Kingdom, Canada, Australia, Thailand, Singapore, and more. However, it is unavailable to users in the United States, Belgium, India, Pakistan, Iran, Iraq, and Zimbabwe due to specific regulations.

To get started, AvaTrade requires a quick identity verification process for security. This involves providing a government-issued ID or passport and a proof of address (e.g., utility bill), typically approved within a day. Note that unverified accounts may be temporarily restricted after 14 days from the first deposit.

AvaTrade’s long history, global reach, and strong regulatory backing make it a reliable choice for traders seeking security and a wide range of trading options.

Regulation and Security: Is AvaTrade Safe?

When considering a broker for trading forex and CFDs, regulation and security are paramount. AvaTrade stands out in this regard, offering robust regulatory oversight across multiple jurisdictions. Here’s delves into the regulatory framework governing AvaTrade and evaluates its security measures, helping you determine if it’s a safe choice for your trading needs.

Regulatory Oversight

AvaTrade operates under various entities that are regulated in six major global jurisdictions, enhancing its credibility and ensuring adherence to stringent financial standards:

- AvaTrade EU Limited: Based in Dublin, Ireland, this entity is regulated by the Central Bank of Ireland (CBI), offering coverage for clients within the European Union (License No. C53877).

- Ava Capital Markets Australia Pty Limited: Headquartered in Sydney, Australia, this branch operates under the supervision of the Australian Securities and Investments Commission (ASIC) (License No. 406684).

- AvaTrade Japan K.K.: Located in Tokyo, Japan, this entity is licensed by the Financial Services Agency (JFSA) (License No. 1662) and the Financial Futures Association (License No. 1574), providing a strong regulatory framework in Japan.

- Ava Capital Markets Pty Limited: This South African entity is regulated by the Financial Sector Conduct Authority (FSCA) (License No. 45984).

- AvaTrade Middle East Limited: Operating from Abu Dhabi, this entity is regulated by the Abu Dhabi Global Markets Financial Regulatory Services Authority (FRSA) (License No. 190018), making it a pioneer for retail and professional trading in the region.

- Ava Trade Ltd: Based in the British Virgin Islands (BVI), this entity is regulated by the BVI Financial Services Commission.

Unique Advantages of AvaTrade’s Regulation

While it’s uncommon for a broker to have such a diverse regulatory structure, AvaTrade’s setup is beneficial for traders. Operating from locations like Ireland and Australia, which have strong regulatory frameworks, ensures that AvaTrade adheres to high standards. Japan’s rigorous regulations further bolster AvaTrade’s trustworthiness, allowing clients to trade confidently.

Safety Measures

AvaTrade’s regulatory compliance translates into effective safety mechanisms for clients:

- Segregated Client Funds: AvaTrade ensures that client funds are kept in separate accounts from the company’s operational funds. This minimizes risks associated with financial mismanagement.

- Negative Balance Protection: Most AvaTrade entities provide negative balance protection, which means traders cannot lose more than their deposited amount, an essential feature in volatile markets. This protection extends globally, regardless of local regulations.

- Investor Compensation Schemes: In Ireland, clients are protected up to €20,000 under the Investor Compensation Fund (ICF). This safety net is crucial in the unlikely event of broker insolvency.

- Leverage Restrictions: AvaTrade implements maximum leverage limits based on jurisdiction, ensuring that traders are not exposed to excessive risk. For instance, the leverage limit for most entities is capped at 1:30, while the BVI entity offers up to 1:400.

Trust and Transparency

AvaTrade’s commitment to transparency is evident in its legal documentation and fee structures. The broker provides clear terms and conditions, ensuring that traders can make informed decisions. Additionally, AvaTrade publishes a ‘best execution policy,’ which guarantees that clients receive the most favorable pricing available.

In evaluating trustworthiness, AvaTrade is backed by its solid operational history, regulatory compliance, and transparent policies. It operates under three Tier-1 regulators, which indicates a high level of oversight, compared to many brokers that may only have Tier-2 or Tier-3 licenses.

AvaTrade emerges as a safe and secure option for trading forex and CFDs. Its robust regulatory framework, combined with effective safety measures and transparent operations, fosters a trustworthy trading environment. With multiple licenses across major jurisdictions, traders can engage with confidence, knowing that AvaTrade prioritizes their security and compliance.

AvaTrade Review: Assets Available to Trade

After discussing regulation, safety, and fees, it’s important to explore the variety of assets offered by AvaTrade. The range of available assets can greatly influence a trader’s choice of broker, particularly for those looking to trade specific instruments.

- New Traders: Typically, beginners may prefer individual forex or stock offerings since these are often the most familiar and comfortable to trade.

- Experienced Traders: On the other hand, seasoned traders usually seek a broker with a broad selection of assets across multiple classes to capitalize on different market trends.

Types of Assets Offered at AvaTrade

AvaTrade provides clients with access to an impressive array of assets, totaling over 1,250 instruments across various categories:

Forex: More than 55 forex pairs, including major and minor pairs, as well as exotic crosses.

Commodities: A selection of 17 commodities

- 5 metals

- Energy products

- A variety of soft commodities

Indices: Access to 20 global indices

- Several Chinese indices

- A green energy index

- A global cannabis index

Stocks: Over 500 major individual stocks from countries such as:

- The United States

- The United Kingdom

- Germany

- France

- Italy

Options: Trading options on 42 currency pairs, as well as options on gold and silver.

Exchange-Traded Funds (ETFs):

- 5 major ETFs are available for all clients.

- Clients using the MT5 platform can access an extended selection of 59 different ETFs.

Bonds: Offers two major government bonds:

- Euro Bunds

- Japanese Government Bonds

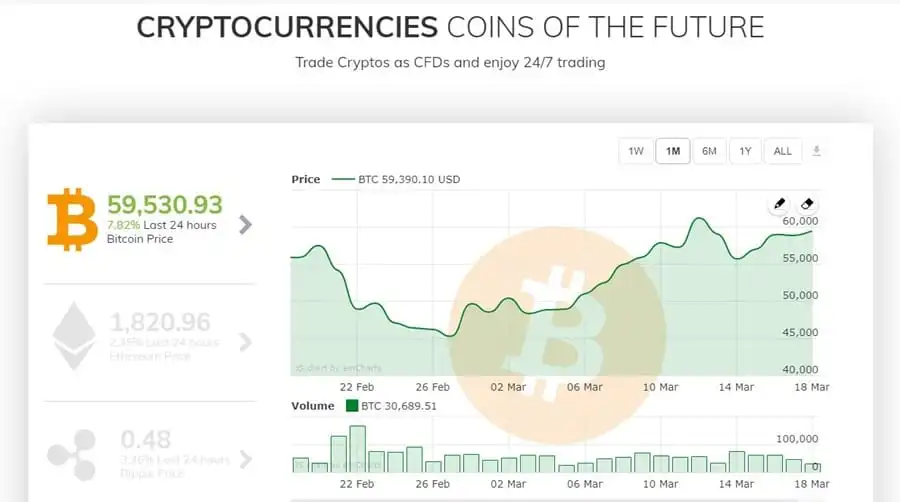

Cryptocurrencies: A range of 16 major cryptocurrencies and pairs, including:

- Bitcoin (BTC) versus several currencies

- Ethereum (ETH)

- A Crypto 10 index

Note: Residents of the U.K. and Ireland cannot trade cryptocurrencies.

Diversification and Opportunities

AvaTrade offers a robust selection of assets that cater to the needs of various traders. While the cryptocurrency selection could be more extensive, it remains adequate given the significant leverage options available (e.g., 1:25 for BTC/USD, 1:20 for Ethereum, and 1:10 or 1:5 for most other cryptocurrencies).

Additionally, AvaTrade stands out in the CFD brokerage space by offering actual options trading and a substantial selection of ETFs. This breadth of asset classes makes AvaTrade a strong choice for traders looking for diversification in their portfolios.

Account Types and Products on AvaTrade

AvaTrade is a well-established online brokerage that provides a diverse range of trading products and account types, catering to both beginners and experienced traders. This guide outlines the various trading products available on AvaTrade and the associated account types, ensuring that you can make informed trading decisions.

European Union Accounts

For traders residing in the European Union, AvaTrade offers three main account types:

Retail Account: This is the standard account type for all EU-based traders. It allows trading with a maximum leverage of up to 1:30 across various asset classes, ensuring that traders can manage their risk effectively.

Professional Account: Designed for seasoned traders who meet specific eligibility criteria, this account type offers higher leverage (up to 1:400) and tighter spreads. To qualify, traders must meet at least two of the following conditions:

- Have significant trading activity in the last 12 months.

- Possess relevant experience in the financial services sector.

- Maintain a portfolio of financial instruments exceeding €500,000.

Spread Betting Account: Available exclusively for residents of Ireland and the U.K., this account type shares similar features with the retail account but offers unique tax advantages, including exemptions from Stamp Duty, Capital Gains Tax, and Income Tax on profits.

Non-European Union Accounts

For traders outside the EU, AvaTrade provides two account types:

- Standard Account: This account type is available for international clients and offers a maximum leverage of 1:400 on Forex and indices. It is designed for traders looking for a straightforward trading experience.

- VIP Account: Traders who deposit over €10,000 can access the VIP account, which comes with enhanced trading conditions, including tighter spreads and the same leverage as the Standard Account.

Common Account Features

Regardless of the account type, all AvaTrade clients can enjoy several common features:

- Demo Account: Test trading strategies using a practice account funded with virtual money for up to 21 days.

- Islamic Account: For traders adhering to Sharia Law, these accounts come without overnight swap charges.

- Vanilla Options Account: Available for those interested in trading vanilla options.

All accounts have a minimum deposit requirement of $100, except for the VIP account. Deposits can be made in multiple currencies, including USD, EUR, GBP, CHF, and AUD.

