Welcome to CoinReviews’ comprehensive BTSE Review for 2024. As one of the emerging cryptocurrency exchanges, BTSE has made a name for itself with its multi-currency support, advanced trading tools, and robust security measures. Whether you’re an experienced trader looking for low fees and sophisticated options like futures and margin trading, or a beginner seeking a secure platform to start your crypto journey, BTSE offers something for everyone.

In this detailed guide, CoinReviews will explore all aspects of the BTSE exchange, from its features and fees to its pros and cons, helping you decide if it’s the right platform for your trading needs in 2024.

What is BTSE?

How is BTSE exchange understood?

BTSE, short for “Buy, Trade, Sell, Earn,” is a reputable digital asset exchange known for providing a secure and intuitive platform for cryptocurrency trading. As a leading platform for institutions, retail investors, and beginners, BTSE has pioneered several trading technologies that have redefined standards of excellence and innovation in the digital asset trading space.

BTSE offers a wide array of financial services designed to integrate traditional finance with digital asset solutions. These include multi-currency spot and derivatives trading, an NFT marketplace, white-label exchange solutions, OTC trading, asset management, and payment gateways. The platform also features advanced futures trading tools, such as customizable leverage and perpetual contracts. With stringent security protocols, an insurance fund, cold storage for over 90% of assets, and unlimited withdrawals for 12+ fiat currencies and 150+ cryptocurrencies, BTSE leads the digital asset industry.

Moreover, BTSE licenses its cutting-edge proprietary technology to exchanges globally through its white-label solutions, extending its impact across the crypto landscape.

[button url=”https://www.btse.com/referral/ih8JHMtj” target=”blank” style=”3d” background=”#49ef2d” color=”#FFFFFF” size=”10″ wide=”no” center=”yes” radius=”auto” icon=”icon: mail-forward” icon_color=”#FFFFFF” text_shadow=”none”]Visit BTSE[/button]Who are the BTSE founders?

BTSE was founded in 2018 by Jonathan Leong with a goal of delivering high-quality trading products tailored for retail users. Leong, an experienced technology entrepreneur, has over 15 years of expertise in developing high-performance, mission-critical systems. He co-founded the platform alongside Wong, who has an impressive background in financial institutions, including roles at Goldman Sachs, and successfully built a high-speed trading product targeting inefficiencies in Asian financial markets.

Currently, BTSE is led by CEO Henry Liu and COO Jeff Mei. Liu, who began his career in blockchain in 2016 after working in merchant banking, oversees BTSE’s operations. Mei, responsible for global expansion and strategic initiatives, brings experience in both blockchain and traditional finance sectors. Together, they continue to drive BTSE’s mission of offering a secure and accessible platform for cryptocurrency trading while integrating traditional finance with digital asset solutions.

How to Sign Up for a BTSE Account?

