In an era where data security is paramount, blockchain technology stands at the forefront of innovation. As we move into 2024, Cryptowriters explores how blockchain is revolutionizing the way we manage and secure data. With its decentralized nature and robust encryption methods, blockchain offers unparalleled protection against data breaches and cyber threats.

Join us as Coinreviews delve into the transformative potential of blockchain and its implications for the future of secure data management.

What Is a Blockchain?

Blockchain is a distributed ledger technology that is shared among nodes within a computer network. Though blockchain is most commonly associated with cryptocurrency systems, where it ensures secure and decentralized transaction records, its uses extend far beyond digital currencies. Blockchain technology has the potential to make data in any industry immutable, meaning it cannot be altered once entered.

Since blocks in a blockchain cannot be modified, trust is only required at the moment data is input. This significantly reduces reliance on trusted third parties, such as auditors, who can introduce errors or additional costs.

Since the launch of Bitcoin in 2009, the use of blockchain technology has surged, driving the creation of various cryptocurrencies, decentralized finance (DeFi) platforms, non-fungible tokens (NFTs), and smart contracts.

How can Blockchain be understood?

How can Blockchain be understood?

Key Takeaways

Blockchain is a shared ledger that differs from traditional databases by storing data in blocks that are cryptographically linked.

While blockchain can store different types of information, its most widespread use has been as a transaction ledger.

In the case of Bitcoin, blockchain is decentralized, meaning no single entity has control over it—control is distributed across all users.

Decentralized blockchains are immutable, making data entry permanent and irreversible. Bitcoin transactions, for example, are recorded forever and can be viewed by anyone.

Who invented blockchain?

Blockchain technology was first introduced by an individual or group known as Satoshi Nakamoto, who published a white paper in late 2008 outlining the principles of a new digital currency called Bitcoin. This paper became the foundation for all subsequent cryptocurrencies, which have since evolved from the concepts Nakamoto described.

Nakamoto’s primary objective was to create a form of digital money that would enable two strangers to conduct online transactions globally without needing a third-party intermediary, such as a credit card company or payment service like PayPal.

To achieve this, Nakamoto had to solve the problem of “double spending,” where someone could potentially use the same funds more than once. The solution was blockchain—a network that continuously verifies the movement of bitcoins.

Every Bitcoin transaction is recorded and validated by a decentralized, global network of computers, beyond the control of any single person, organization, or government. This distributed ledger is known as the blockchain. Bitcoins are “mined” by a peer-to-peer network of computers that constantly verify and maintain the blockchain. In return for contributing their computing power, these miners are rewarded with small amounts of cryptocurrency.

Every Bitcoin transaction is logged on the blockchain, with new data grouped into “blocks” that are added to the chain of existing blocks. The collective computational power of miners ensures the accuracy and security of this ever-evolving ledger.

Bitcoin exists solely on the blockchain; each new Bitcoin is created and recorded there, along with every transaction involving any cryptocurrency.

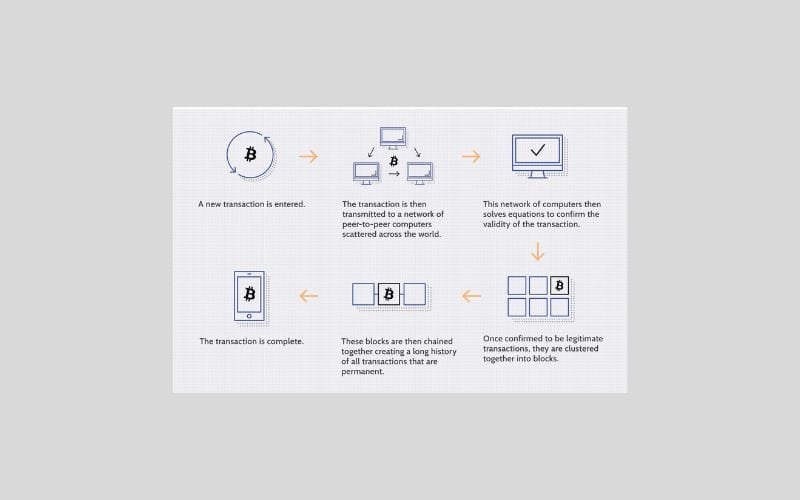

How Does Blockchain Technology Work?

Blockchain operates as a historical record of transactions, where each block is securely “chained” to the previous one in sequence and is permanently recorded across a peer-to-peer network. Using cryptographic trust and assurance, each transaction is assigned a unique identifier, or digital fingerprint, ensuring its integrity.

Blockchain embeds trust, accountability, transparency, and security directly into its structure. This enables organizations and trading partners to share and access data through a system known as third-party, consensus-based trust.