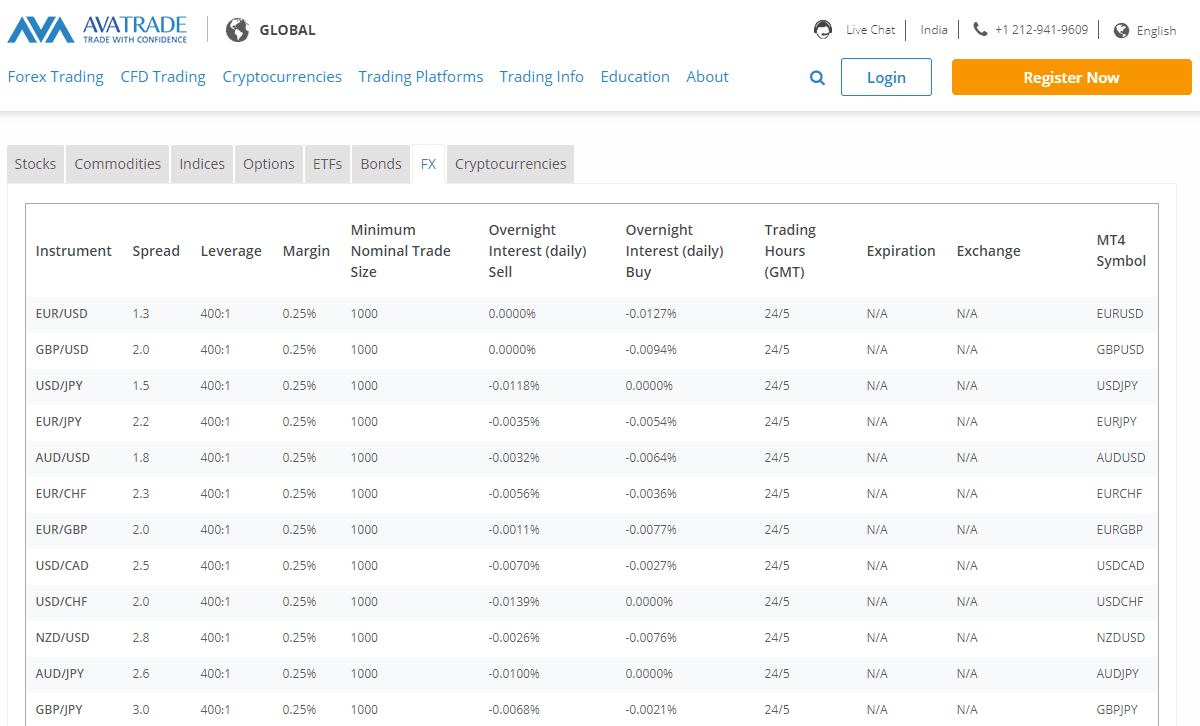

Forex Trading

AvaTrade provides access to a wide range of currency pairs, allowing traders to engage in the foreign exchange market.

- Leverage: Maximum leverage for Forex trading is up to 1:400 for non-EU accounts and 1:30 for EU accounts.

- Pairs Offered: Major, minor, and exotic currency pairs are available for trading.

Indices and Stocks

Traders can access a variety of global indices and stocks, allowing for diversified trading opportunities.

- Indices: Major indices such as the S&P 500, NASDAQ, DAX, and FTSE 100 can be traded, providing exposure to significant market movements.

- Stocks: A selection of international stocks is available for trading, enabling traders to invest in established companies across different sectors.

Commodities

AvaTrade supports trading in several key commodities, including:

- Precious Metals: Gold and silver are available, often used as safe-haven assets during market volatility.

- Energy Commodities: Crude oil and natural gas are among the popular energy commodities that traders can speculate on.

Cryptocurrencies

For those interested in digital currencies, AvaTrade offers trading on major cryptocurrencies.

- Pairs Available: Bitcoin, Ethereum, Litecoin, and others can be traded, typically with leverage of up to 1:20 for non-EU accounts.

- Trading Fees: AvaTrade generally does not charge commissions, but spreads may vary.

Contracts for Difference (CFDs)

CFDs allow traders to speculate on the price movements of various assets without owning the underlying asset.

Advantages of CFDs:

- Leverage: Traders can amplify their positions, enhancing potential profits (and losses).

- Diverse Market Access: Trade on Forex, commodities, stocks, and indices all from a single platform.

AvaTrade offers a well-rounded trading experience with a variety of account types and products tailored to different trading needs. Whether you are a beginner or an experienced trader, AvaTrade provides the necessary tools and resources to enhance your trading journey. The combination of competitive leverage, a user-friendly platform and diverse market access makes AvaTrade a popular choice among traders worldwide.

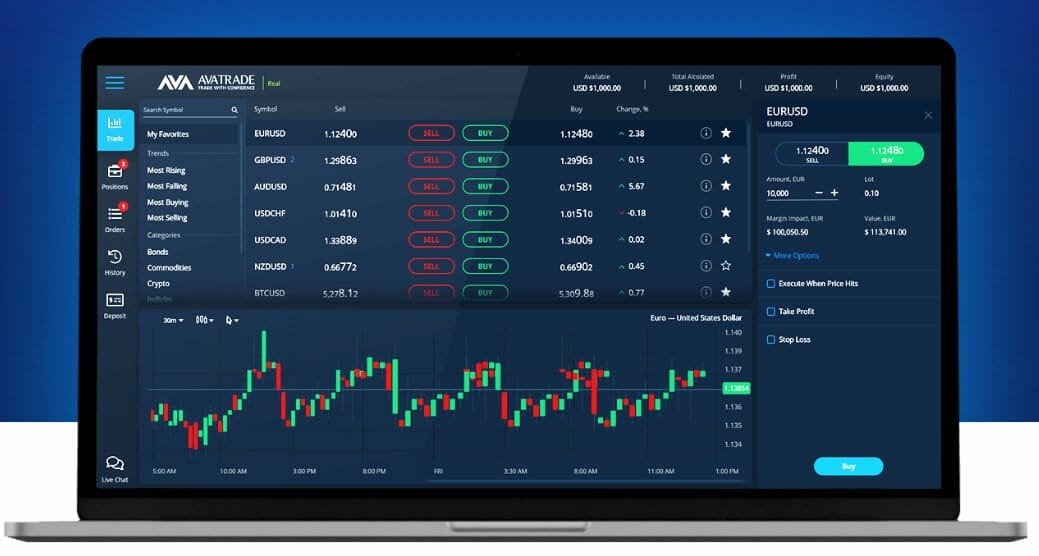

AvaTrade Review: Trading Platforms

AvaTrade is recognized for its versatile trading platforms, which cater to a broad spectrum of trading styles and preferences. Below, we will explore the various trading platforms offered by AvaTrade, including: MetaTrader 4, MetaTrader 5, AvaOptions and WebTrader.

MetaTrader 4 (MT4)

Launched in 2002, MT4 has become one of the most popular trading platforms globally, used by millions of traders. AvaTrade offers MT4 on various devices, including desktop (Windows), mobile (Android and iOS), and as a web-based platform. The desktop version is particularly favored due to its robust performance and minimal glitches.

Key Features of MT4:

- One-click trading for quick transactions.

- 9 timeframes and 3 chart types (line, bar, candlestick).

- 30 built-in indicators and 24 graphical objects for comprehensive analysis.

- A single login allows access across multiple devices.

- Robust data backup and security features.

- Supports 4 types of pending orders and offers backtesting capabilities for strategies.

- Access to trade history, micro lots, and an internal mailing system.

- News streaming and built-in guides for MT4 and MQL4.

Despite no longer being officially supported by MetaQuotes, MT4 continues to be favored by many traders, sometimes even over its successor, MT5.

MetaTrader 5 (MT5)

MT5 is designed to enhance the capabilities of MT4, providing a more powerful platform for traders. Users familiar with MT4 will find the transition to MT5 seamless, as it maintains a similar interface while introducing more advanced features.

Key Features of MT5:

- Multi-asset trading capabilities that include Forex, stocks, indices, commodities, cryptocurrencies and ETF CFDs.

- Inter-account fund transfers and enhanced one-click trading.

- Expanded EA functionality and direct trading from charts.

- 12 timeframes and 3 chart types (line, bar, candlestick).

- 38 built-in indicators and 37 graphical objects for sophisticated analysis.

- Secure, single-login access across all platforms.

- Supports 6 types of pending orders and offers a multi-threaded strategy tester.

- Backtesting, trading history, and risk management tools, including news streaming and internal messaging.

- Access to built-in MT5 and MQL5 help guides.

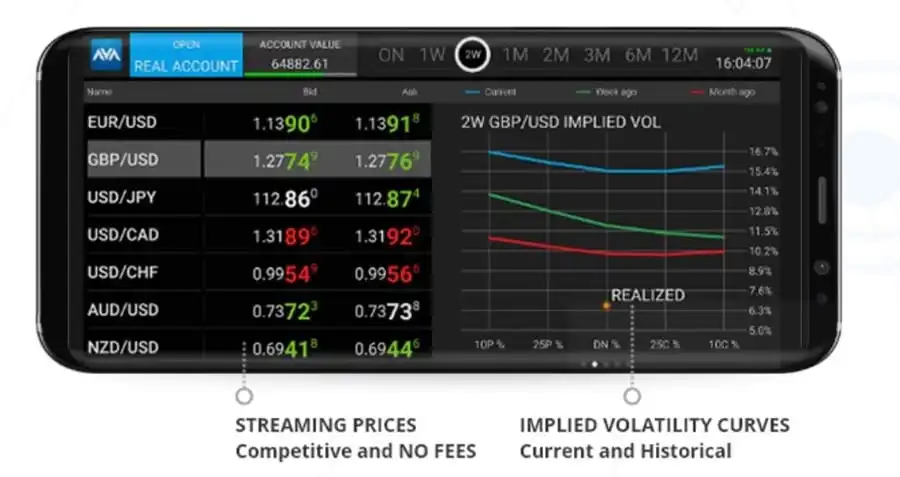

AvaOptions

AvaOptions is AvaTrade’s proprietary platform tailored for options trading, simplifying the process for traders. This platform is essential for clients looking to trade options on forex pairs, gold and silver.