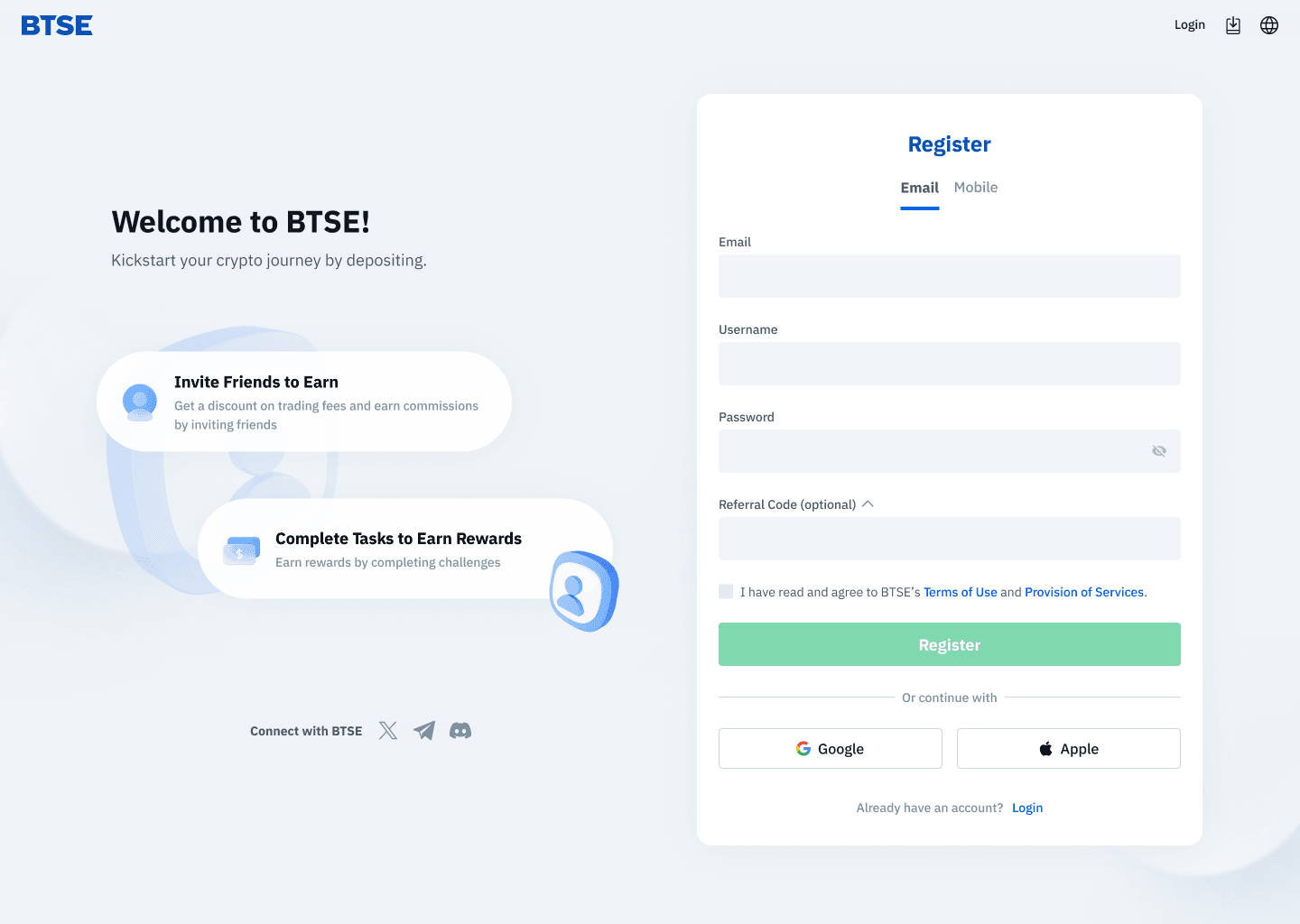

Signing up for a BTSE account is simple and unlocks all the benefits of trading on your preferred cryptocurrency exchange. You can register using either your email address (Step 2a.) or through your Google/Apple account (Step 2b.).

Note: We currently do not support registrations from Canada, Liechtenstein, Lithuania, New Zealand, or the United States.

Step 1.

[button url=”https://www.btse.com/referral/ih8JHMtj” target=”blank” style=”3d” background=”#49ef2d” color=”#FFFFFF” size=”10″ wide=”no” center=”yes” radius=”auto” icon=”icon: mail-forward” icon_color=”#FFFFFF” text_shadow=”none”]Visit BTSE[/button]From BTSE’s homepage, click “Sign Up” or access the registration form directly.

Important Tips for Password Creation:

- Use both lowercase (a-z) and uppercase (A-Z) letters.

- Include at least one number (0-9) or symbol.

- Passwords must be between 8-72 characters long, with no spaces.

- If you have a referral or promo code, enter it in the “Referral Code” field.

Please read the Terms of Service carefully before ticking the box and submitting your registration.

Step 2a.

To register using your email:

- Enter your email, username, and password, then click “Register.”

- Check your email inbox for a confirmation message.

- Click the link in the email to verify your account and start trading.

Step 2b.

To register using your mobile number:

- Enter your mobile number, username, and password, then click “Register.”

- You’ll receive an SMS confirmation—input the code to complete your registration.

Note: Mobile registration is not available for phone numbers from China, the United Arab Emirates, and the UK.

Step 2c.

To sign up using your Google or Apple account:

- Create a fresh BTSE account or effortlessly link it to your existing one

- Complete the requested fields and click “Register.”

Congratulations! You’re ready to begin your BTSE journey!

Content source rewritten from: BTSE

How to deposit fiat on BTSE’s platform?

To deposit fiat into your BTSE account, you’ll need to first complete the KYC (Know Your Customer) process by visiting BTSE’s verification page. This process involves verifying your identity with an ID card, mobile number, and proof of address, as well as declaring your source of funds.