All participants in the blockchain network maintain an encrypted record of each transaction in a decentralized, highly scalable, and tamper-proof mechanism. Blockchain eliminates the need for intermediaries, reducing the costs associated with executing trusted business transactions, even among parties that do not fully trust one another. In permissioned blockchains, typically used by enterprises, only authorized participants can join the network, and each participant keeps an encrypted record of all transactions.

Blockchain technology benefits any company or group of companies needing a secure, real-time, shareable transaction record. Since there is no single point where all data is stored, blockchain enhances security and availability, reducing the risks of central vulnerabilities.

How does Blockchain work?

To better understand blockchain, its components, and applications, here are some key definitions:

- Decentralized trust: Blockchain provides decentralized trust, ensuring data integrity without the need for a central authority, which is a key reason why organizations choose blockchain over other data storage methods.

- Blockchain blocks: The term “blockchain” refers to the structure of data, which is stored in blocks connected to previous ones, forming a chain. In blockchain systems, you can only add new blocks—modifying or deleting existing blocks is impossible once they are added to the chain.

- Consensus algorithms: These algorithms are the rules that govern a blockchain system. Once participants agree on the rules, the consensus algorithm ensures they are enforced across the network.

- Blockchain nodes: Data in a blockchain is stored on nodes, which are the storage units that keep the blockchain in sync. Nodes can quickly detect if a block has been altered. When a new node joins the network, it downloads the entire chain, synchronizes, and stays up to date with new blocks like any other node.

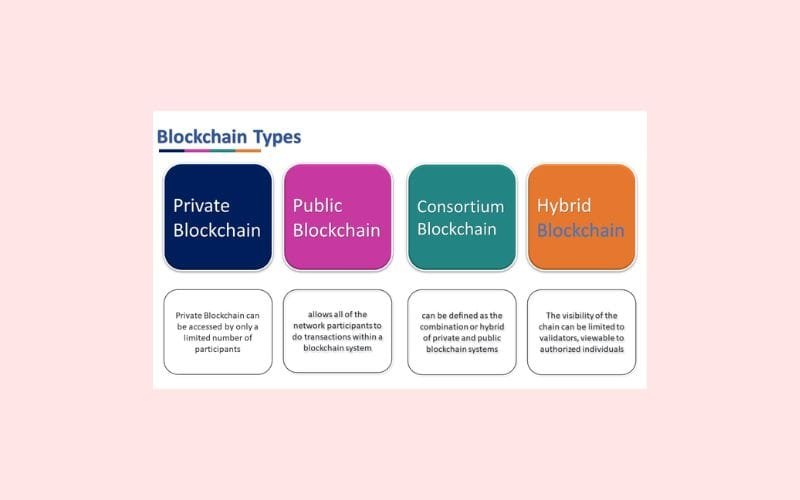

Types Of Blockchain

There are four main types of blockchain structures:

Public Blockchains

Public blockchains are open to anyone, allowing any user to join, read, write, review, and download the blockchain protocol at any time. Validators are often incentivized for their participation. The larger the community of participants, the more secure the blockchain becomes, as increased involvement strengthens protection against cybersecurity threats. Public blockchains are fully decentralized, meaning all nodes can create and validate new blocks. However, blockchain immutability means that once data is added, it cannot be altered. The downside is that validation in public blockchains can be slow.

Public Blockchains are the most widely known type of Blockchain.

Public Blockchains are the most widely known type of Blockchain.

Private (or Managed) Blockchains

Private blockchains operate much faster than public blockchains due to fewer participating nodes. Access is restricted, with only the central authority determining who can act as a node. While these blockchains are partially decentralized, they are controlled by a single organization, limiting the equality of rights among participants. However, private blockchains are more vulnerable to fraud due to their controlled nature.

Consortium (or Federated) Blockchains

Consortium blockchains, also known as federated blockchains, are typically not focused on cryptocurrencies but are used for other blockchain-based projects. These blockchains are governed by a group of organizations, where only pre-selected participants are granted equal authority within the network. Each participant is verified in advance, and any malicious actor can be excluded by the group. Setting up a consortium blockchain can be challenging, as it requires cooperation between multiple organizations, leading to potential logistical difficulties.

Hybrid Blockchains

Hybrid blockchains are managed by a single organization but allow communication with all relevant stakeholders. Like private blockchains, they offer lower transaction costs due to fewer validators. Their hybrid nature provides both controlled access and flexibility. Hybrid blockchains are fully customizable, with the ability to change rules as needed, combining the strengths of private and public blockchain architectures.

What are the business benefits of blockchain?

The adoption of blockchain technology is set to grow significantly in the coming years. As a transformative and disruptive innovation, blockchain is poised to revolutionize existing business processes by delivering greater efficiency, security, and reliability.