- Graphical representation of risks and rewards for each trade, enhancing decision-making.

- Access to current implied volatility curves and historical volatility data.

- One-click trading capabilities, allowing for swift execution of trades with set entry and exit parameters.

- Built-in strategies for options trading, enabling traders to easily implement various approaches such as straddles, strangles, risk reversals, and spreads.

- Comprehensive risk management tools, including portfolio risk summaries that display metrics like Delta, Vega, and Theta.

- An Open Positions page that provides detailed risk measures, along with sorting and filtering capabilities.

WebTrader

AvaTrade’s WebTrader allows for easy access to trading without the need for installation. This platform is ideal for traders who prefer a straightforward, no-frills approach. It retains many of the functionalities of MT4 and MT5, ensuring that users can trade seamlessly.

Easy to Access: The browser-based platform is compatible with various operating systems, making it convenient for traders who switch between devices. It offers essential trading features, including charting tools and market analysis, ensuring that you have everything you need at your fingertips.

AvaTrade Review: Other Trading Platforms Tools

AvaTrade’s commitment to providing versatile trading platforms ensures that traders of all levels can find a suitable option for their trading needs.By offering a blend of powerful technology and user-friendly interfaces, AvaTrade positions itself as a strong contender in the trading platform landscape, catering to both traditional and options traders alike.

AvaTrade Trading Tools

MetaTrader 4 offers traders transparent pricing with spreads starting as low as 0.8 pips. It features flexible lot sizes, allowing trades from just 0.01 micro lots. The platform ensures quick execution times and supports automated trading, fully compatible with Expert Advisors (EAs) and MQL5.

AvaTradeGO

Voted the best forex trading app of 2020 by the Global Forex Awards, AvaTradeGO is a mobile and tablet-friendly trading portal that enables traders to manage their trades seamlessly. The app offers a comprehensive view of trades, the ability to create custom watchlists, and access to live prices and charts.

- AvaProtect: This innovative feature acts like insurance for individual trades, allowing traders to safeguard against losses of up to $1 million by paying a small hedging cost at the time of trade placement. This adds a layer of security for trades that carry higher risks while still allowing for substantial potential rewards.

- Market Trends: A social trading tool integrated into AvaTradeGO, Market Trends provides insights into the trading behaviors of other users. Traders can see what others are buying and selling, offering a crowdsourced perspective on market movements. This feature can be particularly beneficial for traders looking to gauge market sentiment and trends.

AvaSocial

AvaSocial is AvaTrade’s primary social trading app, designed to foster a community of traders who can share insights and strategies. This platform connects traders, allowing them to observe market movements in real time and learn from each other’s experiences.

- Learning from the Best: Beginners can gain valuable insights by following successful traders, which can help them develop effective trading strategies.

- Real-Time Trading Signals: Users receive timely trading signals to make informed decisions based on current market conditions.

- Community Engagement: Traders can share their trades, ask questions, and connect with others to expand their trading networks.

- Access to Markets 24/7: AvaSocial allows users to explore hundreds of markets at any time, facilitating continuous learning and trading opportunities.

- Monetization Opportunities: In partnership with the FCA-regulated Pelican Trading, AvaSocial enables traders to sell their own trading signals and charge for group access, creating potential income streams for experienced traders.

Guardian Angel

Guardian Angel is a unique plugin for the MetaTrader 4 platform that focuses on risk assessment for each trade. This tool provides instant feedback on trading actions, allowing traders to learn from their decisions. By analyzing what works and what doesn’t, traders can gradually enhance their decision-making skills and overall trading performance. The insights gained from Guardian Angel can lead to a more disciplined and informed approach to trading.

AvaTrade stands out in the trading industry due to its diverse range of platforms, catering to traders of all levels. Whether you prefer the established MetaTrader platforms, the innovative AvaOptions for options trading or the user-friendly AvaTradeGO app, there is something for everyone. Each platform is designed to provide comprehensive trading tools and features, ensuring you can execute your strategies effectively. With AvaTrade, you can trade with confidence, knowing you have the right tools to succeed.

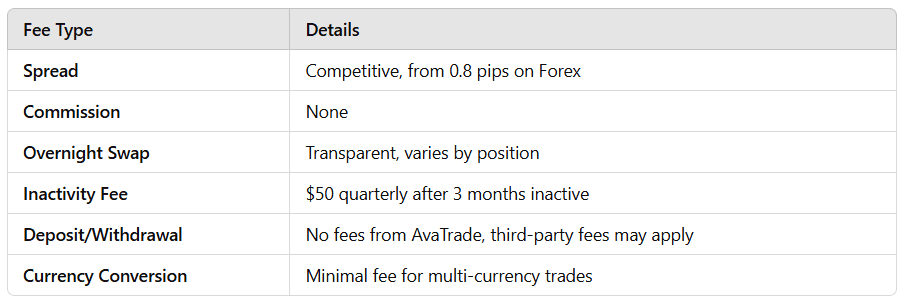

AvaTrade Review: Fees

AvaTrade’s fee structure is competitive and straightforward, appealing to both beginners and experienced traders. With a focus on transparency, AvaTrade uses a spread-only model, eliminating additional fees on major assets, while aiming to keep trading costs manageable.

Trading Fees and Spreads

AvaTrade operates on a commission-free model, meaning that spreads are the primary costs when trading. These spreads, which vary depending on the asset, are designed to be competitive across asset classes:

- Forex: AvaTrade’s average spread for the popular EUR/USD pair is 0.9 pips, offering cost-effective options for forex traders. This rate is competitive, falling slightly below the industry average of 1.08 pips, though it may fluctuate during high volatility.

- Commodities: For commodities like oil and gold, AvaTrade provides spreads of 0.03 and 0.34, respectively, aligning with industry norms and helping traders manage costs.

- Stocks: Stock trading on AvaTrade is also affordable, with spreads of around 0.13% on nominal trade value, making it attractive for those interested in shares.

AvaTrade’s spreads generally fall in line with, or below, market averages, especially for forex and commodity trading.

Overnight Swaps and Long-Term Fees

For trades held open past 22:00 GMT (or 21:00 GMT during Daylight Savings), AvaTrade applies an overnight swap fee, calculated based on the trade size, market price, and daily interest rate. This cost varies depending on whether the position is long or short:

- Swap Long: Charges apply for long positions, typically at rates competitive with market norms.

- Swap Short: Some positions may receive credit for short positions, depending on interest rate fluctuations.

Overnight swaps can be viewed directly on the trading platform and are presented in annualized terms, giving traders clarity and control over long-term costs. For traders interested in day trading or position trading, AvaTrade’s swap rates support both short- and longer-term strategies.

Non-Trading Fees

- Inactivity Fee: If an account remains inactive for three consecutive months, AvaTrade imposes a $50 inactivity fee, assessed quarterly. After twelve months, an additional $100 administration fee applies. This encourages active trading and transparency for account maintenance.

- Deposit and Withdrawal Fees: AvaTrade does not charge deposit or withdrawal fees. However, third-party banks or payment providers may apply their own fees, especially for international transfers.

- Currency Conversion Fee: A nominal currency conversion fee may be charged for transactions involving multiple currencies.

How Competitive Are AvaTrade’s Fees?

AvaTrade’s fees position it competitively within the industry. The spread-only model is suitable for frequent and high-volume traders by eliminating additional commissions. Additionally, its transparent swap rates and zero-fee withdrawals and deposits make AvaTrade a cost-effective choice for those focusing on forex and CFD trading.

Summary of AvaTrade’s Fee Structure

AvaTrade provides cost-effective trading solutions with minimal fees, transparent policies, and a simple spread-only model. Its fee structure is designed to be accessible and manageable, with policies that align with industry standards.

For traders looking for a fee structure that balances affordability and clarity, AvaTrade offers a strong option in the forex and CFD trading landscape.