Once KYC is complete, follow these steps from your BTSE dashboard:

- Click on ‘Deposit Now’ and choose the Fiat option.

- Select your preferred payment method.

- For SEPA bank transfer:

- Make sure to note the BTSE transaction number in the deposit/remittance details.

- Click ‘Deposit’ and select ‘Bank Transfer (SEPA)’, which will guide you through the steps.

- For SWIFT bank transfer:

- Choose the “Bank Transfer (SWIFT)” option, and the system will provide instructions for completing the deposit.

For wire transfer:

- Enter the required bank details, ensuring that the ‘reference code’ and ‘transaction number’ are correct.

- Click ‘Submit’ to send the deposit information to your bank for processing.

How to buy crypto on BTSE?

Is buying cryptocurrency on BTSE different from other exchanges?

To buy cryptocurrency on BTSE, follow these steps:

- At the top of the page, go to the ‘Trade’ tab and select ‘Spot’ from the drop-down menu.

- Choose the trading pair you want to trade from the options listed at the top right of the trading panel.

- On the right side of the page, input the price and amount of crypto you wish to purchase. Alternatively, you can place a market order to buy at the current market price.

- Click ‘Buy Order’ to finalize your purchase.

How to sell crypto on BTSE’s platform?

To sell cryptocurrency on BTSE, follow these steps:

- Navigate to the ‘Trade’ tab at the top of the page and choose ‘Spot’ from the drop-down menu.

- Select the trading pair you wish to trade from the options at the top right of the trading panel.

- On the right side of the page, click on the ‘Sell’ tab and set the price and amount of crypto you intend to sell. Alternatively, you can place a market order to sell at the current market price.

- Click ‘Sell Order’ to complete the transaction.

How Does BTSE Broker Operate?

BTSE Broker operates by offering a comprehensive, user-friendly platform that bridges the gap between traditional finance and the digital asset space. As a broker, BTSE provides institutional-grade trading tools and services that cater to both retail and institutional clients. The platform supports multi-currency spot and derivatives trading, with advanced features such as margin trading, futures contracts, and customizable leverage. Additionally, BTSE Broker allows users to engage in over-the-counter (OTC) trades for high-volume transactions, offering competitive pricing and deep liquidity.

BTSE also integrates fiat gateways, enabling users to deposit and withdraw in multiple fiat currencies, making it more accessible to a global audience. The broker operates under strict security protocols, including cold storage of assets and robust compliance with KYC/AML regulations.

Within this BTSE review, it’s clear that the platform’s focus on flexibility, security, and advanced trading features makes it a top choice for both experienced traders and institutions looking for a reliable broker in the crypto market. BTSE’s seamless user experience and high-performance technology further enhance its appeal, especially for those seeking to diversify their portfolio across both fiat and digital assets.

Technology Behind BTSE Exchange

The technology powering BTSE is highly advanced, enabling it to support a network of over 20 white-label crypto exchanges. These exchanges benefit from shared liquidity with BTSE, offering increased visibility for emerging token projects. White-label exchanges function similarly to BTSE, leveraging its infrastructure and technology to deliver a seamless trading experience while enhancing the overall liquidity in the market.

As highlighted in this BTSE Review, the platform’s robust technology not only reinforces its position in the crypto space but also fosters growth for new projects and partners alike.

BTSE Platform Features

What are the salient features of BTSE?

Are you ready to explore the features of BTSE? Consider this your exclusive VIP tour of the exchange, where I’ll be your entertaining guide through all the essential details.

Streamlined Trading Interface

While assessing this BTSE revie, BTSE offers a sleek and intuitive trading interface that makes navigating the platform a breeze. At the top, you’ll find quick links for deposits, withdrawals, and your order history. The left sidebar allows you to filter through a vast array of assets, while the central area features a dynamic TradingView chart for all your technical analysis needs. Placing orders is simple, with an easy-to-use form located at the bottom of the page. Even beginners in the crypto space will feel comfortable using the platform.

Variety of Order Types

When it comes to executing trades, BTSE provides a wide range of order types to suit your needs:

- Market Orders: Buy or sell instantly at the current best price.

- Limit Orders: Specify your own price for buying or selling.

- Stop Limit Orders: Set a limit order triggered by a stop price.

For those who prefer advanced trading strategies, BTSE also offers options like Stop Market, Take Profit Limit, Take Profit Market, Trailing Stop Market, TWAP (Time Weighted Average Price), and OCO (One Cancels Other).

