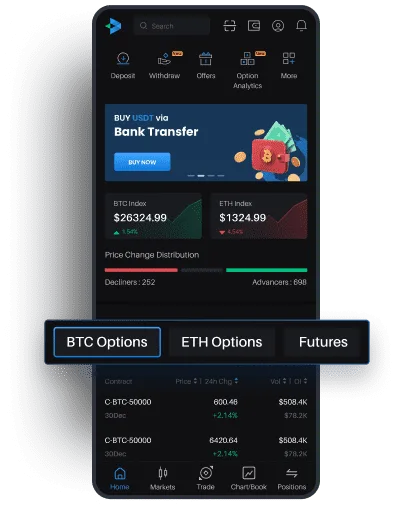

In the ever-evolving world of cryptocurrency trading, selecting the right exchange is crucial for maximizing your trading experience and success. With countless platforms available, each boasting unique features and offerings, it’s essential to identify what makes them stand out. One exchange that has gained considerable attention is Delta Exchange, known for its innovative tools and user-friendly interface.

In this Delta Exchange Review, CoinReviews provides a comprehensive analysis of what sets this platform apart in the crowded crypto trading landscape. From advanced trading options and a diverse range of cryptocurrencies to its strong focus on security, Delta Exchange caters to both seasoned traders and newcomers alike. We’ll explore its unique features, fee structures, and market offerings, giving you valuable insights into why Delta Exchange might be the ideal platform for your trading needs. Join us as we uncover the strengths of Delta Exchange and its potential to enhance your cryptocurrency journey.

What is Delta Exchange?

Delta Exchange is a cryptocurrency derivatives exchange that has successfully carved out a niche in a rapidly growing market. In this Delta Exchange Review, we’ll explore its unique offerings and features. Based in Saint Vincent and the Grenadines, this unregulated trading platform has gained attention amidst increasing demand.

Offering users leverage of up to 100x, Delta stands out with its unique demo account feature, appealing to adventurous investors. This virtual environment allows traders to hone their skills and test strategies without the risk of losing real money.

Unlike typical exchanges, Delta Exchange takes a distinct approach by facilitating futures contract trading with over 50 DeFi coins and altcoins, extending beyond just Bitcoin and Ethereum. It encourages trading in cryptocurrency derivatives, making it particularly suitable for experienced traders eager to explore advanced financial instruments.

The trading opportunities on the Delta Exchange don’t end with futures and options. Traders can utilize the same 100x leverage for swapping interest rate derivatives on Bitcoin and various altcoins, further solidifying its position in the crypto trading arena.

This Delta Exchange Review highlights the platform’s commitment to demystifying the complex world of crypto derivatives, making it accessible to both veterans and newcomers. Its standout features include a wide range of perpetual contracts and a unique selection of derivatives based on altcoins such as Tezos, ATOM, BAT, RVN, and more.

[button url=”https://www.delta.exchange/?code=coinboong” target=”blank” style=”3d” background=”#49ef2d” color=”#FFFFFF” size=”10″ wide=”no” center=”yes” radius=”auto” icon=”icon: mail-forward” icon_color=”#FFFFFF” text_shadow=”none”]Visit Delta Exchange[/button]Delta Exchange overview

Delta Exchange is a leading platform in the cryptocurrency trading space, specializing in derivatives and offering a variety of financial instruments for its users.

Market structure

Delta Exchange operates within a highly competitive market structure that prioritizes liquidity, ensuring users have access to optimal trading conditions. The platform is designed to provide tight spreads, especially for Bitcoin (BTC) and Ethereum (ETH) futures and options. These spreads are often less than 2 basis points (BPS), which significantly enhances the efficiency of trading on the platform.

By maintaining such narrow spreads, Delta Exchange aims to reduce trading costs for its users, allowing them to maximize their returns. This focus on liquidity not only benefits active traders looking to execute rapid transactions but also instills confidence among investors by creating a more stable trading environment. Ultimately, Delta Exchange’s commitment to a robust market structure positions it as a go-to platform for both novice and seasoned traders seeking to navigate the dynamic world of cryptocurrency derivatives.

Financial instruments

Delta Exchange offers a diverse range of financial instruments to meet the needs of its users.

Futures: The platform features both perpetual swap contracts and fixed maturity futures, focusing primarily on Bitcoin (BTC) and supporting over 50 altcoins. Perpetual contracts allow for continuous trading without expiration, while fixed maturity futures enable strategic planning around specific time frames, catering to various trading styles.

Options: Delta Exchange also provides USDT-settled European call and put options on Bitcoin and Ethereum (ETH). These options allow traders to hedge their positions or speculate on price movements without the obligation to buy or sell the underlying assets. The European-style options can only be exercised at expiration, making them an attractive choice for managing risk or capitalizing on market volatility.

About the company of Delta Exchange

The Delta Exchange was founded in 2017 by Pankaj Balani, Jitender Tokas, and Saurabh Goyal, officially launching the following year. Originally based in Singapore, the exchange is now registered in St. Vincent and the Grenadines.