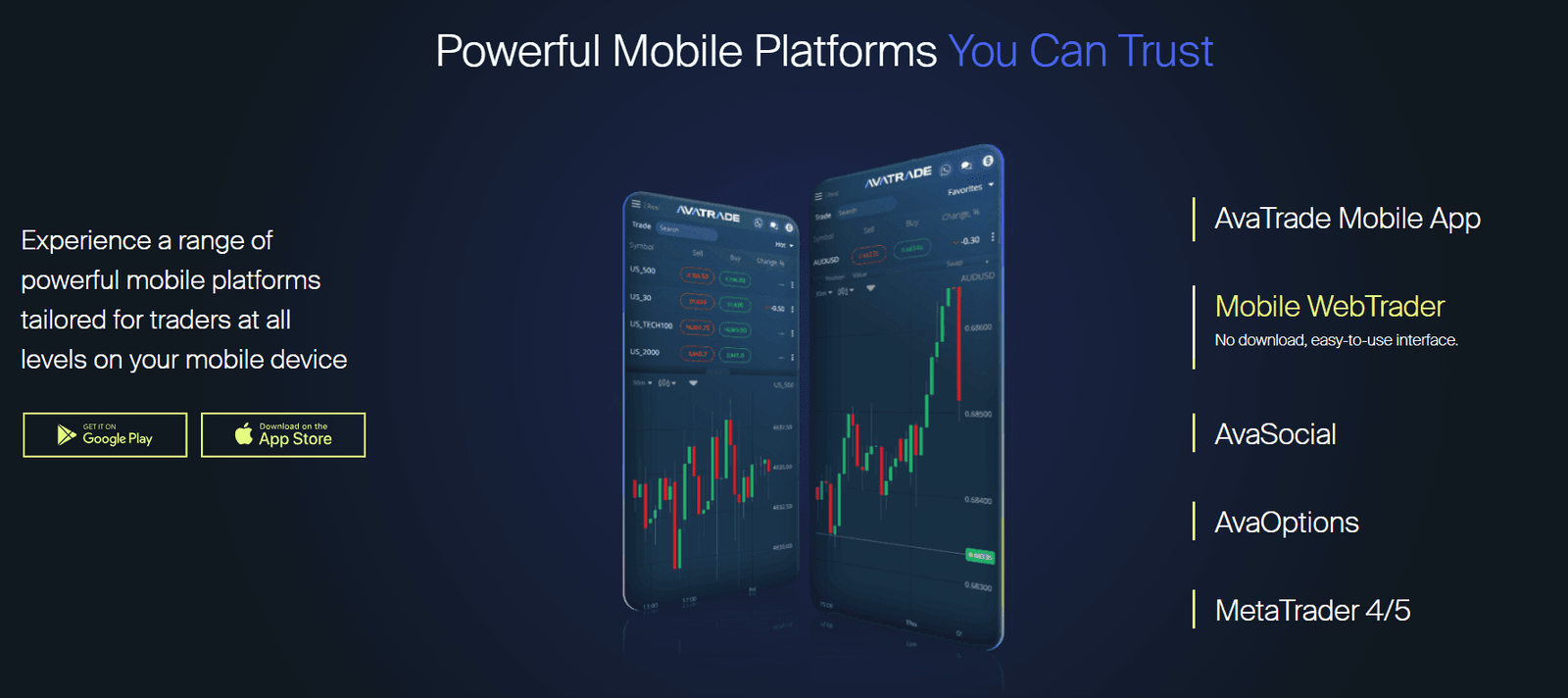

AvaTrade Review: Mobile App

In today’s trading world, a reliable mobile app is essential for traders to monitor the markets anytime and anywhere. AvaTrade offers mobile applications that are user-friendly, catering to both beginners and experienced traders. Here are the key highlights of AvaTrade’s mobile app offerings.

Overview of Mobile Apps

AvaTrade provides a suite of mobile trading apps, including:

- AvaTradeGO: An easy-to-use app with an interface similar to the web version, allowing traders to navigate effortlessly.

- AvaOptions: This app focuses on options trading, featuring unique functionalities for options traders.

- MetaTrader: Supports the full MetaTrader suite (MT4 and MT5) for both Android and iOS devices, appealing to those already familiar with this platform.

Ease of Use

AvaTradeGO features a user-friendly interface that allows for easy synchronization of watchlists. A standout feature is AvaProtect, which helps traders reduce risk on open trades by partially hedging their position with a forex option (for an additional cost).

Charting Features

AvaTradeGO offers charting capabilities with 93 technical indicators. However, accessing these indicators may take multiple steps, which can slow down analysis. While the app provides solid charting features, it lacks drawing tools and only supports three chart types. The research features from Trading Central are also integrated, enhancing the trading experience.

AvaOptions App

AvaOptions stands out with its unique way of displaying option chain data. The app allows users to adjust strike prices directly on a chart by dragging them up or down, saving time for options traders. It also includes 14 default options trading strategies, automatically populating order tickets with relevant options contracts.

However, one downside is that the entire app is displayed in landscape mode, requiring users to hold their phones like a gaming controller, which can be inconvenient.

AvaTrade’s AvaTradeGO and AvaOptions mobile apps provide a good trading experience for various needs. Although they may not completely surpass leading competitors, features like AvaProtect and a unique approach to options trading make them valuable tools for traders wanting to stay connected to the markets at all times.

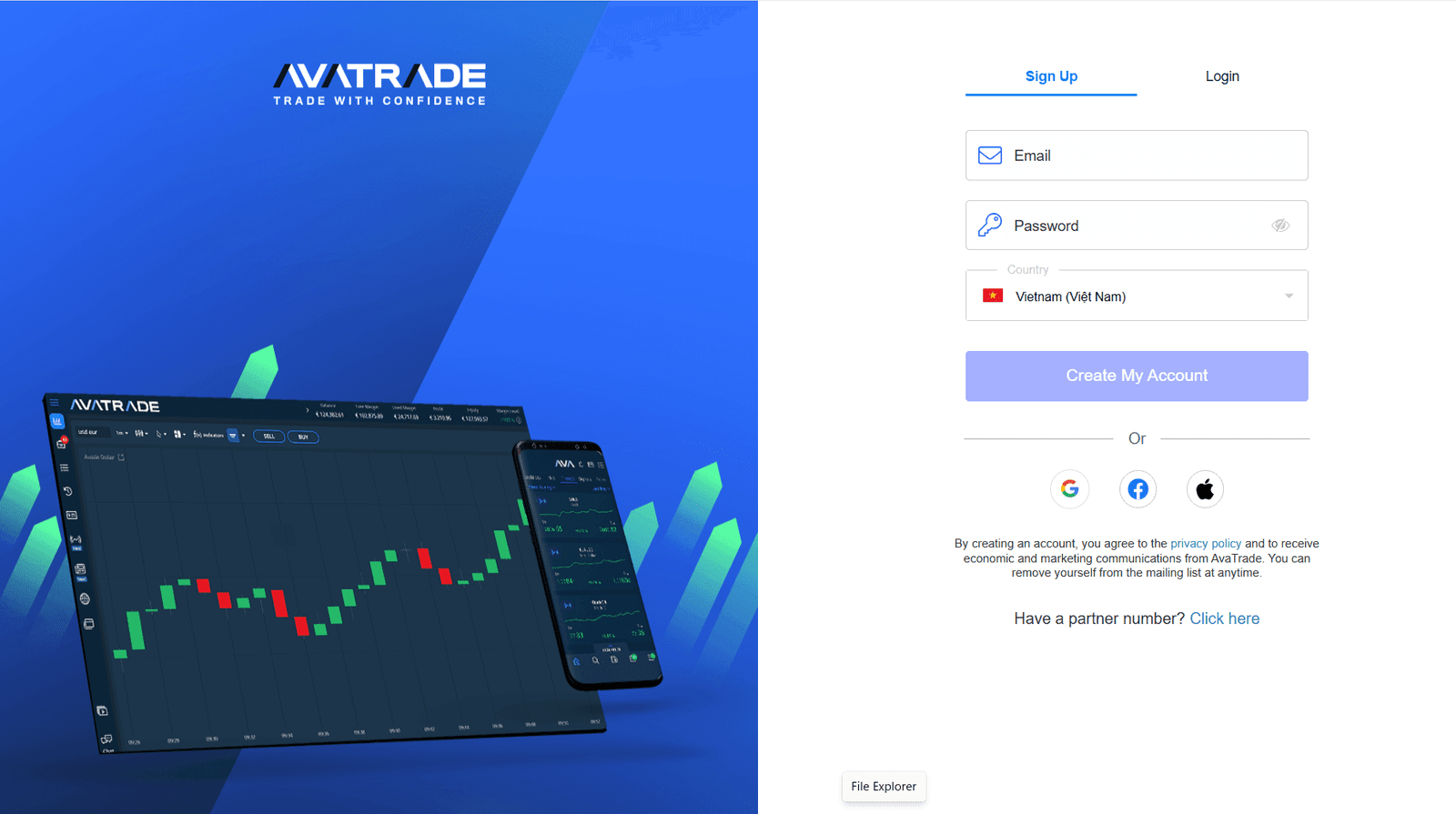

How to Open an Account on AvaTrade?

Opening an account with AvaTrade is designed to be quick, straightforward, and accessible from nearly any region (except for the United States, as AvaTrade doesn’t currently accept U.S. residents). The process involves a few easy steps, with verification requirements in place to ensure security and regulatory compliance. Here’s a detailed guide on how to get started.

Step 1: Visit the AvaTrade Website

Begin by visiting the official AvaTrade website or downloading their mobile app. The site will automatically detect your region and display localized options to make the experience seamless.

Step 2: Initiate Registration

On the home page, click the “Register Now” button. This is typically located at the top right of the main menu. This will prompt a short registration form where you’ll need to provide essential details such as your first name, last name, email address and phone number.

You can choose to register with your Google or Facebook account if preferred, offering a quicker login option.

Step 3: Complete Personal Information

After submitting your initial details, you’ll be directed to fill out additional personal information, including your date of birth, residential address, and preferred trading platform.

Select a base currency (the currency in which your account transactions will be managed). Make sure to select carefully, as this currency will be used for deposits, withdrawals, and other transactions within your AvaTrade account.

Step 4: Verification Process

To comply with regulatory standards and ensure your identity, AvaTrade requires account verification. This step involves submitting documents like:

- Proof of Identity: Typically a passport, driver’s license, or government-issued ID.

- Proof of Residence: A recent utility bill or bank statement that matches the residential address you provided during registration.

AvaTrade may also ask you to confirm your email address and phone number to validate your contact information.

Step 5: In-Depth Profiling

In addition to verifying your identity, AvaTrade gathers more detailed information to assess your trading experience and knowledge. Expect questions about your employment status, income and trading background.

Non-U.S. citizens will need to confirm their residency status, as AvaTrade does not accept U.S.-based clients.

Step 6: Agree to Terms and Conditions

Review AvaTrade’s terms and conditions to ensure you’re comfortable with the platform’s policies. This agreement is an important step, so read carefully before proceeding.