Margin and Futures Trading

BTSE features a robust set of trading leverages designed primarily for professional traders. The platform allows for both futures and spot margin trading on major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and other leading altcoins. For those willing to take risks for potentially high rewards, some contracts offer leverage up to 100x. However, it’s essential to proceed with caution, as leverage amplifies both profits and losses proportionally.

As highlighted in this BTSE Review, the platform’s comprehensive features cater to traders of all experience levels, making it an appealing choice in the competitive crypto market.

BTSE Review: Pros and Cons of 2024

Pros

Low Fees: Within this BTSE review, BTSE offers a highly competitive fee structure, particularly for high-volume traders. With options like maker-taker fee models and discounts for using the BTSE token, traders can significantly reduce their costs. This makes the platform appealing for both casual and professional users.

Multi-Currency Support: One of BTSE’s standout features is its multi-currency support. Traders can deal in various cryptocurrencies and fiat currencies, including USD, EUR, JPY, and others. The platform’s multi-currency order book allows users to trade pairs directly between different fiat currencies and cryptocurrencies, providing flexibility and liquidity.

Advanced Trading Tools: BTSE provides a suite of advanced tools for experienced traders, including futures, margin trading with leverage, and robust charting tools. The platform also offers OTC trading, allowing high-net-worth individuals and institutions to execute large trades without affecting the market price.

Security: BTSE emphasizes strong security measures, such as two-factor authentication (2FA), cold storage for the majority of user funds, and strict KYC/AML protocols. These measures ensure the platform is secure against hacks and fraud.

Cons:

Limited Availability in Certain Regions: Despite its global reach, BTSE faces regulatory hurdles in certain jurisdictions. This can limit access for traders in specific countries, forcing them to use alternative platforms or face restrictions on some services.

Regulatory Concerns: Like many cryptocurrency exchanges, BTSE is subject to changing regulations that can impact its operations. This uncertainty can be a drawback for users seeking a stable long-term trading platform.

Fiat Deposit/Withdrawal Options: Although BTSE supports several fiat currencies, the options for depositing and withdrawing fiat funds can be limited depending on the user’s location. This may require traders to rely more heavily on cryptocurrencies for transactions.

Final Verdict: BTSE is an excellent platform for traders looking for low fees, advanced trading tools, and broad multi-currency support. However, its limited availability in certain regions and potential regulatory concerns may be restrictive for some users. Overall, it is best suited for experienced traders and high-volume users who can take full advantage of its features.

Competitor Comparison: BTSE vs. Other Crypto Exchanges

What differences does BTSE have with other exchanges?

Within this BTSE review, BTSE operates in a highly competitive landscape, with several major players such as Binance, Coinbase, and Kraken dominating the market. Each exchange offers its own set of features, fee structures, and trading options, making it important to compare BTSE against these industry giants. This comparison will examine how BTSE stacks up against its competitors in terms of fees, supported currencies, user experience, security, and more, as well as situations where BTSE may be a better option for certain traders.

Fee Structure: BTSE vs. Binance, Coinbase, and Kraken

Binance is widely known for its low fees, particularly for high-volume traders, and offers additional discounts for users who pay fees with its native Binance Coin (BNB). Coinbase, on the other hand, has a reputation for being one of the more expensive exchanges, especially for retail traders, with its fees reaching up to 4% for credit card purchases. Kraken strikes a balance between the two, offering relatively competitive fees, though they can still be higher than Binance for certain trading volumes.

BTSE offers a fee structure that is competitive with both Binance and Kraken. It employs a maker-taker model with discounts for using its native token (BTSE). Additionally, BTSE’s multi-currency order book feature, which allows users to trade between different fiat and cryptocurrencies directly, can further reduce trading costs by eliminating the need for intermediary conversions. This unique advantage gives BTSE an edge for traders looking to save on fees while accessing a wide range of currency pairs.

Supported Currencies and Trading Pairs

Binance supports an extensive range of cryptocurrencies and fiat currencies, with over 350+ coins available for trading. It is also known for being one of the first to list new and emerging altcoins. Coinbase supports fewer coins, focusing on well-established cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC), making it more suitable for beginner traders. Kraken offers a decent selection of cryptocurrencies but lags behind Binance in terms of variety.