Blockchain offers key business advantages that benefit companies in several ways:

- Establishes trust between business partners by providing consistent and reliable shared data.

- Eliminates isolated data systems by integrating information into a single distributed ledger accessible by permissioned parties within a network.

- Ensures high levels of data security, protecting sensitive information.

- Reduces reliance on third-party intermediaries, streamlining processes.

- Creates tamper-proof, real-time records that can be shared among all participants.

- Ensures the authenticity and integrity of products within the supply chain.

- Facilitates seamless tracking and tracing of goods and services, enhancing supply chain transparency.

- Supports food safety efforts through blockchain platforms like Oracle Blockchain.

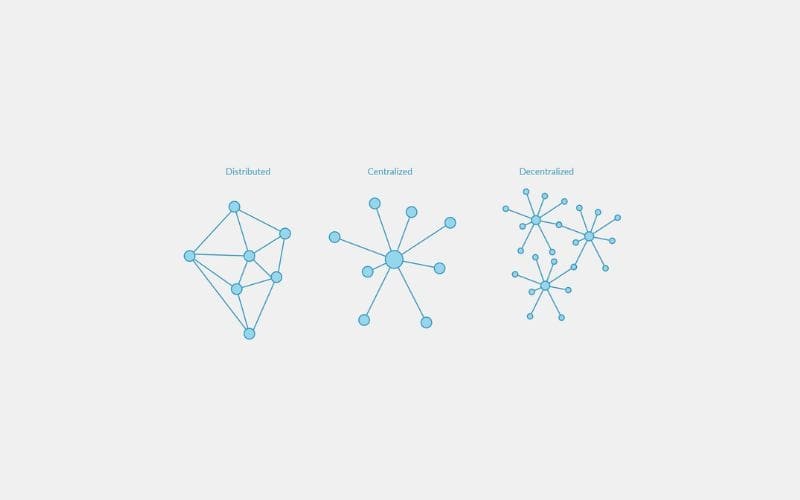

Blockchain Decentralization

Blockchain enables data to be distributed across multiple network nodes—computers or devices running the blockchain software—located in different places. This distribution creates redundancy and ensures data integrity. For instance, if an attempt is made to alter data on one node, the other nodes can reject the change by verifying block hashes, ensuring no single node can manipulate information in the blockchain.

This decentralized structure, combined with cryptographic proof of work, makes blockchain data, such as transaction histories, immutable. While a blockchain commonly records financial transactions, private blockchains can store various types of data, including legal documents, identification records, or business inventories. Most blockchains do not directly store this information but use hashing algorithms to represent the data on the blockchain via tokens.

Blockchain Transparency

The decentralized nature of the Bitcoin blockchain allows for complete transparency, enabling anyone to view transactions either by downloading and inspecting the blockchain or using blockchain explorers to monitor transactions in real-time. Every node maintains its own copy of the blockchain, which is continuously updated with each newly confirmed block. This allows anyone to trace the movement of a bitcoin.

For example, in cases where cryptocurrency exchanges have been hacked, while the hackers’ identities may remain anonymous, the stolen crypto can be traced via their wallet addresses, which are recorded on the blockchain.

Although Bitcoin blockchain records are encrypted, ensuring anonymity, only individuals with access to a particular address can reveal their identity. This allows blockchain users to maintain anonymity while still benefiting from the transparency blockchain offers.

Is Blockchain Secure?

Blockchain technology ensures decentralized security and trust through several mechanisms. First, new blocks are always added in a linear and chronological order, meaning they are appended to the “end” of the blockchain. Once a block is added, it becomes impossible to alter previous blocks.

Any change in the data within a block would alter its hash. Since each block contains the hash of the previous one, modifying a single block would change all subsequent blocks. The network would reject such an altered block because the hash values wouldn’t align. While this type of attack may be feasible on smaller blockchain networks, it’s nearly impossible on large-scale blockchains like Bitcoin.

Blockchain security is absolute

For smaller blockchain networks, an attacker would need control over at least 51% of the network’s computational power, a scenario known as a “51% attack.” On larger blockchains such as Bitcoin, which processes approximately 640 exahashes per second as of September 2024, this level of control is virtually unattainable. By the time an attacker makes an attempt, the blockchain will have moved beyond the blocks they were trying to alter.

The Ethereum blockchain is also highly secure. To compromise Ethereum, attackers would need control of more than half of the staked ether. As of September 2024, over 33.8 million ETH has been staked by more than one million validators. For an attack to succeed, a group would need to own over 17 million ETH and be selected frequently enough to validate blocks, making such a scenario highly improbable.