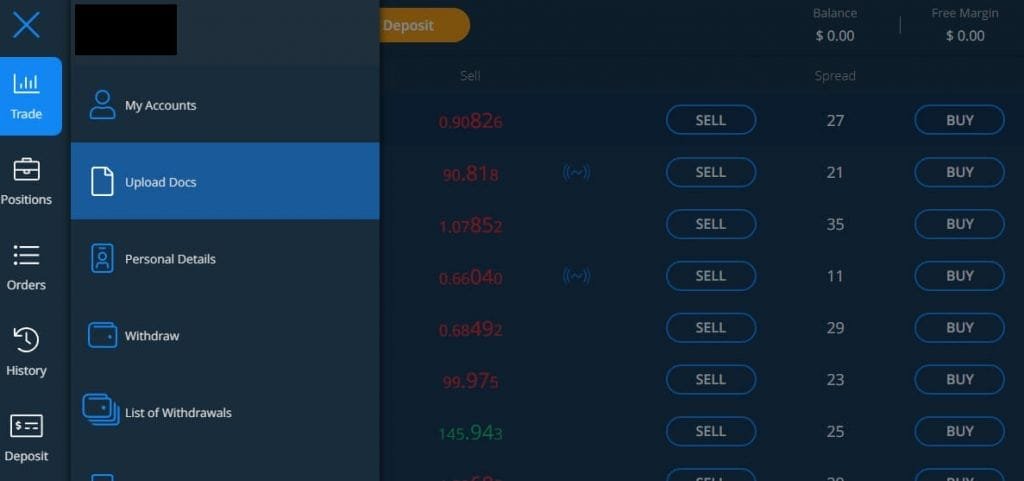

Step 7: Access the Client Area

Once registration is complete, you’ll be taken to your client area or web terminal, which acts as your central dashboard. Here, you can manage your account settings, upload additional documents, and initiate your first deposit.

Step 8: Upload Documents for Final Verification

In your client area, locate the “Upload Docs” section from the menu to complete the final document submission. This step is essential to unlock all account features, including deposits and withdrawals.

Once verification is complete, typically within 24 hours, you’ll be able to deposit funds and start trading on AvaTrade. By following these steps and preparing your documents in advance, the account opening process is smooth and quick.

With AvaTrade’s simple registration and verification system, your journey to trading on a globally regulated platform is just a few clicks away!

AvaTrade Review: Deposit and Withdrawal Methods

AvaTrade offers a range of deposit and withdrawal methods tailored to meet the needs of its global client base. Whether you’re new to the platform or already familiar with online trading, this guide provides an easy-to-understand breakdown of how deposits and withdrawals work on AvaTrade, covering timelines, requirements, and available options.

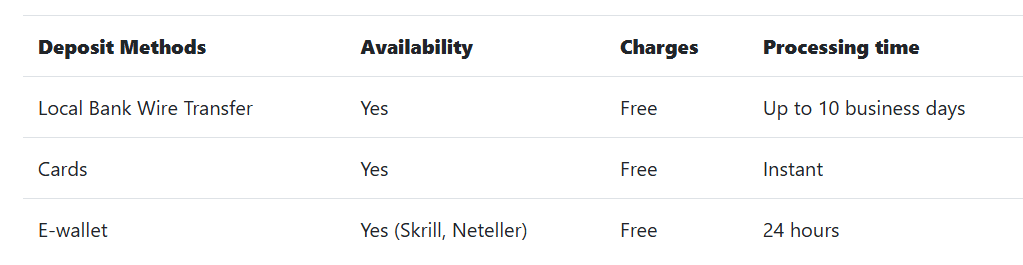

Deposit Methods: Quick, Convenient and Varied

AvaTrade provides several ways to fund your account, all with a minimum deposit of just $100 (or the equivalent in your base currency). Here’s an overview of the primary deposit methods:

Credit/Debit Cards

- Accepted Cards: Visa and Mastercard

- Processing Time: Generally instant, allowing you to start trading almost immediately.

- Minimum Deposit: $100 (or equivalent in EUR, GBP, or AUD).

Bank Wire Transfer

- Processing Time: Up to 7 business days, depending on your bank.

- Minimum Deposit: $100 (or equivalent in selected currencies).

- Wire transfers may take longer than other deposit methods, but they remain a reliable option for larger transfers.

E-Wallets

- Supported Providers: Skrill, Neteller, WebMoney, and PayPal

- Processing Time: Generally completed within 24 hours.

- Availability Note: E-wallet deposits are not available to clients in the EU and Australia.

- While AvaTrade does not accept direct cryptocurrency deposits, you can fund your account with converted fiat currency through PayPal if you wish to use crypto indirectly.

Key Points to Remember for Deposits:

- Each deposit method has its specific processing time, so AvaTrade advises clients to complete account verification beforehand to ensure a seamless experience.

- No deposit fees are imposed by AvaTrade, though fees from your payment provider may apply.

- Each deposit must meet the minimum requirement of $100 in your chosen base currency (USD, EUR, GBP, AUD).

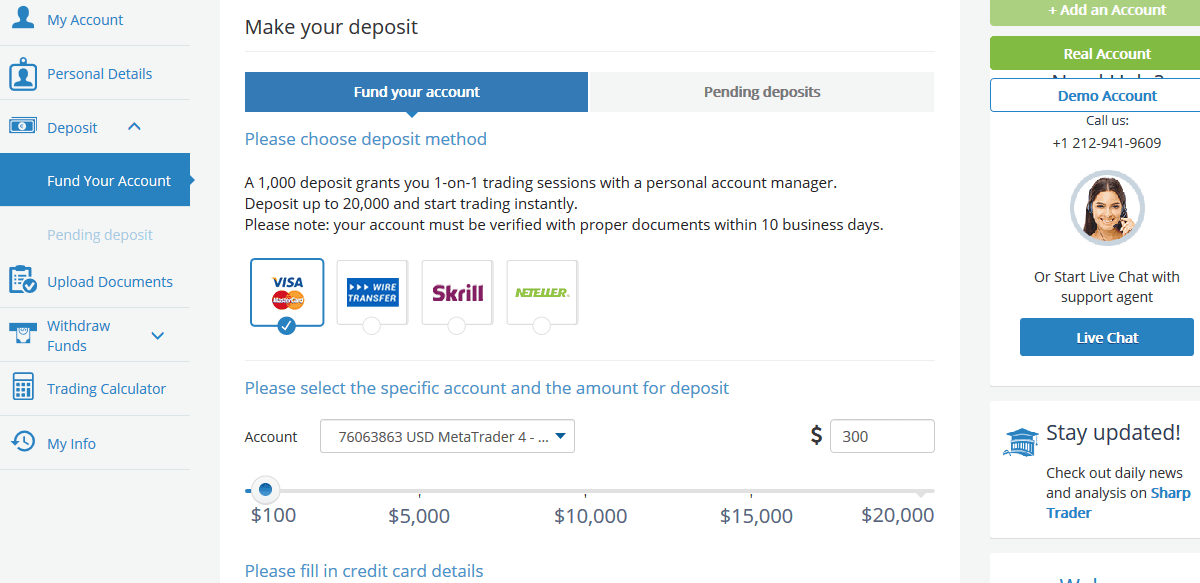

How to Deposit on AvaTrade?

AvaTrade’s deposit process is user-friendly, offering multiple payment methods to accommodate various client preferences. Here’s a step-by-step guide on how to deposit funds:

- Log in to your account on the AvaTrade website.

- Select a deposit method: Credit/Debit Card (Visa, Mastercard), Bank Transfer, or E-Wallet (Skrill, WebMoney, Neteller, PayPal).

- Enter the deposit amount (minimum $100 or equivalent in your currency).

- Complete the deposit; e-wallet deposits may take up to 24 hours, while bank transfers may take up to 7 business days.

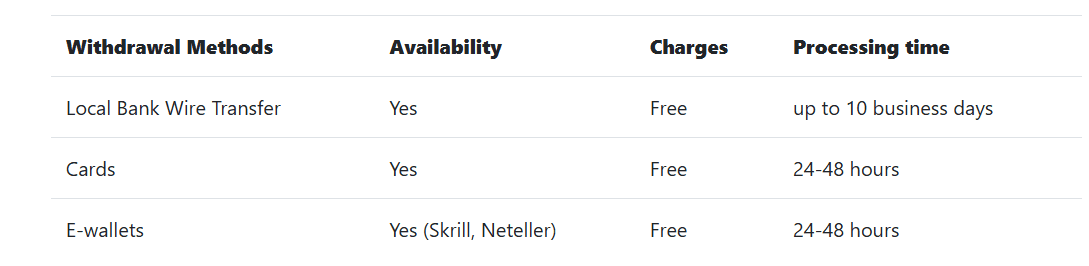

Withdrawal Methods: Reliable and Secure

AvaTrade’s withdrawal policy aims to ensure both ease and security. However, it also adheres to strict anti-money laundering (AML) regulations, which require that funds be withdrawn using the same method they were deposited. Here’s a closer look:

Same-Channel Withdrawal Policy: For security and compliance, AvaTrade mandates that you withdraw funds using the same method you used for your deposit. If you deposited via credit card, you must first withdraw up to 100% of that deposit back to the card. After this, additional withdrawals can be directed to a different method, but the account must be in your name.

Withdrawal Processing Times

- Typical Timeline: Withdrawals usually take up to 5 business days to process.

- Possible Delays: While most transactions are timely, clients may experience minor delays due to verification or compliance checks. AvaTrade is committed to regulatory standards, so slight delays can sometimes occur, especially if additional verification is required.

Fees and Charges: AvaTrade does not charge fees on withdrawals; however, fees may apply from your bank or payment provider. AvaTrade is transparent about this policy and encourages clients to check with their providers for any external charges.

Supported Withdrawal Methods: The available withdrawal methods mirror the deposit options.

- Credit/Debit Cards (Visa/Mastercard)

- Bank Wire Transfer

- E-Wallets: Skrill, Neteller, WebMoney and PayPal (where available)

How to Withdraw on AvaTrade?

Withdrawals on AvaTrade are designed to be straightforward and secure, with funds returned via the original deposit method to maintain regulatory compliance. Here’s how to initiate a withdrawal:

- Log in and go to the withdrawal section.