BTSE’s standout feature is its multi-currency support, enabling direct trading between multiple fiat currencies (USD, EUR, JPY, etc.) and cryptocurrencies. This unique functionality is rare among competitors, even those like Binance, which often require users to convert to USDT or another stablecoin before trading across currencies. For traders who regularly deal with multiple fiat and crypto pairs, BTSE’s system provides unmatched flexibility and convenience.

Security: How BTSE Measures Up?

Security is paramount when comparing crypto exchanges. Coinbase is considered one of the most secure exchanges, as it is heavily regulated in the U.S. and holds most of its assets in cold storage. Kraken also has an excellent track record for security, emphasizing its comprehensive security measures, including two-factor authentication (2FA) and strict KYC/AML processes. Binance, despite being the largest exchange, has faced security breaches in the past, though it has since implemented robust security protocols.

While assessing this BTSE review, BTSE also prioritizes security, employing advanced protection measures like 2FA, cold storage for the majority of user funds, and stringent KYC/AML compliance. BTSE’s security measures are on par with Kraken and Coinbase, making it a reliable choice for traders concerned about safeguarding their assets. Additionally, BTSE has avoided any major security incidents, a notable achievement in a market where even leading exchanges have experienced breaches.

User Experience and Platform Features

Coinbase is often praised for its beginner-friendly interface, making it an ideal entry point for new traders. Binance offers a more complex platform with numerous advanced features and trading options, which can be overwhelming for beginners but is ideal for seasoned traders. Kraken falls somewhere in the middle, offering a solid platform with advanced features but a steeper learning curve than Coinbase.

BTSE is tailored more toward advanced users, offering features like margin and futures trading, staking, and a highly customizable trading interface. However, its platform is still intuitive enough for intermediate traders, making it a viable alternative to Binance and Kraken for those seeking more sophisticated trading options. The BTSE mobile app also provides a streamlined experience, offering traders flexibility for managing their portfolios on the go.

When is BTSE a Better Option?

BTSE is the better choice for multi-currency traders who frequently trade between various fiat and cryptocurrencies. Its multi-currency order book allows for direct trades without the need for intermediary stablecoins, saving time and reducing fees. BTSE also excels in providing advanced trading tools like margin and futures trading, making it ideal for seasoned traders and institutional clients.

For traders who prioritize security, BTSE’s robust measures make it a trustworthy option, particularly when compared to exchanges that have experienced breaches in the past. Additionally, BTSE’s focus on institutional growth, with services like OTC trading and high liquidity, makes it a strong contender for high-net-worth individuals and institutional investors.

Is the BTSE Mobile Trading App Available?

BTSE Mobile App is very convenient for investors

The BTSE mobile trading app is available, providing users with the flexibility to trade cryptocurrencies on the go. Designed for both iOS and Android devices, the app maintains the platform’s user-friendly interface, allowing traders to easily access their accounts, execute trades, and monitor market movements from anywhere at any time.

The BTSE mobile app features all the essential functionalities found on the desktop platform, including the ability to manage deposits and withdrawals, view trading charts, and set various order types. This means that users can stay connected to the market and make informed trading decisions without being tethered to their computers.

Throughout this BTSE review, it is evident that the availability of a mobile trading app significantly enhances the user experience by offering convenience and accessibility. Whether you’re an experienced trader or a newcomer to the crypto space, the mobile app ensures that you can engage with the market in real-time, making it a valuable tool for anyone looking to trade cryptocurrencies effectively. The app’s robust security measures also help safeguard user information and transactions, adding an extra layer of confidence for mobile traders.

Account Types Offered By BTSE

BTSE offers a range of account types to cater to the diverse needs of its users, ensuring that both retail and institutional traders can find a suitable option. Each account type is designed with specific features and benefits, making it easier for users to choose based on their trading experience and requirements.

- Individual Accounts: These accounts are tailored for retail traders and provide access to all standard trading features, including spot and futures trading, various order types, and a user-friendly interface. Individual accounts are perfect for those who are new to cryptocurrency trading or prefer a straightforward trading experience.

- Institutional Accounts: Designed for larger entities and professional traders, institutional accounts offer advanced features such as enhanced trading limits, dedicated account managers, and access to over-the-counter (OTC) trading services. This type of account is ideal for organizations looking to execute high-volume trades with additional support and resources.

- White-Label Solutions: BTSE also provides white-label solutions for businesses that want to launch their own cryptocurrency exchanges. These solutions come with BTSE’s robust technology, allowing companies to create a customized trading platform while benefiting from BTSE’s liquidity and security protocols.