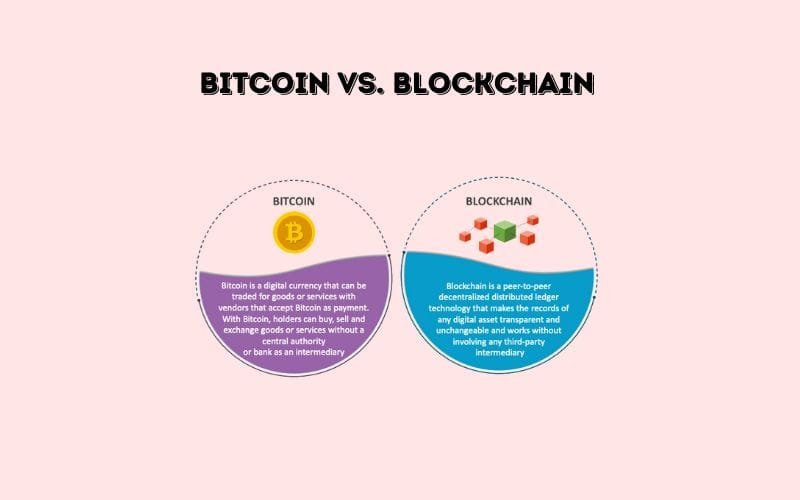

Bitcoin vs. Blockchain

Blockchain technology was initially conceptualized in 1991 by researchers Stuart Haber and W. Scott Stornetta, who sought to create a system that would ensure document timestamps were tamper-proof. However, it wasn’t until nearly two decades later, with the launch of Bitcoin in January 2009, that blockchain found its first practical application.

Bitcoin vs. Blockchain: Is There a Difference?

Bitcoin

The Bitcoin protocol operates on a blockchain. In the research paper that introduced this digital currency, its pseudonymous creator, Satoshi Nakamoto, described it as “a new electronic cash system that’s fully peer-to-peer, with no trusted third party.” The essential point to grasp is that Bitcoin leverages blockchain technology to transparently record a ledger of payments and other transactions between users.

Blockchain

Blockchain can be utilized to securely and immutably record a wide array of data points, including transactions, election votes, product inventories, state identifications, property deeds, and much more.

Currently, there are tens of thousands of projects aiming to implement blockchain solutions in diverse ways beyond mere transaction recording—such as facilitating secure voting in democratic elections. The inherent immutability of blockchain significantly reduces the potential for fraudulent voting. For instance, a voting system could issue each citizen a single cryptocurrency or token.

Each candidate could receive a designated wallet address, allowing voters to send their tokens or cryptocurrency to the address of their preferred candidate. The transparent and traceable nature of blockchain would eliminate the need for manual vote counting and diminish the ability of malicious actors to manipulate physical ballots.

Blockchain vs. Banks

Blockchains are often recognized as a disruptive influence in the financial sector, particularly regarding payments and banking functions. However, there are substantial differences between banks and decentralized blockchains.

To illustrate how banks differ from blockchain, let’s compare the banking system to Bitcoin’s blockchain implementation.

| Feature | Banks | Bitcoin |

| Hours open | Typical brick-and-mortar banks are open from 9:00 am to 5:00 pm on weekdays. Some banks are open on weekends but with limited hours. All banks are closed on banking holidays. | No set hours; open 24/7, 365 days a year. |

| Transaction Fees | Card payments: This fee varies based on the card and is not paid by the user directly. Fees are paid to the payment processors by stores and are usually charged per transaction. The effect of this fee can sometimes make the cost of goods and services rise. Checks: can cost between $1 and $30 depending on your bank. ACH: ACH transfers can cost up to $3 when sending to external accounts. Wire: Outgoing domestic wire transfers can cost as much as $25. Outgoing international wire transfers can cost as much as $45. | Bitcoin has variable transaction fees determined by miners and users. This fee can range between $0 and $50 but users have the ability to determine how much of a fee they are willing to pay. This creates an open marketplace where if the user sets their fee too low their transaction may not be processed. |

| Transaction Speed | Card payments: 24-48 hours Checks: 24-72 hours to clear ACH: 24-48 hours •Wire: Within 24 hours unless international *Bank transfers are typically not processed on weekends or bank holidays | Bitcoin transactions can take as little as 15 minutes and as much as over an hour depending on network congestion. |

| Know Your Customer Rules | Bank accounts and other banking products require “Know Your Customer” (KYC) procedures. This means it is legally required for banks to record a customer’s identification prior to opening an account. | Anyone or anything can participate in Bitcoin’s network with no identification. In theory, even an entity equipped with artificial intelligence could participate. |

| Ease of Transfers | Government-issued identification, a bank account, and a mobile phone are the minimum requirements for digital transfers. | An internet connection and a mobile phone are the minimum requirements. |