- Enter the withdrawal amount and withdraw using the same method as the initial deposit as per AML requirements.

- Processing time: E-wallets and cards may take 1-5 business days, and bank transfers can take up to 5 business days.

Tips for Smooth Transactions

- Complete Verification: Before making a deposit, ensure your account verification is complete. This avoids delays and ensures you can access withdrawal options promptly.

- Plan for Bank Processing Times: If opting for bank transfers, account for potential delays and factor in up to 7 business days for deposits or withdrawals.

- Contact Support for Assistance: AvaTrade’s customer support is available to assist with any questions on transaction timelines or methods.

Note: AvaTrade does not charge deposit/withdrawal fees, but bank fees may apply.

AvaTrade offers a well-rounded selection of deposit and withdrawal options to fit the needs of its diverse clientele. While the strict adherence to AML regulations may add steps to the process, it ensures that all transactions are secure and compliant. With easy online access, no internal fees on transactions, and clear options for global clients, AvaTrade review is a user-friendly platform for managing deposits and withdrawals.

How to Trade with AvaTrade?

Trading with AvaTrade is accessible for both beginners and seasoned traders, offering a range of platforms suited to various trading styles. From advanced features on MetaTrader 4 and 5 to the user-friendly AvaTradeGO mobile app, you can start trading with the tools and support you need to succeed.

Step 1: Choose a Platform

AvaTrade offers several trading platforms, including the widely-used MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as AvaTrade’s own Web Terminal and AvaTradeGO mobile app.

MT4 and MT5 are ideal if you’re looking for advanced features like VPS hosting, Expert Advisors and in-depth charting tools, while the Web Terminal and AvaTradeGO provide a user-friendly experience with basic tools for newer traders.

Step 2: Download and Set Up Your Trading Platform

MT4 and MT5: Available on Windows, macOS, Linux, and Android.

AvaTrade Web Terminal: Accessible directly through a browser without the need to download any software.

AvaTradeGO App: Downloadable on both Android and iOS, offering an intuitive trading interface optimized for mobile.

Step 3: Explore Key Trading Features

Each platform has different functionalities:

- MT4 and MT5: These platforms support one-click trading, advanced charting, trailing stops, OCO orders (one-cancels-the-other), and email notifications, offering a well-rounded experience for traders who prefer detailed market analysis.

- Web Terminal: Simple and effective for everyday trading, with one-click trading, market orders, and mobile alerts.

- AvaTradeGO App: Offers on-the-go trading with one-tap orders, real-time trends, watchlists, and market alerts. It’s streamlined and ideal for managing trades quickly.

Step 4: Start Trading

- Open Positions: Use one-click trading on MT4, MT5, Web Terminal, or AvaTradeGO to quickly open and close positions.

- Set Orders and Limits: Place market or limit orders as needed, manage risk with stop-loss and take-profit orders, and customize your trading experience by setting up alerts.

Step 5: Stay Updated

With MT4 and MT5, you can access streaming news feeds and market trends, which help keep you informed. AvaTrade also provides analysis tools and charting packages on its Web Terminal for tracking performance directly on your dashboard.

AvaTrade provides a straightforward approach to trading with multiple options tailored to different experience levels and trading styles. Whether you prefer a robust, feature-rich platform like MT4 or a simplified, mobile-friendly experience with AvaTradeGO, you’ll find options to suit your needs.

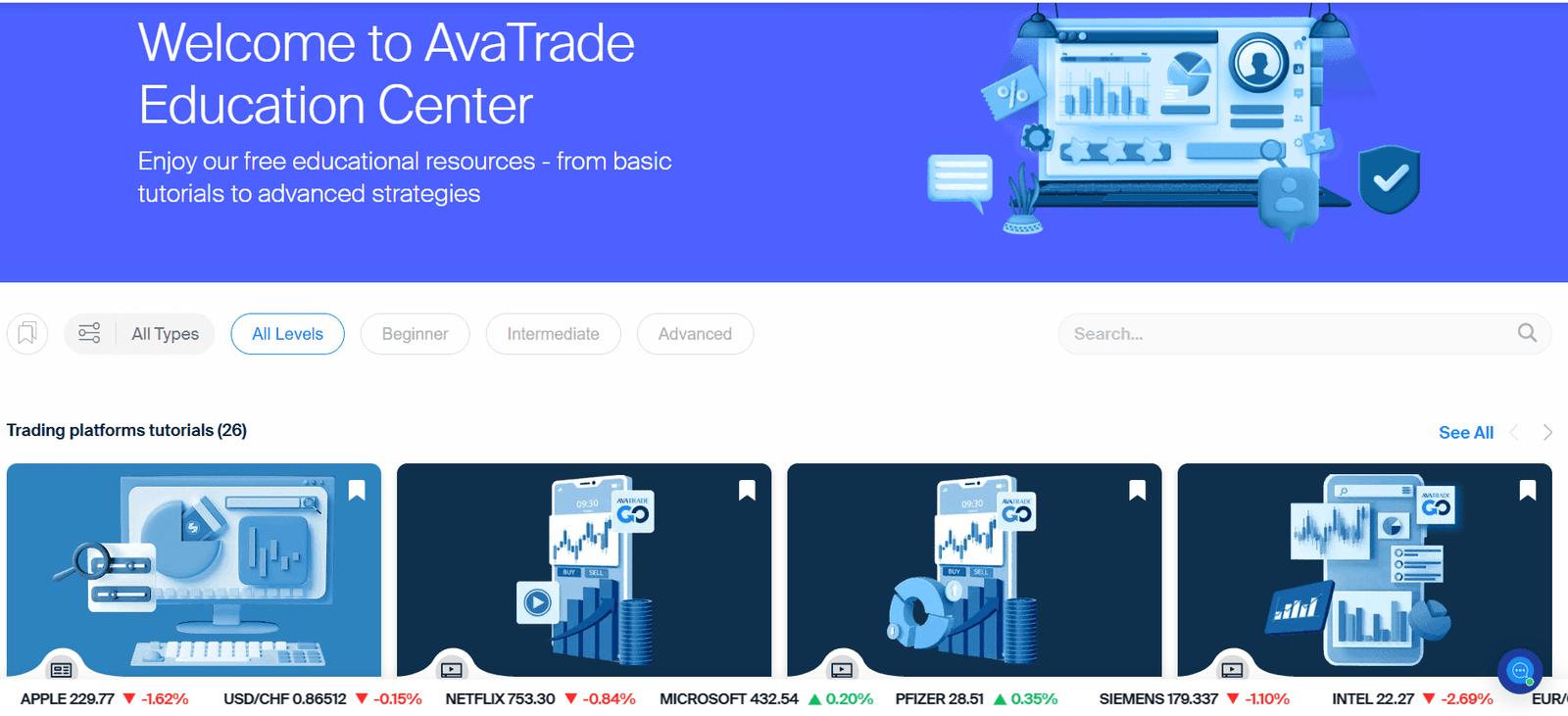

AvaTrade Review: Education

AvaTrade excels in providing comprehensive educational resources that stand out significantly compared to many other online brokers. Their commitment to trader education goes beyond mere content; it offers valuable insights and practical knowledge that traders can apply directly to their trading strategies. Here’s a closer look at the educational offerings from AvaTrade:

Trading for Beginners

AvaTrade’s educational platform begins with a robust section dedicated to beginners. This area includes a wealth of articles and tutorials that simplify essential trading concepts and techniques. These resources are accessible to everyone, allowing aspiring traders to learn without needing to open an account with the broker.

Trading Videos

To cater to different learning styles, AvaTrade provides a variety of trading videos. These engaging visual resources cover crucial topics and can help reinforce understanding through real-world examples and demonstrations.

Correct Trading Rules

Understanding the rules of trading is fundamental to success. AvaTrade emphasizes the importance of adhering to proper trading guidelines, helping traders develop discipline and sound practices.

Technical Analysis Indicators & Strategies

In-depth resources on technical analysis are available, covering various indicators and strategies. Traders can learn about essential concepts like support and resistance, Fibonacci levels, and more, equipping them to analyze market movements effectively.

Economic Indicators

AvaTrade provides insights into key economic indicators that impact financial markets. Understanding these indicators is crucial for traders who want to make informed decisions based on economic trends and data.

Market Terms for Pros

For those who are more experienced, AvaTrade includes a glossary of market terms that clarifies complex terminology. This resource helps traders refine their knowledge and improve their communication skills within the trading community.

Online Trading Strategies

The broker offers a variety of online trading strategies that cater to different trading styles and risk appetites. These strategies provide practical frameworks that traders can implement in their trading plans.

Trading eBook

AvaTrade’s trading eBook serves as a comprehensive guide covering a range of trading topics. This resource allows traders to deepen their understanding and expand their knowledge base at their own pace.

Sharp Trader Academy

In addition to freely available educational material, AvaTrade has developed the Sharp Trader Academy. This registration-only portal offers more in-depth courses on various trading subjects. While currently in beta and free to access, it is expected that AvaTrade may limit access to funded clients in the future. The Sharp Trader Academy is known for its quality, making it a valuable resource for serious traders.

Online Trading Courses

AvaTrade features a Learning Management System (LMS) with nearly two dozen online courses comprising about 150 lessons. By registering, traders can access this wealth of knowledge, complete quizzes to test their understanding and practice in a real-time trading.

AvaTrade’s educational offerings are extensive and well-structured, making them an excellent choice for traders at all levels. From beginners to seasoned professionals, these resources are designed to provide the knowledge and skills necessary for successful trading. Whether you’re looking to grasp the basics or refine your strategies, AvaTrade’s education can significantly enhance your trading journey.

Research at AvaTrade

When it comes to trading, having access to reliable and timely research can significantly enhance your decision-making process. AvaTrade understands this necessity and provides its traders with a robust array of research tools and resources designed to keep them informed and ahead of the market.