In September 2020, Delta Exchange became the first platform to list USDT-settled put and call options contracts, offering daily, weekly, and monthly maturities for assets like BTC, ETH, LINK, and BNB. The exchange primarily serves customers in South and Southeast Asia, with the Indian derivatives market being a key focus. By 2021, Delta’s notional trade volume reached $2 million.

In March 2021, Delta Exchange conducted a private sale for the DETO token, raising $5 million from investors like CoinFund and Aave Ventures, and launched liquidity mining and trade farming services. By June 2021, the platform began offering interest rate swaps with initial trading pairs of USDC and DAI, providing up to 50x leverage.

Pankaj Balani, previously a derivatives trader at Union Bank of Switzerland, is the CEO of Delta Exchange. Jitender Tokas, the Chief Business Officer, holds an MBA in Finance and Strategy and co-founded ZippyBots with Balani. Saurabh Goyal, the Chief Technology Officer, contributed to platform development and co-founded TinyOwl and was part of Housing.com’s founding team. This Delta Exchange Review noted that in 2022, Balani highlighted that Delta Exchange’s average daily options trading volume exceeded $200 million, with expectations for continued growth.

What are Delta Exchange features?

Delta Exchange stands out for its futures and derivatives trading, mock platform, staking options, native tokens, high trading volume, and an insurance fund.

Support for futures and derivatives trading

The Delta Exchange platform is highly regarded for its robust support of futures and derivatives trading. Users have the opportunity to buy and sell futures contracts for over 50 DeFi coins and altcoins, significantly enhancing their trading options. This feature is particularly attractive to experienced traders, as it allows them to leverage their positions, potentially amplifying their returns on investment.

By enabling traders to engage with a diverse array of assets, Delta Exchange fosters an environment where users can capitalize on market fluctuations and make strategic trading decisions. The ability to trade futures contracts not only adds depth to the platform but also provides sophisticated tools for risk management and profit maximization. This makes Delta Exchange a favored choice for those looking to navigate the complexities of cryptocurrency trading while seeking greater financial rewards.

Demo trading

Delta Exchange offers a demo account that allows users to practice trading with virtual assets, making it an invaluable resource for traders of all experience levels. This feature is especially beneficial for beginners looking to familiarize themselves with the platform and its various tools.

By using the demo account, new users can explore the platform’s functionality and test different trading strategies without the risk of losing real money. This risk-free environment helps them understand how leverage works, manage positions, and respond to market fluctuations effectively.

As users build their confidence and skills, the demo account serves as a crucial stepping stone to live trading, ensuring a smoother transition into the competitive cryptocurrency market. Overall, Delta Exchange’s demo account empowers users to develop their trading proficiency and strategies for success.

Delta invest and native Token

Delta Exchange allows users to stake several cryptocurrencies, including DETO, BTC, USDT, and ETH, providing them the chance to earn a return on their crypto holdings. This staking feature enhances the platform’s appeal by offering a passive income stream for those who prefer not to trade actively.

By staking their tokens, users contribute to the liquidity and stability of the exchange while benefiting from interest on their assets. Additionally, investors who support the Delta crypto exchange’s native token, DETO, enjoy exclusive perks such as unlimited fee-free withdrawals. This incentive encourages users to hold and stake DETO, further enhancing the platform’s value proposition for both new and experienced investors looking to grow their portfolios effectively.

High trading volume

Delta Exchange has a high trading volume, ensuring robust liquidity for traders on the platform. This significant trading activity is a positive indicator, as it often leads to tighter spreads and reduced slippage, creating a more favorable trading environment for both novice and experienced users.

For novice traders, high liquidity allows for quicker execution of trades, minimizing the impact of price fluctuations when entering or exiting positions. Tighter spreads also result in lower trading costs, which is beneficial for beginners.

Experienced traders benefit from high trading volume as it enables them to execute larger orders without significantly affecting market prices, allowing for precise entry and exit points. Reduced slippage further enhances their ability to capitalize on quick market movements.

Overall, Delta Exchange’s high trading volume not only enhances liquidity but also fosters an appealing trading environment, making the platform attractive for traders of all levels.

Insurance fund and liquidation mechanism

Delta Exchange features an Insurance Fund that activates if the platform cannot close a liquidation position before the bankruptcy price is breached. This fund is crucial for maintaining trader confidence, providing a safety net during volatile market conditions. The liquidation engine is designed to close all positions at a 5% loss for Bitcoin (BTC) and Ethereum (ETH) contracts, while all other contracts are liquidated at a 2% loss, helping to mitigate risks associated with sudden price swings.

Incorporating the Insurance Fund enhances the overall stability of Delta Exchange, giving users confidence that their investments are safeguarded even during market turbulence. This additional layer of protection is especially appealing to both novice and seasoned traders, promoting a secure trading environment. In the end, this focus on risk management highlights Delta Exchange’s commitment to creating a secure and dependable platform for all users.

Products offered by Delta Exchange

This exchange offers a diverse range of products and services, allowing users to trade futures and options while also swapping interest rate derivatives on Bitcoin and over 50 altcoins with leverage of up to 100x. The platform is dedicated to making crypto derivatives easily accessible, catering to both novice and experienced traders and supporting various trading strategies and risk appetites.