| Privacy | Bank account information is stored on the bank’s private servers and held by the client. Bank account privacy is limited to how secure the bank’s servers are and how well the individual user secures their own information. If the bank’s servers were to be compromised then the individual’s account would be as well. | Bitcoin can be as private as the user wishes. All Bitcoin is traceable but it is impossible to establish who has ownership of Bitcoin if it was purchased anonymously. If Bitcoin is purchased on a KYC exchange then the Bitcoin is directly tied to the holder of the KYC exchange account. |

| Security | Assuming the client practices solid internet security measures like using secure passwords and two-factor authentication, a bank account’s information is only as secure as the bank’s server that contains client account information. | The larger the Bitcoin network grows the more secure it gets. The level of security a Bitcoin holder has with their own Bitcoin is entirely up to them. For this reason it is recommended that people use cold storage for larger quantities of Bitcoin or any amount that is intended to be held for a long period of time. |

| Approved Transactions | Banks reserve the right to deny transactions for a variety of reasons. Banks also reserve the right to freeze accounts. If your bank notices purchases in unusual locations or for unusual items they can be denied. | The Bitcoin network itself does not dictate how Bitcoin is used in any shape or form. Users can transact Bitcoin how they see fit but should also adhere to the guidelines of their country or region. |

| Account Seizures | Due to KYC laws, governments can easily track people’s bank accounts and seize the assets within them for a variety of reasons. | If Bitcoin is used anonymously governments would have a hard time tracking it down to seize it. |

Blockchain vs. Hyperledger

Blockchain vs. Hyperledger: Is There a Difference?

Hyperledger is “an umbrella project that encompasses open-source blockchains and related tools, initiated in December 2015 by the Linux Foundation and supported by industry leaders like IBM, Intel, and SAP. Its purpose is to facilitate the collaborative development of blockchain-based distributed ledgers.”

Participants in the Hyperledger initiative assert that “only an open-source, collaborative approach to software development can guarantee the transparency, longevity, interoperability, and support needed to propel blockchain technologies toward mainstream commercial adoption.”

The goal of the Hyperledger project is “to enhance cross-industry collaboration by developing blockchains and distributed ledgers, with a specific emphasis on improving the performance and reliability of these systems (when compared to traditional cryptocurrency designs) to support global business transactions among major technological, financial, and supply chain organizations.”

How Are Blockchains Used?

As we have established, blocks within Bitcoin’s blockchain primarily store transactional data. Currently, tens of thousands of other cryptocurrencies also operate on various blockchains. However, blockchain technology proves to be a reliable method for storing diverse types of data beyond just transactions.

Numerous companies experimenting with blockchain include Walmart, Pfizer, AIG, Siemens, and Unilever, among others. For instance, IBM has developed its Food Trust blockchain, which traces the journey food products take to their destinations.

Why is this important? The food industry has faced numerous outbreaks of E. coli, salmonella, and listeria; in some instances, hazardous materials have been inadvertently introduced into food items. Previously, identifying the source of these outbreaks or the cause of illnesses related to food consumption could take weeks.

By utilizing blockchain technology, brands can monitor a food product’s path from its origin through every stop it makes until delivery. Moreover, these companies can see everything the product may have encountered along the way, enabling them to identify problems much more quickly—potentially saving lives. This is just one example of blockchain in action, with many other applications of blockchain technology currently being explored.

Pros and Cons of Blockchain

What are the Pros and Cons of Blockchain?

Despite its complexity, the potential of blockchain as a decentralized record-keeping system is virtually limitless. With benefits such as enhanced user privacy, increased security, reduced processing fees, and fewer errors, blockchain technology could find applications far beyond those previously discussed. However, there are also some drawbacks.

| Pros | Cons |

| Enhanced accuracy by minimizing human involvement in the verification process.

| High technological costs associated with implementing certain blockchains.

|

| Cost savings through the elimination of third-party verification.

| Limited number of transactions processed per second.

|

| Decentralization makes it more challenging to tamper with records.

| A history of use in illicit activities, such as those conducted on the dark web.

|

| Transactions conducted on blockchain are secure, private, and efficient.

| Regulatory frameworks vary by jurisdiction and remain uncertain.

|

| It is a transparent technology.

| Limitations on data storage capacity.

|

| Offers a banking alternative and a means to secure personal information for individuals in countries with unstable or underdeveloped governments.

|

Benefits of Blockchains in 2024

Accuracy of the Chain

Transactions on the blockchain network are validated by thousands of computers and devices, significantly reducing human involvement in the verification process. This minimizes the potential for human error and ensures a precise record of information. Even if a single computer on the network were to make a computational mistake, that error would only affect one copy of the blockchain and would not be accepted by the rest of the network.