While assessing this BTSE review, it’s clear that the variety of account types enhances the platform’s appeal by accommodating the needs of different user segments. Whether you’re an individual trader seeking simplicity or an institution requiring advanced features, BTSE has tailored options to support your trading journey. This flexibility not only fosters a more inclusive trading environment but also positions BTSE as a versatile player in the cryptocurrency exchange market.

BTSE Review: Leverage, Spreads, Fees and Taxes

Source: BTSE

When evaluating a trading platform, understanding the leverage, spreads, fees, and tax implications is crucial for making informed trading decisions. BTSE provides competitive conditions that appeal to both retail and institutional traders.

Leverage: BTSE offers substantial leverage options, allowing traders to magnify their positions. Users can access leverage of up to 100x on certain futures contracts, enabling them to increase potential returns significantly. However, it’s important to note that while higher leverage can lead to greater profits, it also amplifies potential losses. Therefore, effective risk management is essential for traders utilizing high leverage.

Spreads: BTSE maintains competitive spreads across its trading pairs, which can vary depending on market conditions and liquidity. Generally, tighter spreads are beneficial for traders as they reduce the cost of entering and exiting positions. The platform’s focus on liquidity ensures that users can execute trades at favorable prices.

Fees: BTSE employs a transparent fee structure that includes trading fees, withdrawal fees, and deposit fees. Trading fees are generally low compared to other exchanges, making it an attractive option for frequent traders. Additionally, there are no withdrawal limits on more than 12 fiat currencies and 150 cryptocurrencies, allowing for greater flexibility in managing funds. However, users should always review the latest fee schedule on the platform to avoid unexpected charges.

Taxes: When trading on BTSE, it’s essential to consider the tax implications of cryptocurrency transactions. Tax regulations can vary significantly depending on the trader’s jurisdiction, and it is advisable for users to consult with a tax professional to ensure compliance with local laws. BTSE provides users with transaction records that can assist in tax reporting, simplifying the process of tracking gains and losses.

Throughout this BTSE review, the platform’s favorable leverage options, competitive spreads, transparent fee structure, and consideration for tax reporting demonstrate its commitment to creating a trader-friendly environment. By offering these features, BTSE empowers users to optimize their trading strategies while minimizing costs and managing risk effectively.

Is the BTSE Welcome Bonus Available?

BTSE offers a welcome bonus for new users, designed to enhance the trading experience right from the start. This promotional offer is aimed at attracting new traders to the platform, allowing them to explore its features and services with added incentives.

The welcome bonus typically comes in the form of a trading credit, which can be used to execute trades without risking your own funds initially. This feature is particularly beneficial for newcomers, as it allows them to familiarize themselves with the platform’s interface, order types, and trading strategies without incurring immediate financial risk. By providing this bonus, BTSE encourages users to engage more actively and confidently in the market.

However, it’s important to read the terms and conditions associated with the welcome bonus. There may be specific requirements, such as minimum deposit amounts or trading volume that must be met to fully utilize the bonus. Understanding these details can help users maximize their benefits and avoid any potential pitfalls.

While assessing this BTSE review, the availability of a welcome bonus reflects BTSE’s commitment to supporting new traders as they embark on their cryptocurrency trading journey. This initiative not only fosters user engagement but also serves as an excellent opportunity for individuals to test the platform’s capabilities. Overall, the welcome bonus can significantly enhance the initial trading experience, making BTSE an appealing choice for those entering the crypto market.

Is BTSE Withdrawal Possible?

BTSE allows users to withdraw their funds seamlessly, making it a flexible option for traders looking to manage their assets effectively. The withdrawal process is straightforward and user-friendly, ensuring that users can access their funds whenever needed.

To initiate a withdrawal, users must first navigate to the withdrawal section of their BTSE account. Here, they can select the asset they wish to withdraw, whether it be fiat currency or cryptocurrencies. BTSE supports a wide variety of withdrawal options, catering to both fiat and digital assets, which enhances user convenience.

One of the notable features of BTSE’s withdrawal system is that it imposes no limits on withdrawals for more than 12 fiat currencies and over 150 cryptocurrencies. This flexibility is particularly advantageous for high-volume traders or those who prefer to move large sums of money without restrictions. However, users should be aware that withdrawal fees may apply, depending on the asset type and method chosen.