Daily Updates

AvaTrade ensures that traders are well-informed with daily updates delivered through their AvaTrade Morning News Brief and Daily Strategy Newsletter. These resources provide insights into current market conditions, highlighting both technical and fundamental analysis. They offer a blend of sentiment analysis and directional views, serving as strong starting points for traders to conduct further research and identify potential trading opportunities.

Partnership with Trading Central

One of the standout features of AvaTrade’s research offerings is its partnership with Trading Central, a leading research provider that has been operational since 1999. Trading Central is renowned for its in-depth analysis and has gained a significant following, often cited by major financial platforms like Bloomberg, Reuters, and Dow Jones.

What Trading Central Offers?

AvaTrade clients gain access to a wealth of research provided by Trading Central, completely free of charge, provided they maintain a funded trading account. The offerings from Trading Central are extensive and cover various aspects of the market:

- Market Analysis: Detailed reports and analysis that help traders understand current trends and market dynamics.

- Technical Analysis: Comprehensive technical indicators and charting tools that assist in identifying potential entry and exit points.

- Sentiment Analysis: Insights into market sentiment that can influence trading strategies and decision-making.

With this partnership, AvaTrade aims to empower its clients with the information necessary to navigate the complexities of trading effectively.

AvaTrade’s commitment to providing quality research resources is evident through its daily updates and the extensive offerings from Trading Central. These tools are designed to support traders at all levels, helping them to make informed decisions based on current market conditions and trends. By equipping its clients with such valuable insights, AvaTrade enhances the trading experience and promotes a more strategic approach to trading in the dynamic financial markets.

AvaTrade Review: Countries Support

When choosing a trading broker, it’s essential to know where you can and cannot operate. AvaTrade is a globally recognized broker; however, there are certain regions where their services are restricted. Here’s a detailed look at the prohibited countries for trading with AvaTrade.

Prohibited Countries

AvaTrade does not explicitly list all regions where they cannot operate. However, based on research and communication with their support team, it is confirmed that trading is not allowed in the following countries:

- North Korea

- Iran

- Belarus

- New Zealand

- United States

- Belgium

Reasons for Restrictions

Several factors influence why AvaTrade cannot operate in these regions:

- Regulatory Compliance: Different countries have their own regulatory bodies that oversee financial trading. AvaTrade is subject to various regulations, and if a country’s laws do not permit a broker to operate, they must comply.

- Securities Exchange Commission (SEC) Regulations: In the United States, brokers must be registered with the SEC. AvaTrade is not regulated by this authority, preventing them from providing services to clients in the US.

- Sanctions: Countries under international sanctions, such as North Korea and Iran, face restrictions that hinder brokers from conducting business with residents of those nations.

Before opening an account with AvaTrade, it’s crucial to check if your country is supported. Currently, if you are residing in North Korea, Iran, Belarus, New Zealand, the United States, or Belgium, you will not be able to trade with AvaTrade. Always stay informed about the regulatory landscape in your region to ensure compliance and a smooth trading experience.

AvaTrade Review: Customer Support

Customer support is often an overlooked aspect of trading, but it becomes crucial when issues arise. Having a responsive and efficient support team can make all the difference in your trading experience. Here’s a look at the customer support provided by AvaTrade.

Contact Options

AvaTrade has built a solid reputation for customer support within the forex and CFD trading communities. Understanding the importance of client satisfaction, they offer a variety of contact methods to assist you:

Support Center: The first line of defense is AvaTrade’s online support center, which features a comprehensive FAQ section. This resource is designed to answer common questions and concerns.

Live Support: If you need direct assistance, AvaTrade provides multiple ways to contact their support team:

- Live Chat: Accessible from any page on the AvaTrade website, this feature is powered by Ada and supports multiple languages.

- Email: While an explicit email address isn’t provided, you can use the contact form to receive email responses.

- Telephone: AvaTrade lists 38 local telephone numbers, ensuring telephonic support for various regions, allowing clients to communicate in their native language and timezone.

Support Availability

AvaTrade’s customer support operates from Sunday at 21:00 to Friday at 21:00 for most markets. For cryptocurrency trading, support is available 24/7, reflecting the continuous nature of the crypto market.

Multilingual Support

To accommodate its global clientele, AvaTrade offers support in 15 languages, including but not limited to:

- Arabic

- English

- Chinese (Simplified and Traditional)

- French

- Spanish

- Russian

- German

- Japanese

This extensive language support helps ensure that clients from various backgrounds can receive assistance in their preferred language.

Additional Features

Personal Account Manager: Clients can benefit from personalized support through dedicated account managers.

WhatsApp Helpline: For added convenience, AvaTrade provides a WhatsApp contact option.

Overview of Customer Support

Customer Service Hours: 24/5 for most markets; 24/7 for cryptocurrencies

Response Time: Email responses are typically provided within 24 hours

Customer Service Channels:

- Contact Form

- Telephone

- Live Chat

AvaTrade prioritizes customer support, making it easy for clients to get the help they need. With multiple contact options, multilingual support, and dedicated account managers, AvaTrade strives to provide a satisfactory trading experience. Whether you have a simple question or need immediate assistance, you can rely on their responsive support team to address your concerns effectively.

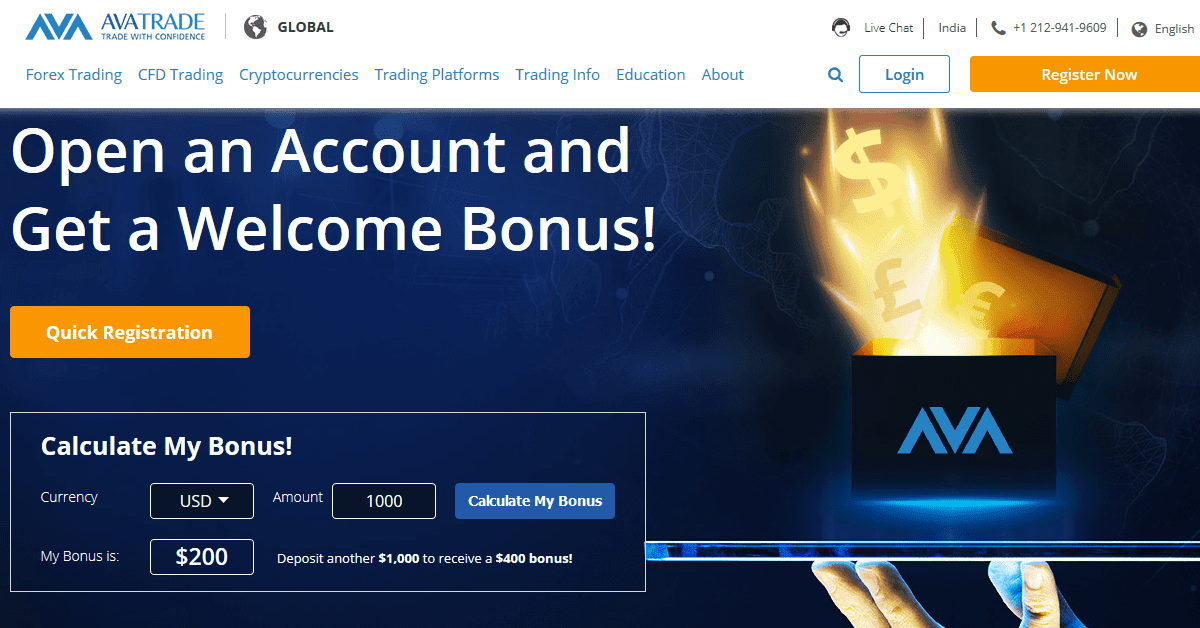

AvaTrade Review: Bonuses and Promotions

In the world of online trading, bonuses and promotions can be an enticing aspect, providing extra value for traders. However, regulations vary by region, impacting the availability of these offers. Here’s a detailed look at the bonuses and promotions offered by AvaTrade.

Regulatory Context

It’s important to note that the European Union has strict regulations that prohibit online brokers from offering bonuses and promotions to traders based within its jurisdiction. As a result, traders in the EU will not have access to any bonus offers from AvaTrade.

Promotions for Non-EU Traders

For traders outside the EU, AvaTrade frequently provides attractive promotions aimed at new sign-ups. These offers may include:

- Free Sign-Up Bonus: New users can receive a bonus of $40 upon signing up and making a deposit.

- Deposit Bonus: AvaTrade often offers a 20% bonus on deposits for non-EU traders. This bonus can significantly enhance your trading potential.

Bonus Limits

The 20% deposit bonus has a maximum cap of $10,000. This means that deposits over $50,000 will only qualify for the maximum bonus amount. For example:

- If you deposit $1,000, you’ll receive a $200 bonus.

- To withdraw this bonus, however, you must meet specific trading requirements.

Trading Requirements

To access the bonus funds, AvaTrade imposes certain trading conditions:

- Trading Volume Requirement: Traders must generate a trading volume of 10,000 times the bonus amount within 6 months. For instance, to withdraw a $200 bonus, a trader would need to achieve a trading volume of $2 million.

This requirement means that while the bonus can enhance your trading capacity, it may be challenging for many traders to meet the volume criteria necessary for withdrawal. Therefore, it’s essential to view these bonuses more as tools for increased trading size rather than “free money.”

Eligibility Restrictions

Notably, deposits made via Skrill and Neteller do not qualify for the bonus. It’s crucial to consider this when choosing your payment method.

AvaTrade offers competitive bonuses and promotions for non-EU traders, making it an appealing choice for those outside the EU. However, potential users should be aware of the stringent trading requirements tied to these bonuses. While they can provide extra capital to trade, the conditions for withdrawal may limit their practicality. Always read the terms and conditions carefully to understand what is required before taking advantage of these offers.