Cost Reductions

Traditionally, consumers pay banks to verify transactions or notaries to sign documents. Blockchain technology eliminates the need for these third-party verifications, along with their associated costs. For instance, business owners often incur fees when accepting credit card payments due to the processing done by banks and payment companies. In contrast, Bitcoin operates without a central authority, resulting in minimal transaction fees.

Decentralization

Blockchain does not keep any information in a central location. Instead, it distributes copies of the blockchain across a network of computers. When a new block is added, every computer in the network updates its copy of the blockchain to reflect that change. This distribution makes blockchain significantly more resistant to tampering compared to a centralized database.

Decentralized Cloud Storage of Blockchain

Efficient Transactions

Transactions managed through a central authority can take several days to settle. For example, depositing a check on Friday evening may not result in available funds until Monday morning. Financial institutions typically operate during business hours, five days a week. In contrast, a blockchain operates 24/7, all year round. On certain blockchains, transactions can be completed and confirmed within minutes, which is especially beneficial for cross-border trades that often face delays due to time zone differences and the need for multiple confirmations.

Private Transactions

Many blockchain networks function as public databases, allowing anyone with internet access to view the transaction history. While users can access transaction details, they cannot see identifying information about the individuals making those transactions. It’s a common misconception that blockchain networks like Bitcoin offer complete anonymity; they are actually pseudonymous, as each user has a visible address that could be linked to them if the information becomes known.

Secure Transactions

Once a transaction is recorded, its authenticity is verified by the blockchain network. After validation, the transaction is added to a block in the blockchain. Each block has its own unique hash as well as the hash of the preceding block, ensuring that blocks cannot be altered once confirmed by the network.

Transparency

Many blockchains are entirely open source, meaning that anyone can access their code. This transparency allows auditors to review the security of cryptocurrencies like Bitcoin. However, it also means there is no definitive authority controlling Bitcoin’s code or its modifications. Anyone can propose changes or enhancements, and if a majority of network users agree that the new code is beneficial, the blockchain can be updated accordingly.

Private or permissioned blockchains may limit public transparency based on their design and intended use. Such blockchains could be created for organizations that wish to track data accurately while restricting access to authorized users only. Alternatively, publicly traded companies might be required to provide financial transparency through a regulator-approved blockchain reporting system, which would prevent manipulation of financial statements to present an overly favorable picture of profitability.

Is Blockchain technology effective in today’s time?

Banking the Unbanked

One of the most transformative aspects of blockchain and cryptocurrency is its accessibility for anyone, regardless of ethnicity, gender, location, or cultural background. According to The World Bank, approximately 1.4 billion adults lack bank accounts or means to securely store their wealth. Most of these individuals reside in developing countries where the economy heavily relies on cash.

These individuals often receive physical cash as payment and must find secure locations to store it, increasing their vulnerability to theft and violence. Although not entirely immune to theft, cryptocurrency offers a more secure alternative, making it more challenging for potential thieves.

Drawbacks of Blockchains

What are Drawbacks of Blockchains?

Technology Cost

While blockchain technology can reduce transaction fees for users, it is not without its costs. For instance, the proof-of-work (PoW) system employed by the Bitcoin network for transaction validation consumes an enormous amount of computational power. In fact, the energy used by the millions of devices within the Bitcoin network exceeds the annual energy consumption of Pakistan.

However, solutions are beginning to emerge to address these concerns. Some bitcoin-mining farms are now utilizing renewable energy sources such as solar power, excess natural gas from fracking sites, or wind energy.

Speed and Data Inefficiency

Bitcoin serves as a prime example of the inefficiencies associated with blockchain technology. The PoW mechanism takes approximately 10 minutes to add a new block to the blockchain, allowing the network to process only about seven transactions per second (TPS). While other cryptocurrencies, such as Ethereum, demonstrate better performance, they still face limitations due to the intricate nature of blockchain. For context, Visa can handle up to 65,000 TPS.

Efforts to enhance transaction speed have been ongoing for years. Numerous blockchain projects now claim to achieve tens of thousands of TPS, and Ethereum is implementing a series of upgrades that include data sampling, binary large objects (BLOBs), and rollups. These enhancements aim to boost network participation, alleviate congestion, lower fees, and increase transaction speeds.

Another challenge with many blockchains is the limited data capacity of each block. The ongoing debate regarding block size remains one of the most critical issues affecting the scalability of blockchain technology in the future.

Illegal Activity

Although the confidentiality provided by blockchain networks protects users from hacks and helps preserve privacy, it also facilitates illegal trading and activities. A prominent example of blockchain being utilized for unlawful transactions is the Silk Road, an online dark web marketplace for illegal drugs and money laundering that operated from February 2011 until the FBI’s shutdown in October 2013.