Throughout this BTSE review, the platform’s efficient and user-friendly withdrawal process highlights its commitment to customer satisfaction. By offering a hassle-free experience and a wide range of withdrawal options, BTSE empowers users to manage their funds according to their individual trading strategies and financial goals. Additionally, the ability to withdraw without limits further positions BTSE as a competitive player in the cryptocurrency exchange market, making it an appealing choice for traders of all levels.

Key Aspects of BTSE Exchange

No exchange review would be complete without examining the vital features that every serious trader should consider. Let’s explore how BTSE measures up in these important areas.

Exceptional Security: In the world of cryptocurrency, where significant amounts of money are at stake, security is not just a concern—it is the foremost concern. BTSE implements bank-grade security systems and advanced crypto protection measures, including hardware security modules and multi-signature authorization.

With 99% of assets kept in cold storage—well above the industry average—BTSE ensures a robust security posture. Additionally, comprehensive insurance coverage provides an extra layer of protection, allowing users to trade with peace of mind. Their stringent security protocols enable traders to engage confidently.

Is BTSE exchange security stable?

Is BTSE exchange security stable?

Reliable Customer Support: BTSE provides 24/7 customer support through ticketing and email channels. Even during times of market volatility, their response times remain swift. The multilingual support team guarantees assistance for traders from diverse backgrounds.

Moreover, BTSE enhances its customer service experience with benefits such as referral credits, educational resources, and an active Discord community. Their commitment to customer support is evident, showcasing a well-rounded approach to trader care.

BTSE Review – Frequently Asked Questions

Is BTSE Exchange Safe?

Safety is a paramount concern for any cryptocurrency exchange, and BTSE takes this matter seriously. The platform employs a variety of security measures designed to protect user assets and information. BTSE utilizes bank-grade systems along with advanced security features such as hardware security modules and multi-signature authorization.

To further enhance safety, 99% of user assets are stored in cold storage, a practice that significantly reduces exposure to potential hacks or online threats. This storage method keeps the majority of funds offline, thereby providing a higher level of security compared to exchanges that keep a large portion of assets in hot wallets. Additionally, BTSE has implemented comprehensive insurance coverage, offering users peace of mind knowing their investments are protected against unforeseen circumstances.

Does BTSE Require KYC?

Yes, BTSE requires users to complete a Know Your Customer (KYC) process. This procedure is essential for ensuring regulatory compliance and maintaining a secure trading environment. Users must submit identification documents, proof of address, and other relevant information to verify their identity before they can start trading or make withdrawals.

The KYC process is designed to protect both the platform and its users from fraud, money laundering, and other illicit activities. While some traders may find this requirement cumbersome, it is a standard practice in the industry aimed at fostering a safer trading landscape.

What cryptocurrencies can I trade on BTSE?

BTSE supports a diverse array of cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and many others.

How does BTSE’s fee structure compare to other exchanges?

BTSE offers competitive fees, particularly for high-volume traders and those utilizing the BTSE token for discounts.

Does BTSE have a mobile app?

Yes, BTSE provides a mobile app for both Android and iOS, offering a user-friendly interface for on-the-go trading.

Can I stake cryptocurrencies on BTSE?

Yes, BTSE has staking and earning programs with attractive interest rates.

How do I deposit and withdraw funds on BTSE?

BTSE facilitates deposits and withdrawals through both fiat and cryptocurrencies, with various payment methods available.

What is the BTSE token?

The BTSE token is the platform’s native cryptocurrency, used for obtaining fee discounts and other benefits.

What are the pros and cons of using BTSE?

Advantages include low fees and advanced tools, while drawbacks include limited accessibility in some regions.

Is BTSE available in my country?

Availability depends on local regulations, so users should check BTSE’s official website for a list of supported countries.

Is BTSE reliable in the future?

BTSE exchange has been chosen by many investors to trade in recent years?

Throughout this BTSE review, BTSE has positioned itself as a highly competitive and innovative cryptocurrency exchange, offering a wide range of features and tools that appeal to both retail and institutional traders. As the cryptocurrency industry continues to evolve, it’s natural to ask whether BTSE will remain reliable and relevant in the future. Let’s explore the key factors that influence BTSE’s future reliability, including its current strengths, market adaptability, and potential challenges.

Strong Foundation and Security

One of the core indicators of BTSE’s reliability is its commitment to security. The platform employs industry-standard security measures such as two-factor authentication (2FA), cold storage for the majority of user funds, and strict KYC (Know Your Customer) and AML (Anti-Money Laundering) policies. These measures have protected BTSE from major security breaches, which is crucial in building long-term trust with users. The exchange’s dedication to protecting user assets positions it as a trustworthy platform in an industry where security is paramount.

Innovation and Adaptability

BTSE’s multi-currency support and innovative trading features, such as multi-currency order books, make it stand out in the competitive landscape. The ability to trade fiat and cryptocurrencies directly in various combinations gives traders flexibility that few other platforms offer. Additionally, BTSE’s continuous introduction of new tools, such as advanced charting, futures, and margin trading, demonstrates its willingness to innovate. In a rapidly changing crypto market, adaptability is key, and BTSE’s commitment to staying at the forefront of technology and trading tools suggests it is well-positioned to continue serving traders’ needs in the future.

Compliance and Regulatory Challenges

One of the most significant factors that could affect BTSE’s long-term reliability is the regulatory environment. As the global cryptocurrency industry faces increasing scrutiny, exchanges like BTSE will need to navigate a complex web of regulations that vary by country and region. While BTSE has implemented KYC and AML procedures, future regulatory changes could impact its operations, especially in jurisdictions with stringent crypto laws. However, BTSE’s proactive approach to compliance—combined with its global focus—indicates that the platform is prepared to adapt to these challenges, ensuring its longevity in various markets.

Competitive Market Landscape

In this BTSE review operates in a highly competitive market where major players like Binance, Coinbase, and Kraken dominate the landscape. For BTSE to remain reliable in the future, it will need to differentiate itself continually through lower fees, better user experience, and unique features. While BTSE’s current offering is robust, especially for advanced traders, it must ensure it continues to attract and retain users by staying competitive with the leading exchanges.

Focus on Institutional Growth

Another positive aspect of BTSE’s future reliability is its increasing focus on institutional clients. With services such as OTC (Over-The-Counter) trading, higher liquidity, and tailored solutions for high-net-worth individuals and institutions, BTSE has carved out a niche that can drive long-term growth. As institutional interest in cryptocurrencies grows, BTSE’s ability to cater to these clients will contribute to its reliability and expansion.

[button url=”https://www.btse.com/referral/ih8JHMtj” target=”blank” style=”3d” background=”#49ef2d” color=”#FFFFFF” size=”10″ wide=”no” center=”yes” radius=”auto” icon=”icon: mail-forward” icon_color=”#FFFFFF” text_shadow=”none”]Visit BTSE[/button]Conclusion

BTSE continues to evolve as a reliable and innovative cryptocurrency exchange in 2024, offering a wide range of advanced trading tools, multi-currency support, and competitive fees. While it faces competition from larger exchanges, BTSE’s unique features make it an attractive option for experienced traders and institutions. As highlighted in this BTSE Review, its commitment to security and adaptability in a rapidly changing market ensures its place as a trusted platform. For those looking for a comprehensive trading experience, CoinReviews recommends BTSE as a strong contender for both retail and institutional clients in the ever-growing crypto space.

Read more:

- Binance Review: Features, Supported Cryptos and Fees!

- Bybit Review: Pros, Cons and Key Features

- OKX Review: Pros, Cons, Future Potential & More

- HTX Review: Fees, Security, Pros & Cons

- Bitget Review: Pros & Coins, Fees & More

- Bitfinex Review: Is It Secure or Scam?

- Kucoin Review: Social Trading, Fees, Pros & Cons

- Crypto.com Review: Is the Exchange Safe or Scam?

- BingX Review: Verified Reviews, Pros & Cons

- LBank Review: Should You Use It?

- bitFlyer Review: Pros & Cons and Ratings

- ProBit Review: Is It the Right Crypto Exchange for You?

- P2B Review: Fees, Features, Safety, Pros & Cons

- Pionex Review: Pros, Cons & All You Need to Know

- BitMEX Review: Fees, Trading, Staking & More

- Phemex Review: Is It a Good Crypto Exchange?

- CoinEx Review: Is This Crypto Exchange Safe?

- Poloniex Review: Features, Regulation & Risks

- BITFLEX Review: Features, Safety, Pros & Cons

- CoinJar Review: Is It the Right Exchange for You?

- Paymium Review: Pros, Cons, Key Features & Fees

- LBank Review: Is It the Right Exchange for You?

- MEXC Review: Latest Pros, Cons, Key Features & Fees

- BitMart Review: Reviews, Trading Fees & Cryptos