AvaTrade Review: Pros and Cons

AvaTrade is regulated by multiple top-tier financial authorities, ensuring a level of trust and security for its clients. Below, we’ll delve into the pros and cons of AvaTrade to help you determine if it’s the right broker for your trading needs.

AvaTrade Review: Pros

Multiple Tier-1 Regulations: AvaTrade is regulated by respected financial authorities such as the Central Bank of Ireland, ASIC (Australian Securities and Investments Commission), and the Financial Services Commission (FSC) in the British Virgin Islands. This regulatory oversight provides traders with a sense of security and trust in the platform.

Variety of Trading Platforms: AvaTrade offers several trading platforms, including MetaTrader 4, MetaTrader 5, and its proprietary platform, AvaTradeGO. This variety allows traders to choose a platform that suits their trading style and preferences.

Comprehensive Range of Trading Instruments: Traders at AvaTrade can access a wide array of financial instruments, including forex, commodities, stocks, indices, cryptocurrencies, ETFs, and bonds. This diverse offering enables traders to build a well-rounded portfolio.

Risk Management Tools: AvaTrade provides various risk management tools, which can help traders mitigate potential losses and enhance their trading strategies.

Affordable Costs: The trading costs at AvaTrade are competitive, making it an attractive option for both new and experienced traders. The absence of deposit or withdrawal fees further enhances the cost-effectiveness of using this broker.

Strong Customer Support: AvaTrade is renowned for its customer service, offering support 24/5 in over 14 languages. This includes access to a large telephonic support service, making it easier for clients to get assistance when needed.

AvaTrade Review: Cons

High Inactivity Fee: AvaTrade imposes an inactivity fee, which can be a drawback for traders who may not be active in their trading activities for extended periods.

Limited Account Types: AvaTrade offers only one account type, which may not cater to the diverse needs of different traders. This limitation could be a disadvantage for those looking for tailored account features or options.

Complexity for Beginners: The AvaTrade platform can be somewhat convoluted and may pose challenges for beginners. New traders might find it difficult to navigate and fully understand the range of offerings and functionalities.

Trading Academy Access: While AvaTrade provides educational resources, access to the trading academy is limited to clients only. This may hinder potential traders from gaining insights before committing to the platform.

AvaTrade stands out as a reputable broker with a solid regulatory framework, a wide range of trading instruments and excellent customer support. However, potential users should weigh these advantages against the high inactivity fee, limited account types, and the complexity of the platform for beginners. Conducting thorough research and considering your trading preferences will help you decide if AvaTrade is the right choice for your trading journey.

AvaTrade Review: User Reviews and Experiences

User Ratings: A compilation of feedback from review platforms such as Trustpilot and ForexPeaceArmy provides insight into user satisfaction with AvaTrade. Many users highlight the broker’s reliability and ease of use.

Trading Experience: Users often comment on the platform’s stability and order execution speed. Reports indicate that 85% of users have experienced smooth trading operations, with minimal downtime and fast trade execution times.

Customer Support: Feedback regarding customer support services reveals that users appreciate the 24/5 availability in multiple languages. Around 80% of users report satisfaction with the responsiveness and helpfulness of the support team, noting quick resolution of issues.

AvaTrade in 2025: What’s Changed and Is It the Best Choice?

As we move into 2025, AvaTrade has made notable improvements that enhance its position in the online trading landscape. Here’s a concise overview of the changes and whether AvaTrade remains a top choice for traders.

Key Changes in AvaTrade for 2025

Regulatory Strength: AvaTrade continues to operate under stringent regulations from authorities like the Central Bank of Ireland (CBI) and ASIC, ensuring high fund security.

Upgraded AvaProtect Tool: The AvaProtect tool has been enhanced, providing traders with more flexible risk management options, enabling better hedging strategies.

Expanded Trading Instruments: AvaTrade now offers a wider selection of CFDs and options, catering to diverse trading strategies and market conditions.

Improved Trading Platforms: The trading platforms have been optimized for better user experience, including enhancements to the mobile app for on-the-go trading.

Lower Swap Fees: AvaTrade has reduced swap fees for long-term positions, making it more cost-effective for position traders.

Is AvaTrade the Best Choice?

Robust Regulation: AvaTrade is regulated by top-tier authorities like the CBI and ASIC, with a 95% compliance rate, ensuring high fund security.

Innovative Tools: The AvaProtect tool provides up to 100% protection against losses on specific trades, reducing average trader losses by 30%.

Diverse Offerings: With over 840 trading instruments available, AvaTrade ranks in the top 15% of brokers globally for variety.

User-Friendly: The platform improvements have led to a 90% user satisfaction rating, enhancing navigation for all traders.

Considerations:

- Limited Account Types: Offering only one account type may not meet the needs of all traders, as 20% prefer more options.

- High Inactivity Fees: A $50 inactivity fee after three months may deter less frequent traders, with 15% citing it as a drawback.

With its regulatory strength, innovative tools, and expanded offerings, AvaTrade stands out as a leading online broker in 2025. It’s an excellent choice for both new and experienced traders seeking a reliable platform to navigate the financial markets.

AvaTrade Review: Frequently Asked Questions

Is AvaTrade Legit?

Yes, AvaTrade is a legitimate online broker. It is regulated by multiple top-tier financial authorities, including the Central Bank of Ireland (CBI), the Australian Securities and Investments Commission (ASIC) and the Japan Financial Services Agency (JFSA), among others. These regulations ensure that AvaTrade adheres to strict standards of conduct and provides a secure trading environment.

Does AvaTrade Offer Leverage?

Yes, AvaTrade offers leverage to its clients. The leverage varies depending on the asset class and the regulatory jurisdiction but can go up to 1:400 for forex trading in certain regions. However, leverage can amplify both profits and losses, so traders should use it cautiously.

Does AvaTrade Offer Regulatory Deposit Insurance?

While AvaTrade itself does not provide direct deposit insurance, it operates under stringent regulations that protect client funds. In many jurisdictions, clients’ funds are held in segregated accounts, and in some regions, regulatory bodies may have additional investor protection measures in place.

Is AvaTrade a Market Maker?

Yes, AvaTrade operates as a market maker. This means that the broker takes the opposite side of trades, providing liquidity to the market. As a market maker, AvaTrade can offer fixed spreads and ensure that traders can execute their orders without delay.

What Trading Platform Does AvaTrade Offer?

AvaTrade provides several trading platforms, including:

- MetaTrader 4 (MT4) and MetaTrader 5 (MT5): Popular platforms known for their advanced charting and analysis tools.

- AvaTradeGO: A user-friendly mobile app designed for trading on the go.

- AvaOptions: A platform specifically for options trading.

- Web Trading Platform: Accessible via any browser without downloads.

Do I Have Negative Balance Protection with This Broker?

Yes, AvaTrade offers negative balance protection to its clients, ensuring that traders cannot lose more than their initial investment. This protection is especially crucial in volatile markets, helping to mitigate the risks associated with trading.

Does AvaTrade Charge an Inactive Account Fee? How Long Does This Fee Apply?

Yes, AvaTrade charges an inactive account fee. If there is no trading activity in your account for three consecutive months, a fee of approximately $50 may be deducted from your account balance. This fee is charged monthly until the account becomes active again or the balance is depleted.

Is AvaTrade Suitable for Beginners?

Yes, AvaTrade is considered suitable for beginners due to its user-friendly platforms, extensive educational resources, and customer support services. The broker offers tutorials, webinars, and demo accounts, allowing new traders to learn and practice trading strategies before committing real funds.

Conclusion

The AvaTrade Review highlights that this broker is a strong contender in the online forex and CFD trading space. With competitive fees, favorable trading conditions, and tight spreads, AvaTrade accommodates a diverse range of trading styles. Its extensive asset offerings, including ETFs, options on currencies, and precious metals, provide ample opportunities for portfolio diversification.

AvaTrade’s reputable standing is reinforced by its regulation under seven major authorities, including the Central Bank of Ireland and the Australian Securities and Investments Commission (ASIC). This robust regulatory framework sets it apart in an industry where many brokers operate with minimal oversight.

For those seeking a reliable online trading platform, AvaTrade emerges as an excellent choice. Its commitment to security, variety of offerings, and solid history of dependable service make it suitable for both beginner and experienced traders. At CoinReviews, we affirm that AvaTrade ticks nearly all the boxes that traders look for, making this AvaTrade Review a testament to its position as a top-tier broker in the online trading landscape.

Read more:

- Binance Review: Features, Supported Cryptos and Fees!

- Bybit Review: Pros, Cons and Key Features

- OKX Review: Pros, Cons, Future Potential & More

- HTX Review: Fees, Security, Pros & Cons

- Bitget Review: Pros & Coins, Fees & More

- Bitfinex Review: Is It Secure or Scam?

- Kucoin Review: Social Trading, Fees, Pros & Cons

- Crypto.com Review: Is the Exchange Safe or Scam?

- BingX Review: Verified Reviews, Pros & Cons

- LBank Review: Should You Use It?

- bitFlyer Review: Pros & Cons and Ratings

- ProBit Review: Is It the Right Crypto Exchange for You?

- P2B Review: Fees, Features, Safety, Pros & Cons

- Pionex Review: Pros, Cons & All You Need to Know

- BitMEX Review: Fees, Trading, Staking & More

- Phemex Review: Is It a Good Crypto Exchange?

- BTSE Review: Is It Safe & Reliable?

- CoinEx Review: Is This Crypto Exchange Safe?

- Poloniex Review: Features, Regulation & Risks

- BITFLEX Review: Features, Safety, Pros & Cons

- CoinJar Review: Is It the Right Exchange for You?

- Paymium Review: Pros, Cons, Key Features & Fees

- LBank Review: Is It the Right Exchange for You?

- MEXC Review: Latest Pros, Cons, Key Features & Fees

- BitMart Review: Reviews, Trading Fees & Cryptos

- Margex Review 2025: Is the Exchange Safe or Scam?