The dark web enables users to trade illegal goods anonymously through the Tor Browser and make illicit purchases using Bitcoin or other cryptocurrencies. This scenario starkly contrasts with U.S. regulations, which mandate financial service providers to collect customer information upon account creation, verifying identities and ensuring that individuals are not affiliated with known or suspected terrorist organizations.

This dual nature of blockchain can be seen as both an advantage and a disadvantage. It grants anyone access to financial accounts but also facilitates criminal activities. Many argue that the positive uses of cryptocurrency, such as providing banking services to the unbanked, outweigh the negatives, particularly since much illegal activity continues to be conducted using untraceable cash.

There are still many dangers when using Blockchain in 2024

Regulation

Concerns regarding government regulation of cryptocurrencies have been prevalent within the crypto community. Some jurisdictions are tightening regulations on specific types of cryptocurrencies and virtual currencies. However, there have been no regulations introduced that specifically target the development and use of blockchain technology itself, focusing instead on certain products created with it.

Data Storage

Another important consideration regarding blockchains is their storage requirements. While it may not seem significant given our existing storage capabilities, the increasing use of blockchain technology will necessitate more storage space, especially on blockchains where nodes maintain the entire chain.

Currently, data storage is centralized in large facilities. However, if industries around the world begin to adopt blockchain technology for all applications, the exponentially increasing size of blockchain data will require more advanced storage solutions or compel participants to upgrade their storage capabilities continually.

This could lead to substantial expenses regarding both financial investment and physical space, as the Bitcoin blockchain alone was over 600 gigabytes as of September 15, 2024, and records only Bitcoin transactions. While this amount is relatively small compared to the data stored in large data centers, the proliferation of numerous blockchains will only add to the overall storage demands in the digital landscape

What else can blockchain be used for?

Cryptocurrency represents just the beginning of blockchain’s potential. The applications for blockchain are rapidly growing beyond simple person-to-person transactions, especially as it is integrated with other emerging technologies. Some notable examples of additional blockchain use cases include:

Blockchain enables companies to establish a permanent audit trail by sequentially and indefinitely recording transactions. This capability allows for the maintenance of both static records (such as land titles) and dynamic records (like the exchange of assets).

With blockchain, businesses can monitor a transaction’s progress down to its current status. This feature allows organizations to pinpoint the exact origin of the data and track its delivery, significantly aiding in the prevention of data breaches.

Furthermore, blockchain technology supports the use of smart contracts.

What are some concerns around the future of blockchain?

Although blockchain has the potential to be a transformative technology, skepticism is growing regarding its actual business value. A significant concern is that despite numerous idea-stage applications, sensational headlines, and substantial investments amounting to billions of dollars, there are still very few practical and scalable use cases for blockchain.

One contributing factor to this skepticism is the rise of competing technologies. In the payments sector, for instance, blockchain is not the only fintech innovation disrupting the value chain. In 2021, 60 percent of the nearly $12 billion invested in U.S. fintechs was directed toward payments and lending. Given the complexity often associated with blockchain solutions and the fact that simpler solutions are usually more effective, blockchain may not always be the best answer to payment issues.

Looking to the future, some experts believe that the true value of blockchain lies in its ability to democratize data, foster collaboration, and address specific challenges. Research from McKinsey indicates that these particular applications are where blockchain exhibits the most promise, rather than in traditional financial services.

Blockchain – Frequently Asked Questions

FAQs for Blockchain

What Exactly Is a Blockchain?

In simple terms, a blockchain is a shared database or ledger. Data is stored in files known as blocks, and each node in the network possesses a complete copy of the entire database. Security is maintained because the majority of nodes will refuse to accept any changes if an attempt is made to modify or delete an entry in one version of the ledger.

What Is a Blockchain in Easy Terms?

Consider that you input some information into a document on your computer and utilize a program that generates a string of numbers and letters (referred to as hashing, with the generated string known as a hash). You prepend this hash to a new document and input additional information. Again, you employ the program to create a hash, which you attach to the next document. Each hash represents the preceding document, resulting in a chain of encoded documents that cannot be altered without modifying the hash. These documents are stored across computers in a network. This network of programs validates each document by comparing it with the stored ones, accepting them based on the hashes they generate. If a document produces a hash that doesn’t match, the network rejects that document.

What Is a Blockchain for Beginners?

A blockchain is a decentralized network of files linked together through programs that generate hashes—strings of numbers and letters that symbolize the information within the files. Each participant in the network is a computer or device that compares these hashes with the ones they generate. If the hashes match, the file is retained. If they don’t match, the file is rejected.

What is the biggest advantage of blockchain technology?