In a short period, the exchange has established itself as a reputable and secure platform within the crypto derivatives space, gaining a solid and growing customer base. Its commitment to providing a trustworthy trading environment is reflected in its advanced infrastructure, prioritizing user safety and market integrity.

What sets this exchange apart is its unique focus on altcoin derivatives. Traders have access to a wide variety of perpetual contracts, enhancing flexibility in their strategies. The platform features exclusive products based on cryptocurrencies like Tezos, ATOM, BAT, and RVN, making it an attractive option for users seeking innovative trading opportunities in the crypto derivatives market.

Delta Exchange supported cryptocurrencies & countries

Supported cryptocurrencies

According to our Delta Exchange Review, the platform currently accepts only Bitcoin as a payment method. Despite this limitation, it offers a wide array of cryptocurrency perpetual and futures contracts for users to invest in. Below is a list of some of the supported cryptocurrencies available on the exchange:

- Bitcoin (BTC)

- Binance Coin (BNB)

- Bitcoin SV (BSV)

- Basic Attention Token (BAT)

- Ethereum (ETH)

- Litecoin (LTC)

- Chainlink (LINK)

- LEOcoin (LEO)

- Matic Network (MATIC)

- Monero (XMR)

- USD Coin (USDC)

- Ripple (XRP)

- Stellar Lumens (XLM)

- Tezos (XTZ)

- Tether (USDT), among others.

Supported countries

Delta Exchange is committed to providing a global trading platform for cryptocurrency enthusiasts. It supports a variety of countries, ensuring that users from different regions can access its offerings. Here are some of the supported countries where Delta Exchange operates:

- United Kingdom

- European Union

- Canada

- Australia

- Netherlands

- Sweden

- Finland

- Denmark

- Iceland

- Norway

- Austria

- Germany, among others.

MOVE options

On March 5, 2020, Delta Exchange announced the launch of MOVE Options in an email to its users, introducing an innovative product to the cryptocurrency trading landscape. MOVE Options allow traders to speculate not on the direction of price movements for Bitcoin (BTC) or Ethereum (ETH) but rather on the magnitude of those movements. This unique approach adds a new layer of strategy for traders, enabling them to focus on volatility rather than just bullish or bearish trends.

If a trader anticipates a significant price movement, they can take a long position on MOVE Options. Conversely, if they expect only minor fluctuations, they should consider going short. This flexibility provides traders with an opportunity to profit from their predictions about market volatility, regardless of which way prices may swing.

Delta Exchange offers two types of MOVE Options: the Daily MOVE and the Weekly MOVE. The Daily MOVE captures the expected price movement in BTC or ETH over a 24-hour period, while the Weekly MOVE assesses anticipated price changes over a week. This variety allows traders to tailor their strategies based on their market outlook, whether they are looking for quick gains or more extended predictions, further enhancing the platform’s appeal to users seeking innovative trading opportunities.

Delta Exchange stablecoin-settled futures contracts

Delta Exchange is unique as the only cryptocurrency futures exchange that offers futures contracts margined and settled in USDC, a stablecoin launched by Goldman Sachs-backed Circle. Traders can engage in futures for Bitcoin, Ethereum, and Ripple, quoted in USD but settled in USDC. This stablecoin settlement reduces the risk of market volatility on margins, allowing traders to speculate in the crypto market with greater confidence. Delta Exchange has discussed the advantages of this feature in a dedicated blog post, emphasizing its role in enhancing the trading experience.

On April 18, 2019, Delta Exchange further expanded its offerings by introducing futures (Perpetual Swaps with 20x leverage) for additional cryptocurrencies, including NEO, Bitcoin Cash (BCH), Bitcoin SV (BSV), Litecoin (LTC), and Basic Attention Token (BAT). This move demonstrates the exchange’s commitment to providing a diverse range of trading options, catering to various user preferences and investment strategies, and solidifying its position in the cryptocurrency derivatives market.

Risk management features

Delta Exchange offers robust risk management features tailored for cryptocurrency traders aiming to balance potential profits with effective risk control measures. As discussed in our Delta Exchange Review, these tools, including advanced stop-loss orders and position sizing capabilities, help users navigate the volatile crypto market and manage their investments wisely, making the platform essential for serious cryptocurrency derivatives traders.

Margin system

Delta Exchange features a high leverage margin system, allowing traders to leverage their positions up to 100x. This capability enables users to maximize potential gains by borrowing funds to increase their position size, making it particularly attractive to experienced traders.

To promote responsible trading, Delta Exchange implements a tiered margin structure where the required margin increases with larger positions. This design encourages traders to carefully assess their risk exposure, fostering discipline in their trading strategies. By balancing high leverage with risk management practices, Delta Exchange caters to a diverse range of traders, from those seeking high-risk opportunities to those focused on mitigating risk.

Stop-Loss and Take-Profit orders

The exchange offers advanced order types for risk management, including bracket orders that feature two key components:

- Take-Profit Order: Automatically closes a position at a specified price to secure profits.

- Stop-Loss Order: Closes a losing position at a predetermined price to limit losses.

Together, these orders form a protective bracket around a position, managing risk by automating the exit strategy for both favorable and unfavorable market movements.

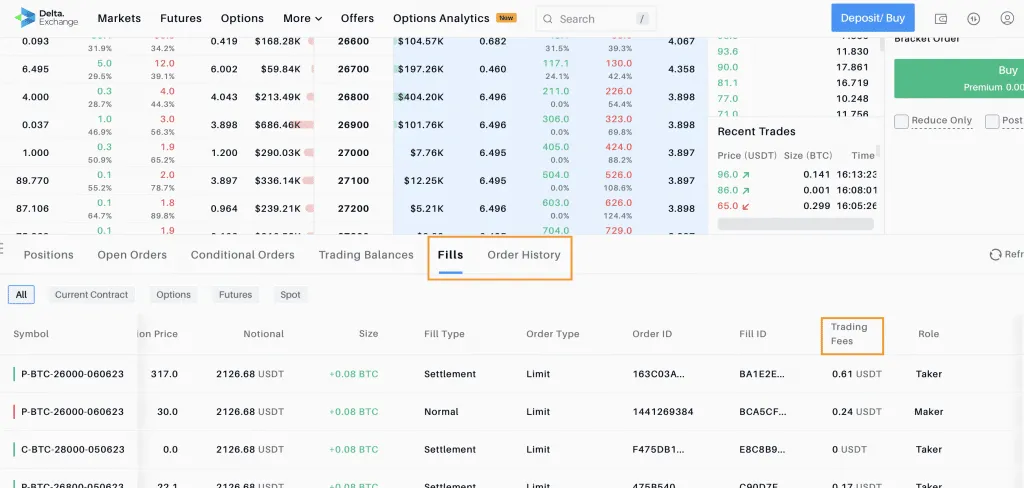

What are Delta Exchange fees?

Trading fees on Delta Exchange vary depending on the type of contract, which is an important consideration in our Delta Exchange Review 2024:

- For inverse futures and USDT linear futures, the taker fee is 0.05%, the maker fee is 0.02%, the settlement fee is 0.05%, and the liquidation factor is 0.2.

- ALT-BTC futures feature a uniform fee structure with a taker, maker, and settlement fee of 0.1%, also with a liquidation factor of 0.2.

- Options and MOVE contracts have a taker, maker, and settlement fee of 0.03%, along with a liquidation factor of 0.5.

- Spot trading incurs a fee of 0.05%.

Negative fees indicate that the trader has received a rebate. The settlement fee applies to all open contracts at the time of settlement, and trading fees for all contracts are based on the notional size of the position. Additionally, Delta Exchange caps trading fees at 10% of the option’s premium to mitigate excessive charges on deep out-of-the-money options.

Regarding deposits, Delta Exchange does not enforce minimum deposit amounts for any supported cryptocurrencies. However, the number of confirmations required before a deposit is credited varies: it ranges from 1 confirmation for networks like XRP, Solana, and USDT (TRC20 and Polygon) to up to 15 confirmations for BEP20-based deposits.

Withdrawal fees are transparent and reasonable, with specific rates such as 10 USDT for USDT (ERC20), 1 USDT for USDT (BEP20 and TRC20), 0.001 BTC for BTC, and 0.0025 ETH for ETH (ERC20). Notably, holders of Delta Exchange Token (DETO) benefit from zero withdrawal fees. Minimum withdrawal amounts vary across different cryptocurrencies.

Most withdrawals are processed within 30 minutes, though some may take up to 24 hours.

Delta Exchange wallet

Insights from our Delta Exchange review, we underscore that the platform offers a dedicated trading wallet designed specifically for storing Bitcoin. Once users register, they receive a unique wallet address for transferring their BTC, which simplifies the process of accessing funds for trading and investment activities.

It’s essential to note that Delta Exchange exclusively supports Bitcoin transactions, meaning users must have BTC in their wallets to execute any trades. This limitation encourages traders to focus on Bitcoin, aligning with the platform’s specialization and enhancing the overall trading experience.

The dedicated wallet not only provides a secure storage solution for Bitcoin but also streamlines trading activities, allowing users to quickly manage their investments. This focus on a single cryptocurrency enables Delta Exchange to create a user-friendly environment tailored to Bitcoin traders.

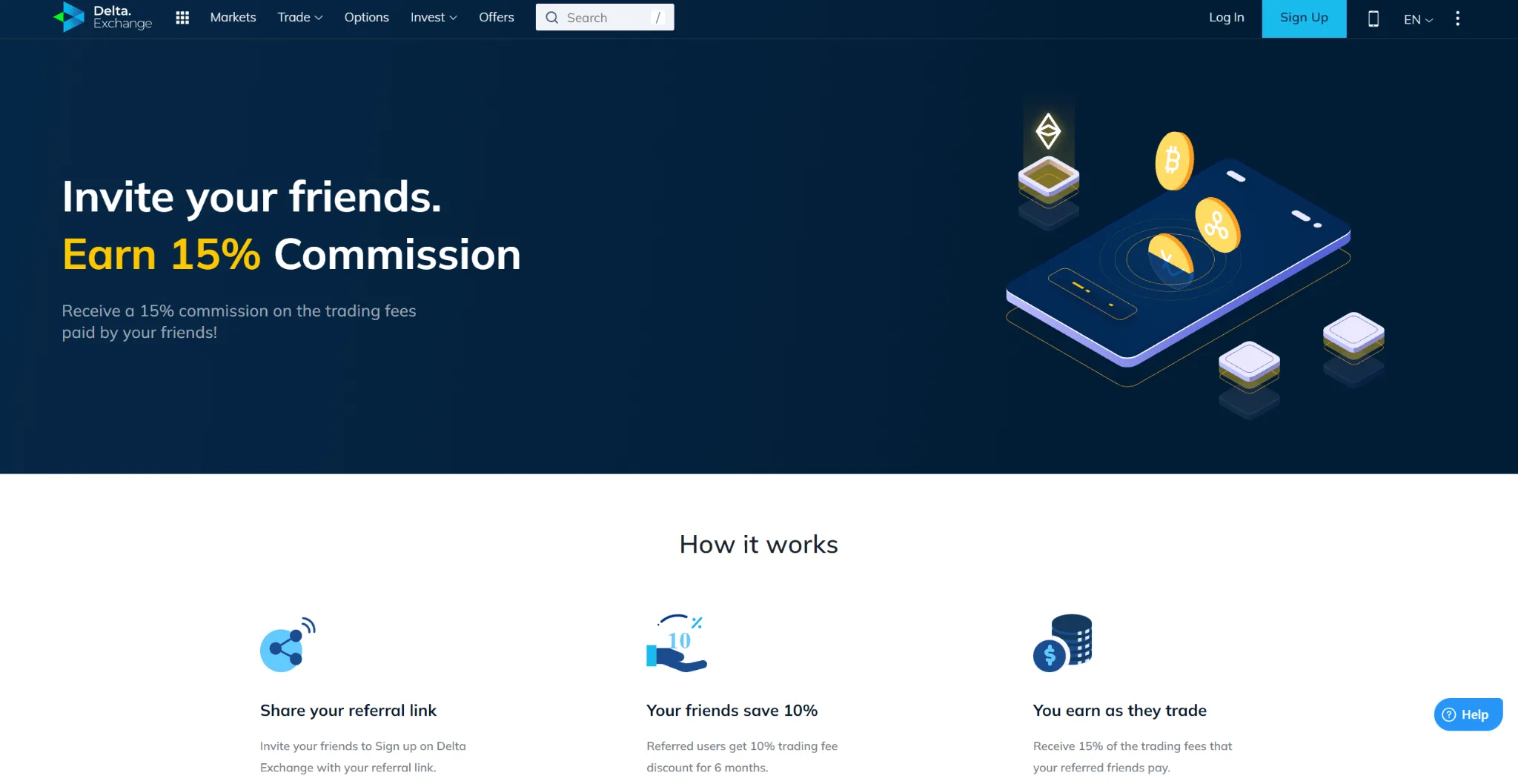

Delta Exchange Referral program

Delta Exchange offers a rewarding referral program designed to increase trading volumes and enhance user engagement. Users can share their unique referral codes with friends and family, earning a 15% commission on the trading fees generated by their referrals during the first year. This incentivizes users to introduce others to the platform.

After the first year, users continue to earn a lifetime commission of 10% on their referrals’ trading fees, fostering a strong community among traders. This ongoing incentive encourages users to actively promote the platform and support one another in their trading endeavors.

In addition to the referral program, Delta Exchange frequently provides attractive deposit bonuses to entice new users. These bonuses enhance the value of joining the platform, creating a compelling trading environment for both existing and prospective users.

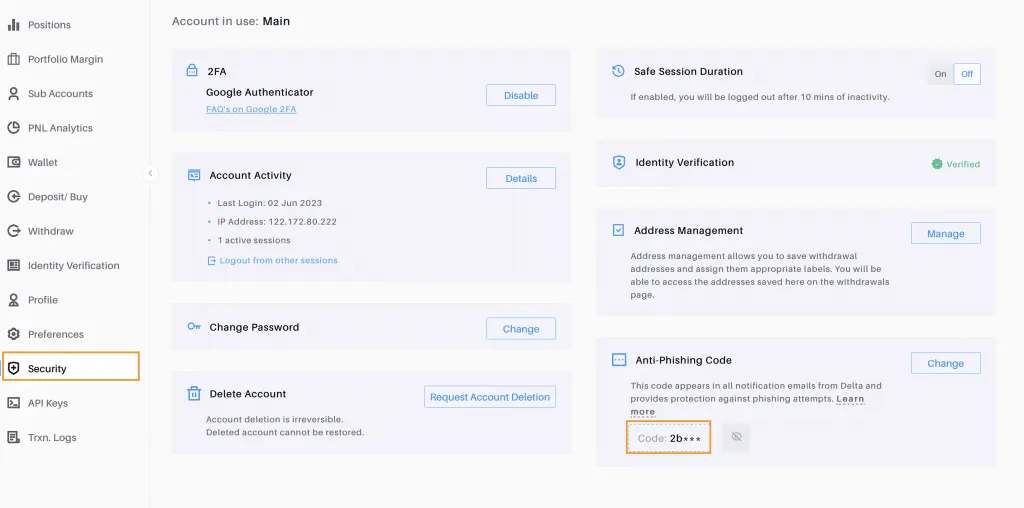

Delta Exchange security & safety

Delta Exchange prioritizes the highest level of security to safeguard its users and their assets. Since its inception, the platform has not experienced any cyberattacks, providing users with peace of mind about their funds’ safety. To bolster this security framework, Delta Exchange employs two-factor authentication (2FA), a widely recognized method used across various online platforms to enhance user protection. This additional layer of security ensures that even if login credentials are compromised, unauthorized access remains unlikely.

In addition to 2FA, Delta Exchange implements industry-standard firewalls and advanced encryption protocols to protect sensitive information and transactions. These robust security measures guard against potential threats and vulnerabilities, ensuring that user data and funds are continuously protected. Furthermore, the exchange utilizes enterprise-grade safety measures, demonstrating a strong commitment to maintaining a secure trading environment.

Delta Exchange also enhances its security by storing cryptocurrencies in multi-signature wallets. This approach requires multiple signatures for any transaction to occur, significantly reducing the risk of unauthorized access. By combining these advanced security features, Delta Exchange establishes itself as a secure and trustworthy platform for cryptocurrency trading, allowing users to focus on their trading activities without worrying about potential security breaches.

Delta Exchange Customer Support

To conduct a Delta Exchange Review, CoinReviews explored a variety of customer support options available to users, ensuring that assistance is both accessible and effective. Here’s a breakdown of the support services offered by the platform:

Email support

Delta Exchange provides email support, allowing users to directly reach out to the customer service team for any inquiries or concerns. This method is particularly useful for more detailed questions or issues that require in-depth explanations. Users can expect a prompt response, as the support team is dedicated to addressing concerns efficiently. Email support allows for documented communication, which can be beneficial for users who may need to reference previous conversations.

Live Chat

The platform includes a live chat feature, enabling users to engage in real-time conversations with customer support representatives. This instant communication option is ideal for urgent queries or immediate assistance, ensuring that users can receive quick resolutions to their issues. The live chat service is designed to minimize wait times and enhance user satisfaction, making it a preferred choice for those seeking immediate help.

Help Center

Delta Exchange features an extensive Help Center on its website, which serves as a valuable resource for users. This comprehensive section includes a wide range of guides, articles, and FAQs that cover various topics, from account setup and verification processes to understanding trading fees and security measures. The Help Center is organized in a user-friendly manner, allowing users to easily navigate and find answers to common questions. This self-service option empowers users to troubleshoot issues independently, saving time and enhancing their overall experience.

Social media channels

The exchange maintains an active presence on social media platforms such as Twitter, LinkedIn, and Telegram. These channels provide users with access to the latest news, updates, and announcements related to Delta Exchange. Additionally, social media serves as a platform for users to engage with the broader community, share insights, and receive real-time information about ongoing promotions or features. Following Delta Exchange on these platforms can enhance users’ connection to the exchange and keep them informed about important developments.

Community forums

Delta Exchange may also host community forums where users can discuss trading strategies, share experiences, and seek advice from fellow traders. These forums foster a sense of community and provide an additional layer of support, allowing users to learn from each other and exchange valuable insights.

Webinars and educational resources

The platform might offer webinars or educational resources to help users better understand trading strategies, market trends, and platform features. These sessions provide an opportunity for users to interact with experts, ask questions, and enhance their trading knowledge, ultimately improving their trading skills.

Feedback mechanism

Delta Exchange may implement a feedback mechanism, encouraging users to share their experiences and suggestions for improvement. This approach not only helps the exchange identify areas for enhancement but also shows users that their opinions are valued, fostering a sense of community and engagement.

Delta Exchange Review: Pros and Cons

When evaluating any cryptocurrency trading platform, understanding its strengths and weaknesses is crucial. Detailed Delta Exchange Review explores the various pros and cons to help you make an informed decision about whether this platform meets your trading needs.

Pros

- Intuitive and easy-to-use trading interface for a seamless experience.

- Offers both traditional and perpetual futures contracts for Bitcoin.

- Provides up to 100x leverage, allowing for significant potential gains.

- Features live support for immediate assistance with trading inquiries.

- Excellent referral program to earn commissions for referring new users.

- Supports a variety of trading pairs and cryptocurrencies, enhancing diversification.

- Implements robust security measures, including two-factor authentication and multi-signature wallets.

- Active community engagement through social media channels for updates and support.

- Comprehensive educational resources available in the Help Center to assist users.

- Quick deposit and withdrawal processing times to enhance liquidity.

Cons

- Low liquidity for perpetual contracts on Bitcoin, potentially impacting trading efficiency.

- Insufficient liquidity for several trading pairs, which may limit trading opportunities.

- Limited support for cryptocurrencies beyond Bitcoin, which may deter altcoin traders.

- Fees can be relatively high compared to some competitors, affecting overall profitability.

- Occasional delays in customer support response times during peak trading hours.

- Not all features are available in every country, which may limit accessibility for some users.

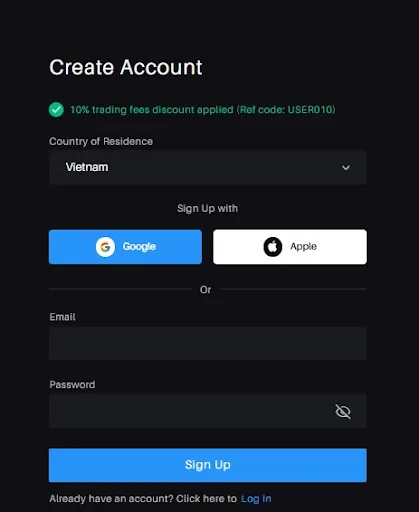

How to open an account at Delta Exchange?

Getting started on Delta Exchange is a straightforward process that allows users to quickly create an account and begin trading. Follow these steps to navigate the sign-up process efficiently, as presented in our Delta Exchange Review:

- Visit Delta Exchange website: Begin by navigating to the official Delta Exchange website.

- Sign Up: Click on the “Sign Up” button located in the upper right corner of the homepage.

- Enter personal details: You’ll need to provide your email address and create a password. Choose a strong, unique password to enhance the security of your Delta Exchange account.

- Referral Code (optional): If you have a referral code, you can enter it during this step. A valid referral code may provide benefits such as discounts on trading fees.

- Agree to terms and conditions: Before proceeding, confirm that you’ve read and agree to Delta Exchange’s terms of use and privacy policy.

- Account Verification: After completing the sign-up process, check your email for a verification message. Click on the link in the email to verify your account.

- Set up Two-Factor authentication (2FA): For added security, it’s recommended to set up two-factor authentication. This typically involves linking your account to an authenticator app on your mobile device, which generates a unique code for logging in.

Please note that Delta Exchange is currently unavailable in the following countries: the United States of America, St. Vincent and the Grenadines, Iran, North Korea, Syria, Crimea, Cuba, Canada, Afghanistan, Cambodia, and Pakistan.

If you’re looking to practice trading strategies without the risks, you can explore the Delta Exchange Testnet, a mock trading environment that allows users to experience the platform’s features. This comprehensive guide aims to enhance your understanding of the Delta Exchange and help you make the most of your trading experience, as showcased in our Delta Exchange Review.

Delta Exchange deposit and withdrawal method

According to our Delta Exchange Review, the platform primarily supports Bitcoin for both deposit and withdrawal methods. Upon creating an account, users must fund their wallets exclusively with Bitcoin. This focus on BTC means that new traders who are looking to enter the cryptocurrency space will need to purchase Bitcoin from an entry-level exchange that accepts fiat currency. Once they have acquired Bitcoin, they can transfer it to their Delta Exchange wallet to begin trading. This limitation on payment methods may pose a challenge for beginners unfamiliar with navigating the cryptocurrency ecosystem.

While Delta Exchange does not accept fiat deposits, it does provide futures trading options on various cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Stellar Lumens (XLM). Traders can leverage their positions up to 100x, making it an attractive option for those looking to maximize their potential gains. However, it’s crucial for users to understand the risks associated with high-leverage trading, as it can lead to significant losses just as easily as it can lead to profits.

The deposit method is solely focused on Bitcoin transfers, and the platform does not accommodate any other payment methods or currencies. Users can convert their deposited Bitcoin into other cryptocurrencies using the currency converter option available on the platform. This streamlined process ensures that traders can efficiently manage their assets within Delta Exchange, but it also emphasizes the importance of selecting a reliable cryptocurrency wallet for storing BTC before engaging in trading activities.

Is Delta Exchange safe?

Delta Exchange has established several robust security measures to protect users’ funds and data. These include multi-signature cold wallets for fund storage, two-factor authentication (2FA) for account security, and manual approval for withdrawal requests. The platform also employs advanced technologies like IP whitelisting, SSL encryption, and traffic monitoring to enhance overall security.

Despite these measures, past incidents have raised concerns about potential data breaches. While Delta has significantly improved its security protocols, users should remain cautious and vigilant when trading online.

In addition to security features, Delta Exchange provides user protection through an Insurance Fund, which activates when a liquidation position cannot be closed before reaching its bankruptcy price. This fund absorbs losses of up to 5% for Bitcoin (BTC) and Ethereum (ETH) contracts, and 2% for other contracts, maintaining a substantial balance of over $2 million to give traders peace of mind.

Customer Reviews – What do customers say about Delta Exchange?

Delta Exchange has received mixed customer reviews, reflected in its TrustScore of 2.3 out of 5. Some users commend the platform for its extensive range of crypto derivatives and user-friendly interface, making it appealing for both novice and experienced traders. They find the trading experience smooth and engaging, contributing to overall satisfaction.

Conversely, some users have raised concerns, even labeling Delta Exchange as a “scammer exchange.” These negative reviews often relate to issues such as customer support responsiveness and withdrawal delays. This contrast emphasizes the need for thorough research before using the platform, as revealed in our Delta Exchange Review.

These mixed opinions highlight the importance of due diligence for potential users. Traders should weigh customer experiences, security measures, and overall platform reputation to make informed decisions about using Delta Exchange for their trading needs.

Delta Exchange Review- Frequently asked questions

How long does Delta Exchange withdrawal take?

To ensure the highest level of security for the cryptocurrencies in our custody, we conduct manual reviews of withdrawal requests once every 24 hours. Withdrawals are processed daily between 12 PM and 3 PM UTC. To be included in the same day’s batch, please ensure that your withdrawal request is confirmed before 11 AM UTC.

What countries are banned from Delta Exchange?

We do not offer services to individuals or entities who are citizens or residents of the United States (including Puerto Rico and the U.S. Virgin Islands), Afghanistan, Iran, or North Korea.

What is the minimum deposit in Delta Exchange?

You can deposit any amount ranging from Rs 1 to Rs 5 lakhs per transaction, with no daily limit on the number of transactions you can make.

Can we trade forex in Delta Exchange?

In Delta Trading, you can trade CFDs on more than 1,000 instruments, including forex, stocks, indices, gold, silver, futures, ETFs, and cryptocurrencies.

Is the Delta Exchange free or paid?

Delta Exchange provides a fee capping feature that limits the trading fee to a maximum of 12.5% of the premium on options contracts. This benefit is particularly advantageous for traders engaging with Deep OTM options, which typically have lower premiums.

Is Delta Exchange a worthwhile choice for traders in 2025?

Is Delta Exchange a worthwhile choice for traders in 2024? As the cryptocurrency trading landscape continues to evolve, traders are increasingly looking for platforms that offer not only a variety of features but also security and user support. Delta Exchange has made a name for itself with its user-friendly interface, which is designed to cater to both novice and experienced traders alike. The platform provides access to a diverse range of trading options, including traditional and perpetual futures contracts, as well as high leverage of up to 100x on certain trades, allowing traders to maximize their potential profits.

In addition to its trading features, Delta Exchange emphasizes robust security measures, employing multi-signature cold wallets and two-factor authentication to protect users’ funds. Furthermore, the platform offers an Insurance Fund designed to absorb losses in case of liquidation, which adds an extra layer of safety for traders. The presence of a comprehensive Help Center and multiple customer support options also highlights Delta Exchange’s commitment to enhancing the user experience.

However, potential users should weigh these benefits against some of the platform’s limitations. For instance, Delta Exchange currently only supports Bitcoin for deposits and withdrawals, which may pose challenges for traders looking to engage in transactions with other cryptocurrencies or fiat currencies. Additionally, while the exchange boasts an impressive array of features, some customer reviews have raised concerns about liquidity for certain trading pairs and past data breaches.

Whether Delta Exchange is a suitable choice for traders in 2024 hinges on individual trading needs and risk tolerance. Conducting thorough research, recognizing the platform’s strengths and weaknesses, and aligning them with personal trading strategies will be essential for making an informed decision.

[button url=”https://www.delta.exchange/?code=coinboong” target=”blank” style=”3d” background=”#49ef2d” color=”#FFFFFF” size=”10″ wide=”no” center=”yes” radius=”auto” icon=”icon: mail-forward” icon_color=”#FFFFFF” text_shadow=”none”]Visit Delta Exchange[/button]Conclusion

In summary, Delta Exchange Review 2024 highlights a trading platform that caters to a diverse range of traders by offering an extensive array of crypto derivatives and competitive leverage options. Unique features, such as fee capping on options contracts, enhance its appeal, while robust security measures and a user-friendly interface create a safe and engaging trading environment.

However, users should be mindful of certain limitations, including the exclusive focus on Bitcoin for deposits and withdrawals, along with varying liquidity across trading pairs. Conducting thorough research is essential for informed decision-making. Ultimately, Delta Exchange’s commitment to innovation and user satisfaction positions it as a noteworthy option among crypto exchanges in 2024. For further details about Delta Exchange and other cryptocurrency platforms, visit CoinReviews.

Read more:

- Binance Review: Features, Supported Cryptos and Fees!

- Bybit Review: Pros, Cons and Key Features

- OKX Review: Pros, Cons, Future Potential & More

- HTX Review: Fees, Security, Pros & Cons

- Bitget Review: Pros & Coins, Fees & More

- Bitfinex Review: Is It Secure or Scam?

- Kucoin Review: Social Trading, Fees, Pros & Cons

- Crypto.com Review: Is the Exchange Safe or Scam?

- BingX Review: Verified Reviews, Pros & Cons

- LBank Review: Should You Use It?

- bitFlyer Review: Pros & Cons and Ratings

- ProBit Review: Is It the Right Crypto Exchange for You?

- P2B Review: Fees, Features, Safety, Pros & Cons

- Pionex Review: Pros, Cons & All You Need to Know

- BitMEX Review: Fees, Trading, Staking & More

- Phemex Review: Is It a Good Crypto Exchange?

- BTSE Review: Is It Safe & Reliable?

- CoinEx Review: Is This Crypto Exchange Safe?

- Poloniex Review: Features, Regulation & Risks

- BITFLEX Review: Features, Safety, Pros & Cons

- CoinJar Review: Is It the Right Exchange for You?

- Paymium Review: Pros, Cons, Key Features & Fees

- LBank Review: Is It the Right Exchange for You?

- MEXC Review: Latest Pros, Cons, Key Features & Fees

- BitMart Review: Reviews, Trading Fees & Cryptos