The primary advantage of blockchain technology is its decentralization. The Bitcoin blockchain is distributed and upheld by numerous interconnected participants. This framework is permanent and operates based on a consensus mechanism.

What makes blockchain technology trustworthy?

Blockchain technology addresses the challenge of digital trust by securely recording vital information in a public domain. Data stored on the blockchain exists in a shared and continuously reconciled state, enhancing its reliability.

What distinguishes blockchain from traditional databases?

Blockchain operates in a decentralized and immutable manner, meaning that no single entity has control, and data cannot be altered once added. In contrast, traditional databases are centralized and allow administrators to modify the stored information.

How secure is blockchain technology?

Blockchain ensures security through advanced cryptographic methods and consensus protocols such as Proof of Work (PoW) and Proof of Stake (PoS). These mechanisms safeguard data integrity and secure the network against malicious activities.

Which industries benefit the most from blockchain?

Blockchain has proven to be highly beneficial in sectors such as finance, supply chain management, healthcare, and real estate, where it has enhanced transparency, security, and operational efficiency.

How can blockchain enhance your business?

By implementing blockchain, businesses can increase transparency, improve security, lower operational costs, and streamline processes by eliminating the need for middlemen in transactions.

What risks are associated with using blockchain?

Blockchain presents some challenges, including issues with scalability, evolving regulatory environments, and, in some models like Proof of Work, high energy consumption.

How can you begin using blockchain in your business?

To integrate blockchain into your operations, start by consulting blockchain experts who can assess your needs. Select the most appropriate blockchain platform or partner to match your business requirements.

What is The Future of Blockchains?

Future of Blockchain

The concept of blockchain has proven to be a foundation upon which a diverse array of applications can be constructed. Although it remains a relatively new and rapidly developing technology, many experts believe that blockchain has the potential to revolutionize our lives and work in ways akin to the impact of public Internet protocols like HTML during the early days of the World Wide Web.

Blockchains like Bitcoin Cash and Litecoin function in a manner similar to the original Bitcoin blockchain. However, the Ethereum blockchain represents a further advancement of the distributed ledger concept, as it is not solely focused on managing a digital currency like the Bitcoin blockchain. That said, Ethereum does operate as a cryptocurrency and can be utilized to transfer value between individuals. The Ethereum blockchain can be viewed as a robust and highly adaptable computing platform that enables developers to easily create a variety of applications that harness blockchain technology.

For instance, imagine a charity that aims to distribute funds to thousands of individuals every day for an entire year. With Ethereum, this process could be executed with just a few lines of code. Alternatively, if you are a video game developer looking to create items such as swords or armor that can be traded outside the game environment, Ethereum is specifically designed to support that functionality as well.

Conclusion

As we move into 2024, blockchain continues to redefine secure data management by offering unparalleled transparency, decentralization, and protection against data tampering. Its potential across various industries is undeniable, from finance to healthcare, making it a key player in future-proofing businesses. However, adopting blockchain comes with challenges that require careful planning and strategy. For those looking to leverage blockchain technology, understanding its complexities is essential. At Coinreviews, we are committed to keeping you informed about the latest developments and guiding you through the evolving landscape of blockchain.

Best Crypto Exchange Reviews:

- Binance Review: Features, Supported Cryptos and Fees!

- Bybit Review: Pros, Cons and Key Features

- OKX Review: Pros, Cons, Future Potential & More

- HTX Review: Fees, Security, Pros & Cons

- Bitget Review: Pros & Coins, Fees & More

- Bitfinex Review: Is It Secure or Scam?

- Kucoin Review: Social Trading, Fees, Pros & Cons

- Crypto.com Review: Is the Exchange Safe or Scam?

- BingX Review: Verified Reviews, Pros & Cons

- LBank Review: Should You Use It?

- bitFlyer Review: Pros & Cons and Ratings

- ProBit Review: Is It the Right Crypto Exchange for You?

- P2B Review: Fees, Features, Safety, Pros & Cons

- Pionex Review: Pros, Cons & All You Need to Know

- BitMEX Review: Fees, Trading, Staking & More

- Phemex Review: Is It a Good Crypto Exchange?

- BTSE Review: Is It Safe & Reliable?

- CoinEx Review: Is This Crypto Exchange Safe?

- Poloniex Review: Features, Regulation & Risks

- BITFLEX Review: Features, Safety, Pros & Cons

- CoinJar Review: Is It the Right Exchange for You?

- Paymium Review: Pros, Cons, Key Features & Fees

- LBank Review: Is It the Right Exchange for You?

- MEXC Review: Latest Pros, Cons, Key Features & Fees

- BitMart Review: Reviews, Trading Fees & Cryptos

- Margex Review 2025: Is the Exchange Safe or Scam?

See More: