As the cryptocurrency landscape evolves at a rapid pace, choosing a reliable exchange is critical. In this OKX Review, CoinReviews delves into why OKX is a frontrunner in 2024. With its comprehensive range of features, unparalleled security protocols, and innovative tools, OKX sets a high standard for trading platforms. Catering to both novice and experienced traders, OKX offers a seamless user experience, robust customer support, and an array of trading options.

CoinReviews examines how OKX’s commitment to transparency, efficiency, and user satisfaction makes it a standout choice in the ever-competitive crypto market. Join us as we explore what makes OKX a leader this year.

What is OKX?

OKX, previously known as OKEx, is a global cryptocurrency trading platform recognized for its large trading volumes, deep liquidity, and easy-to-use interface. Founded by Star Xu in 2017, the platform rebranded from OKEx to OKX in 2022. It operates in over 100 countries and has offices in key regions such as the UAE, Hong Kong, Singapore, Silicon Valley, and the Bahamas. OKX’s services are provided by entities incorporated in Seychelles and registered in the Bahamas. While the platform offers Web3 services in the U.S. through its Silicon Valley office, centralized exchange services are not available to U.S. residents.

Is OKX trusted by many people?

The OKX exchange supports an extensive selection of over 327 digital assets and 533 trading pairs, including well-known cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), and Tether (USDT). Users can easily trade these assets with more than 100 fiat currencies and access over 900 local payment methods globally.

For advanced traders and those with high trading volumes, OKX provides various derivatives products, including traditional futures, perpetual contracts, and options contracts, enabling more complex trading strategies. The platform also offers opportunities to earn passive income through staking, savings products, and yield-generating services such as crypto loans.

OKX’s Web3 portal features an integrated non-custodial multi-chain wallet called the OKX Wallet, supporting over 70 blockchain networks. The wallet connects users to more than 400 decentralized applications (DApps) and NFT marketplaces, allowing them to fully engage with the Web3 ecosystem.

[button url=”https://okx.com/join/98565217″ target=”blank” style=”3d” background=”#49ef2d” color=”#FFFFFF” size=”10″ wide=”no” center=”yes” radius=”auto” icon=”icon: mail-forward” icon_color=”#FFFFFF” text_shadow=”none”]Visit OKX[/button]OKX Review: Quick Summary

| Types | Crypto trading platform |

| Headquarters | Globally (offices in UAE, Hong Kong, Singapore, Silicon Valley, and the Bahamas) |

| Year Founded | 2017 |

| Founder | Star Xu |

| Supported Countries | 100+ (excluding Canada and the US) |

| Number of Supported Cryptocurrencies | 327 crypto tokens and 533 trading pairs |

| Types of Trading | Spot Trading, Margin Trading, Futures, Options, Copy Trading, P2P Trading, etc. |

| Fiat Currencies Supported | USD, EUR, GBP, etc. |

| Deposit Methods | Bank account transfer, credit/debit card, third-party payment providers like MoonPay and Mercuryo, etc. |

| Trading Fees | Spot: 0.08% maker and 0.1% taker Futures: 0.02% maker and 0.05% taker Options: 0.02% maker and 0.03% taker |

| Staking Options | Fixed/flexible staking, on-chain DeFi staking, structured products like dual investment and snowball |

| NFT Marketplace | Available for 10+ blockchains |

| Security Measures | 2FA, cold storage, insurance funds, PoR data, anti-phishing code, address whitelisting, and more |

| Customer Support Channels | Live chat, email, support ticket system |

| Mobile App | Android and iOS |

Who created OKX Exchange?

OKX was founded by Star Xu (徐明星) in 2017. Initially, the exchange operated from China, but it exited the Chinese market due to regulatory challenges. Despite this, it is reported that Star Xu and a significant portion of the OKX team are of Chinese origin.

OKX is part of the Ok Group, which also owns another cryptocurrency exchange known as Okcoin.

How does OKX work?

OKX operates as a comprehensive cryptocurrency exchange platform, offering users a wide range of trading and investment opportunities. Here’s a breakdown of how OKX works:

Account Creation and Verification

Users start by signing up for an account on OKX. The platform requires basic information for account setup, and depending on the region and services accessed, users may need to complete KYC (Know Your Customer) verification for security and regulatory compliance.

Deposit and Withdrawal

OKX supports deposits in various cryptocurrencies and fiat currencies. Users can fund their accounts by transferring crypto from an external wallet or by purchasing assets directly using fiat via credit/debit cards, bank transfers, or other supported payment methods. Withdrawals are similarly straightforward, with options for both fiat and crypto transfers to personal wallets or bank accounts.

Trading Options

OKX offers several trading options:

- Spot Trading: Users can buy and sell cryptocurrencies instantly at the current market price or set limit orders.

- Futures and Derivatives: For more experienced traders, OKX provides access to futures contracts, perpetual swaps, and options contracts, allowing traders to speculate on price movements with leverage.

- Margin Trading: This feature lets users borrow funds to trade larger positions, amplifying both potential profits and risks.

Earning Passive Income

Beyond trading, OKX allows users to earn passive income through various financial products:

- Staking: Users can lock up their crypto assets to earn rewards based on network participation.

- Savings: Flexible savings accounts let users earn interest on their idle assets.

- Crypto Loans: Users can lend their crypto to earn interest, or borrow against their holdings to maintain liquidity without selling assets.

Web3 and DeFi Services

OKX has expanded into Web3 services, offering an integrated OKX Wallet, a non-custodial multi-chain wallet that supports 70+ blockchain networks. Users can access decentralized applications (DApps), explore the NFT marketplace, and participate in decentralized finance (DeFi) protocols directly from the platform.

Is OKX’s Defi different from other exchanges?

Security and Compliance

OKX places a strong emphasis on security. The platform employs two-factor authentication (2FA), cold storage for most assets, and encryption protocols to protect user funds. It also follows regulatory standards in various regions to ensure compliance, although its services may be restricted in certain countries.

Pros Explained

Trading fees starting at 0.1% or less: OKX offers highly competitive trading fees, beginning at just 0.1%. These fees can be further reduced with higher trading volumes or by holding the platform’s native token, OKB.

High-yield staking opportunities: OKX provides lucrative staking options, with potential annual returns exceeding 100% for certain cryptocurrencies.

Simple cryptocurrency purchasing process: Users can easily purchase cryptocurrencies using a variety of methods, including credit/debit cards, bank transfers, Apple Pay, and other digital wallets, making transactions quick and convenient.

Cons Explained

Unavailable for U.S. residents: Due to regulatory and compliance constraints, OKX does not offer its exchange services to users based in the United States.

Low liquidity for some assets: While OKX ranks among the top exchanges globally, some digital currencies on the platform experience lower liquidity.

Mixed customer feedback: Reviews from past users have highlighted issues such as subpar customer service and, in some cases, concerns over lost funds, as seen in various OKX Reviews.

OKX Trading Review: Key Features

Spot Trading

Spot trading is the most basic method for buying and selling cryptocurrencies. OKX supports over 327 cryptocurrencies, with pairs against widely used assets like USDT (a stablecoin tied to the US dollar), USDC, and other major cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH). The platform provides users with charting tools, technical indicators, and multiple order types to simplify the trading process.

Some of the common order types available on the OKX exchange include:

- Limit Orders: Set a specific price to buy or sell, and the trade executes when the market hits that price, giving more control over entry and exit points.

- TP/SL (Take Profit / Stop Loss): Manage risks by setting both take-profit and stop-loss prices to lock in gains or limit losses. Once either price is reached, the platform triggers a corresponding order.

- Trailing Stop: A dynamic stop-loss that follows the market price upward, securing profits while protecting against downward movements.

- Trigger Orders: These orders execute once a specified condition is met, such as reaching a particular price, and can be used for both buy and sell orders.

- Iceberg Orders: For large trades, this order type breaks the trade into smaller parts to minimize price slippage, showing only a fraction of the total order at a time.

- TWAP (Time-Weighted Average Price): This strategy splits a large order into smaller segments over time to achieve an average price, reducing market impact.

Futures Trading

What will OKX futures trading be like?

The OKX futures trading platform supports more than 228 cryptocurrencies with up to 100x leverage for popular assets like BTC and ETH. Other coins, such as MATIC, ADA, XRP, DOT, and SOL, offer up to 50x leverage.

There are two primary types of futures trading on OKX:

- Traditional Futures: These have a set expiration date, and as the contract nears this date, its price may differ more from the spot price.

- Perpetual Futures: These contracts have no expiration, allowing traders to hold positions indefinitely.

Additionally, OKX supports both cross and isolated margin modes. Cross margin utilizes the total available margin across all positions, while isolated margin limits risk by applying margin only to specific trades. Tools like market and limit orders, stop-limit orders, and advanced order types are also available.

Futures trading on OKX includes four margin modes:

- Margin Free: No initial margin is required, and profits from open positions are used as collateral.

- Single-Currency Margin: This uses a specific cryptocurrency as collateral for futures positions.

- Multi-Currency Margin: Users can utilize multiple cryptocurrencies as margin.

- Portfolio Margin: Risk is assessed across the entire portfolio, potentially reducing margin requirements.

Margin Trading

OKX allows margin trading with up to 10x leverage for assets like BTC, ETH, OKB, MATIC, SOL, and DOGE. Other assets offer up to 5x leverage. Users must provide collateral to borrow funds for trading. To maintain open positions, a “maintenance margin” must be maintained. If the collateral falls below this margin, the position will be liquidated to repay the loan.

Options Trading

Options trading on OKX is more complex than spot trading. Traders can buy (call) or sell (put) an asset at a specific price before or on a set date, but they are not obligated to do so. OKX offers European-style options, meaning they can only be exercised upon expiration. Unlike other platforms that settle in stablecoins, OKX settles its options contracts in the underlying cryptocurrency, like BTC or ETH.

Copy Trading

OKX provides a copy trading feature, enabling users to replicate the trades of expert “master traders.” Traders can select master traders based on factors like their performance, strategy, and risk profile. This feature is available for both spot and futures trading markets. Users can either copy trades exactly or customize their own investment limits. The platform provides detailed statistics on master traders’ performance, win rates, and assets under management (AUM).

P2P Trading

Peer-to-peer (P2P) trading allows users to trade directly with others, with OKX acting as an escrow service to ensure safe transactions. OKX freezes the cryptocurrency involved until both the buyer and seller confirm the transaction. Supported assets include USDT, USDC, BTC, and ETH, with over 100 fiat currencies and 900+ payment methods available.

Trading Bots

OKX offers automated trading bots for users who want to execute professional strategies without active management. There are several bot options, including:

- Grid Bots: Work by placing buy and sell orders within a set price range, aiming to profit from small market movements.

- Signal Trading Bots: Operate based on third-party trading signals or custom-created signals.

- Arbitrage Bots: Take advantage of price discrepancies across markets to earn small, quick profits.

- DCA (Dollar-Cost Averaging) Bots: Consistently invest set amounts at regular intervals to minimize the effects of market volatility.

- Slicing Bots: Designed for large trades, these break orders into smaller parts to achieve better overall prices.

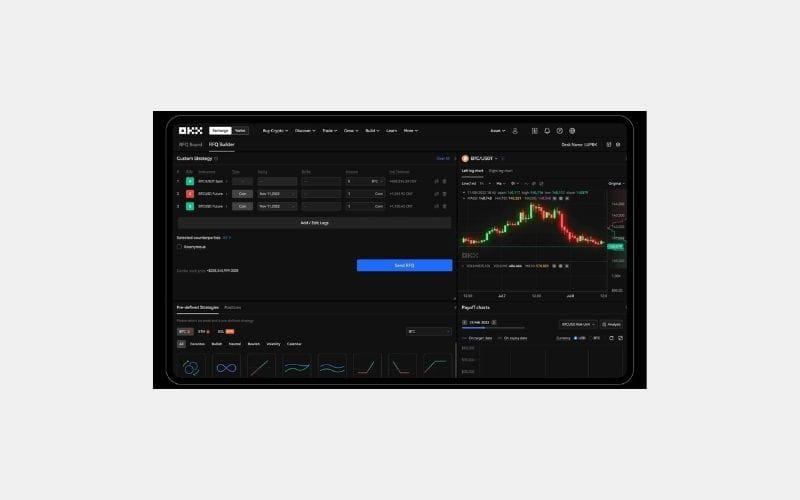

Liquid Marketplace

OKX’s Liquid Marketplace caters to institutional and high-volume traders. It operates as an over-the-counter (OTC) platform, where trades are negotiated directly between parties, providing privacy, customization, and better pricing than standard exchanges. The platform also offers a Request-for-Quote (RFQ) tool, where users can request the best prices from market makers.

For a detailed analysis of all these features, check out our OKX Review.

OKX Earn Services

Staking

Should you trade on OKX in 2024?

Within this OKX review from CoinReviews, OKX provides several passive income opportunities for cryptocurrency holders, primarily through staking. The “Simple Earn” feature includes two main options:

- Flexible (Savings): This option lets you deposit your crypto and earn interest with high flexibility. You can withdraw your assets anytime, but the interest rates tend to be lower compared to more long-term options.

- Fixed (Staking): With fixed staking, you lock up your cryptocurrency for a defined period, which can yield higher returns. During this time, your assets contribute to blockchain security, earning you more substantial rewards. Fixed staking rates vary based on the crypto and lock-up duration, with some coins offering up to 100% APY or more.

Additionally, OKX features Structured Products, which blend staking with market prediction strategies:

- Dual Investment: This allows you to predict whether a cryptocurrency’s price will rise or fall by a certain date. If your forecast is correct, you earn high returns. Your deposit is in one asset, but the payout is in another.

- Seagull: Ideal for those expecting a significant market shift, this product lets you choose between Bullish or Bearish BTC, with greater potential profits for large price movements.

- Snowball: This option automatically reinvests your staking earnings, compounding your returns.

OKX also offers On-chain earning, where you stake directly on proof-of-stake blockchains like ETH, contributing to network validation while earning rewards.

Crypto Loan

In this OKX Review, we’ll look at another standout feature—Crypto Loans. OKX enables you to borrow cryptocurrency without selling your holdings. You use your crypto as collateral, ensuring the loan’s security. If you default on the loan, OKX keeps your collateral.

OKX supports loans for assets like BTC, ETH, USDT, ALGO, and APT, with flexible or fixed interest rate options. Flexible loans allow you to repay at your own pace, while fixed rates provide more predictable costs. Interest rates average around 1% APR (subject to hourly changes).

Factors affecting your interest rate include:

- Loan to Value Ratio (LTV): The amount borrowed relative to your collateral’s value—higher LTVs generally mean higher interest.

- Market Conditions: Supply and demand in the lending market directly influence the interest rate.

Jumpstart (Launchpad)

As part of this OKX Review, we also explore Jumpstart, the platform’s launchpad for new blockchain projects. So far, OKX has raised $2.54 billion through 11 projects.

Users can participate by either staking their existing cryptocurrency or pledging OKB (the native token of OKX) for a chance to buy new tokens from these projects. This launchpad provides a unique way to invest in up-and-coming blockchain innovations.

OKX Decentralized Finance (DeFi) Ecosystem

OKX Wallet

OKX Wallet is highly appreciated by many investors

The OKX Wallet is a gateway to a variety of decentralized finance (DeFi) applications, allowing users to trade on decentralized exchanges (DEXs), explore NFT marketplaces, and engage with numerous decentralized applications (DApps).

This wallet is highly user-friendly, supporting over 70 blockchains, making it easy to send, receive, and store a wide range of cryptocurrencies. It comes with an integrated DEX aggregator that scans through more than 400 DEXs and 20 cross-chain bridges across 20+ networks, ensuring the best prices for Bitcoin and other cryptocurrencies.

As a non-custodial wallet, OKX ensures that only you have access to your private keys, enhancing security. The wallet is accessible as a browser extension or a mobile app for Android and iOS, and it can seamlessly connect to the OKX centralized exchange for smoother transactions.

OKT Chain

OKX also operates OKT Chain (OKTC), a layer-1 blockchain that is compatible with the Ethereum Virtual Machine (EVM) and built on Cosmos (ATOM). This open-source blockchain handles up to 6,000 transactions per second, which is significantly faster than Ethereum’s 12-15 TPS. Transaction fees on OKTC are also extremely low, averaging about $0.01 per transaction. The chain has its own native token, OKT, and is known for its efficiency and cost-effectiveness compared to older blockchains.

NFT Marketplace

Another highlight in this OKX Review is the OKX NFT Marketplace, which supports a wide range of NFT categories, including art, collectibles, music, game items, and virtual land.

The marketplace is not limited to one blockchain, offering NFTs from multiple networks such as Ethereum, Polygon, Solana, Base, and BNB Chain. By aggregating NFTs from top marketplaces like OpenSea, Blur, LooksRare, X2Y2, and MagicEden, OKX provides users with flexible buying and selling options, catering to both creators and collectors.

What Cryptocurrencies Can I Trade on OKX?

Cryptocurrencies traded on OKX such as: BTC, ETH, USDT,…

While this OKX review, OKX offers a broad selection of over 327 cryptocurrencies, providing traders access to more than 533 trading pairs. These assets span various sectors such as AI, Metaverse, gaming, DeFi, and smart contract platforms.

While the variety is impressive, it may not fully satisfy those seeking brand-new, low-cap coins with higher risk and potential rewards. OKX tends to focus on more established cryptocurrencies, whereas platforms like MEXC and Bybit are often quicker to list newer, riskier coins with potential for significant returns.

Here are some of the popular cryptocurrencies available for trading on OKX:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- Bitcoin Cash (BCH)

- USD Coin (USDC)

- Aptos (APT)

- Cardano (ADA)

- Solana (SOL)

- Dogecoin (DOGE)

- Polkadot (DOT)

- Polygon (MATIC)

OKX Fees Review

OKX Spot Trading Fees

OKX employs a maker-taker fee model for its spot and derivatives trading, meaning your fees vary depending on whether you are adding liquidity to the market (maker) or removing it (taker). The platform features a tiered fee structure influenced by your 30-day trading volume and OKB holdings. As your trading activity or OKB holdings increase, you’ll benefit from lower trading fees.

To start, let’s explore the fee structure based on your OKB holdings:

| Tier | OKB Holdings | Maker Fees | Taker Fees |

| Lvl 1 | < 100 | 0.08% | 0.1% |

| Lvl 2 | ≥ 100 | 0.075% | 0.09% |

| Lvl 3 | ≥ 200 | 0.07% | 0.08% |

| Lvl 4 | ≥ 500 | 0.065% | 0.07% |

| Lvl 5 | ≥ 1000 | 0.06% | 0.06% |

Even without holding OKB tokens, you can receive a trading fee rebate based on your trading volume. Here is an overview:

| Tier | 30-Day Volume | Maker Fees | Taker Fees | Withdrawal Limit |

| VIP 0 | – | 0.08% | 0.1% | $10,000,000 |

| VIP 1 | ≥ 5,000,000 | 0.045% | 0.05% | $12,000,000 |

| VIP 2 | ≥ 10,000,000 | 0.04% | 0.045% | $16,000,000 |

| VIP 3 | ≥ 20,000,000 | 0.03% | 0.04% | $20,000,000 |

| VIP 4 | ≥ 100,000,000 | 0.02% | 0.035% | $24,000,000 |

OKX Futures Trading Fees

The trading fees for futures contracts also utilize a tiered maker-taker model. For standard users, the fees begin at 0.02% for makers and 0.05% for takers, with reductions available as trading volume and OKB holdings grow.

OKX Deposit and Withdrawal Fees

OKX does not impose fees for cryptocurrency deposits. However, you will still incur network fees (often referred to as gas fees) when transferring cryptocurrencies on the blockchain.

Withdrawal fees depend on the specific cryptocurrency you withdraw and are updated regularly based on network conditions.

For fiat transactions, using third-party services like Mercuryo or Moonpay to purchase crypto may result in additional fees and spreads, typically ranging from 2% to over 10%. Credit and debit card transactions may also attract variable fees based on your location.

OKX Payment Methods

OKX provides a range of payment options for purchasing crypto or making deposits. As noted earlier, it offers over 900 payment methods on its P2P marketplace. However, direct deposits on the platform may have more limited options, which include:

- Credit/Debit cards (Visa and Mastercard)

- SEPA

- Bank account transfers

- iDEAL

- PIX

- Apple Pay and Google Pay (using debit cards)

- Moonpay

- Mercuryo

- Deposit and Withdrawal Limits

The limits for deposits and withdrawals on OKX may vary according to your fee tier, with users at higher VIP levels generally enjoying higher limits. For fiat transactions, these limits can change based on the payment method used.

| Fiat Currency | Payment Method | Minimum Deposit | Max. Deposit | Max. Withdrawal |

| EUR | SEPA | €1 | €100,000 Daily €1,000,000 per 30 days | €100,000 Daily €1,000,000 per 30 days |

| EUR | iDEAL | €1 | €100,000 Daily €1,000,000 per 30 days | N/A |

| BRL | Pix | $10 | $20,000 Daily $50,000 per 30 days | $20,000 Daily $50,000 per 30 days |

| AUD | Bank Transfer | $10 for deposits and $5 for withdrawal | $10,000 Daily $20,000 Weekly | $10,000 Daily $20,000 Weekly |

OKX Security Measures in 2024

Is OKX security good?

- Two-Factor Authentication (2FA): Enabling 2FA is essential! OKX offers 2FA options via SMS, email codes, and authenticator apps like Google Authenticator, adding an extra layer of security.

- Passkeys: While still emerging, OKX is investigating the implementation of passkeys as a password alternative. Passkeys provide enhanced resistance against hacking and phishing attempts.

- Anti-Phishing Code: Users can establish a unique anti-phishing code that appears in all legitimate emails from OKX. This feature allows you to easily identify fraudulent emails attempting to compromise your information.

- Cold Wallets: The majority of OKX’s cryptocurrency assets are stored offline in “cold wallets.” A smaller portion is maintained in online “hot wallets” for day-to-day transactions.

- Multi-Signature Technology: OKX employs multi-signature systems, requiring several authorized individuals to approve transactions. This safeguards against unauthorized access to user funds.

- Proof-of-Reserve Data (PoR): The platform publicly shares its solvency data, which can be verified through DeFi blockchain explorers like Defilama. As of now, OKX manages over $29.25 billion in assets.

- OKX Risk Shield: The exchange maintains an insurance fund specifically designated to protect user assets in the event of a security breach, akin to Binance’s “SAFU.”

- Withdrawal Address Whitelisting: Users can whitelist withdrawal addresses, ensuring that any attempts to transfer funds to unapproved addresses are blocked.

- Mandatory KYC (Know Your Customer): OKX enforces mandatory KYC verification for users, which helps prevent illicit activities and ensures the authenticity of user identities.

OKX App Review

Within this OKX review, many traders prefer using their smartphones for cryptocurrency trading. If you’re among them, you’ll be pleased to discover that OKX offers a well-designed mobile app featuring a user-friendly interface, advanced trading capabilities, and strong security measures. The app is available for both Android and iOS devices, providing all the essential tools needed to trade on the move. You can easily monitor prices, execute orders, and manage your portfolio from virtually anywhere.

The OKX mobile app also includes a convenient “Lite” mode, tailored for newcomers to cryptocurrency who may prefer a simplified trading experience. Meanwhile, more experienced traders can benefit from the comprehensive set of features available in the full version, allowing for greater control over their trading activities.

OKX Supported Countries & Regions

OKX operates in more than 100 countries worldwide, offering its services to a vast range of users. However, certain regions are restricted from accessing the platform. The following countries are currently excluded from using OKX:

- Hong Kong

- United States

- Cuba

- North Korea

- Iran

- Crimea

- Sudan

- Malaysia

- Syria

- Bangladesh

- Ecuador

- Kyrgyzstan

OKX Review: Restrictions for U.S. Traders

Due to regulatory constraints, OKX is not available to traders in the United States. While some users may seek workarounds, there are several leading U.S.-based crypto exchanges that provide similar services. For those based in the U.S., we recommend exploring our list of the best crypto exchanges available in the country.

OKX Customer Support

Source: OKX

Source: OKX

While assessing this OKX review, having reliable customer support is crucial, and OKX offers several options to assist users when needed. Their website features a comprehensive help center with a wealth of articles and solutions to common questions.

For more specific issues, customers can reach out through the following channels:

- Email: You can contact them via okx@support.com, and they typically respond within 1-2 business days.

- Live Chat: The OKX website includes a live chat feature for real-time assistance from a customer service representative.

- Social Media: OKX is active on platforms like Twitter, where users can also get in touch with support.

In addition to these methods, the online support center provides answers to frequently asked questions. The platform generally receives positive ratings, with scores like 4.6/5 on the App Store and 4.5/5 on Google Play. However, OKX has a lower rating on Trustpilot, with a Trust score of 1.9/5, and some users have reported that response times for customer service can occasionally be slow.

OKX Review: User Experience and Ease of Use

When it comes to user experience, OKX shines with its diverse cryptocurrency offerings and competitive trading fees. For traders on the move, the mobile app is a standout feature, enhancing accessibility and convenience. The platform itself is well-crafted, though it may seem a bit daunting for beginners.

Thankfully, there are guides available to help newcomers get started. For seasoned traders, OKX provides an array of advanced tools for market analysis, including detailed charts and various order types. Overall, OKX offers a robust and user-friendly trading experience, catering to both novice and experienced traders.

OKX Customer Satisfaction in 2024

OKX has garnered mixed feedback from its users, with its overall rating landing in the mid-range. Some users praise the platform for its user-friendly interface, making it easy to navigate and perform transactions online.

A major highlight of OKX Review is the platform’s fast transaction speeds, which appeal to those looking for quick trades. Additionally, the exchange is appreciated for its competitive, low fees, drawing positive remarks from users seeking to minimize costs.

However, not all feedback is positive. A number of users have reported issues such as lost funds, which is a serious concern. Negative reviews often focus on poor customer support, particularly when dealing with problems. Delays in processing withdrawals have also been a common complaint, leaving users frustrated when trying to access their funds.

While OKX offers several benefits, the recurring issues with withdrawals and customer support weigh down its overall rating.

OKX Account Management

Within this OKX review, managing your OKX account is simple and efficient, regardless of the platform you choose. Whether you access it via the OKX website on a desktop or through the mobile app, both provide a user-friendly interface for checking balances, reviewing transaction history, and updating personal details.

If you run into any difficulties, the help center offers a range of guides and FAQs to help resolve common issues. The mobile app mirrors the desktop experience, giving you the full range of account management features, ensuring you can handle your account on the go.

OKX Alternatives to Consider

Two of the most popular alternatives to OKX are Binance and Bybit. Here’s a quick comparison to help you evaluate these platforms:

| Features | OKX | Binance | Bybit |

| Founded | 2017 | 2017 | 2018 |

| Popular trading features | Spot, margin, derivatives, OKX Earn, NFT marketplace, Web3 wallet | Spot, margin, futures, P2P, Earn products, launchpad, staking, NFTs | Spot and derivatives trading, copy trading, bots, Web3 ecosystem |

| Web3 Wallet | Yes | Yes | Yes |

| Supported coins | 327+ | 381+ | 1,167+ |

| Trading fees | 0.08% maker and 0.1% taker | 0.1% maker/taker | 0.1% maker/taker |

| Deposit and withdrawal fees | Zero fees | Zero fees | Zero fees |

| US presence | Limited (OKCoin operates) | Separate platform Binance US available | No availability |

| Native token | OKB | BNB | BIT |

OKX Exchange Review on Buying and Selling

Source: OKX

Source: OKX

As with many exchanges, OKX provides a range of order types for both investors and traders. Algorithmic orders are a key feature, and OKX meets industry standards in this area. Traders can select from market orders, limit orders, advanced limit orders, stop-limit orders, trailing stops, iceberg orders, and time-weighted average price (TWAP) orders.

While most cryptocurrency traders are familiar with basic order types like limit and market orders, OKX stands out by offering two advanced options that might be less common:

- Iceberg orders: This algorithmic type breaks large orders into smaller ones, helping reduce slippage by placing them based on the best bid and ask prices.

- TWAP orders: This type schedules market orders over time, executing them at intervals, like a 10-order set with a 6-second delay between each transaction over 60 seconds.

These additional order types give OKX an edge in diversity over many other exchanges in the market.

User Experience on OKX

OKX’s user interface is comparable to top-tier exchanges. The primary screen offers a trading view chart, order depth, recent trades, open orders, transaction history, and a buy/sell panel. Like many web-based platforms, the desktop version is resource-intensive, but this is typical for browser-based exchanges.

Overall, the interface is simple, user-friendly, and straightforward. The instrument page is basic, and placing an order is intuitive. However, it lacks some features like exchange metrics (which Phemex offers) and a news feed. That said, most traders rely on external platforms like TradingView for such data. The ability to switch between OKX’s native charts and TradingView is a nice bonus.

Mobile Trading Support

For those who prefer trading on the go, the OKX mobile app is a solid alternative to the desktop version. Available for both Android and iOS devices, the app is easy to navigate and doesn’t leave users feeling frustrated with their choice of platform.

The mobile app lets users manage trades, monitor real-time data, and handle transactions like deposits and withdrawals. It’s suitable for both novice and experienced traders, providing a seamless experience whether you’re trading spot or derivatives. The mobile app’s interface is well-designed for quick, efficient trades, making it an ideal choice for mobile traders.

OKX Review on Banking services

OKX provides a range of banking services and offers a seamless fiat on-ramp and off-ramp solution for users. The platform supports various payment methods for deposits and withdrawals, making it convenient for users to manage funds. These options include:

- Cryptocurrency transfer

- Credit/debit cards (Visa, MasterCard)

- Bank transfers

- UPI

- PayPal

- Payoneer

- Skrill

- SEPA

- ApplePay

- Poli

- BPay

- Qiwi

- Kakao Pay

- PayID

- Blueshift

- iDeal

- Western Union

- Gift Cards (iTunes, Google, Amazon)

To open an account, users need to make a minimum deposit of 10 USDT or an equivalent amount in another cryptocurrency. After completing the verification process, users are ready to start trading on the platform.

How to Buy Crypto on the OKX Platform?

Is buying crypto on OKX different from other exchanges?

Step 1: Sign Up for an OKX Account

Visit the OKX website or download the mobile app.

[button url=”https://okx.com/join/98565217″ target=”blank” style=”3d” background=”#49ef2d” color=”#FFFFFF” size=”10″ wide=”no” center=”yes” radius=”auto” icon=”icon: mail-forward” icon_color=”#FFFFFF” text_shadow=”none”]Visit OKX[/button]Click the “Sign Up” button and fill in your basic details, such as your email address, and set a secure password. You’ll receive a verification email from OKX—simply click the link in the email to activate your account. To enhance security, OKX requires two-factor authentication (2FA), which can be done via SMS or Google Authenticator.

Step 2: Complete Identity Verification (KYC)

Before trading, OKX requires users to verify their identity through a process known as KYC (Know Your Customer). This is a mandatory security measure common on most exchanges.

Navigate to your profile and choose the “Verification” option. Follow the instructions, which typically involve submitting a photo of a government-issued ID (such as a passport or driver’s license) and a selfie. The verification may take anywhere from a few hours to a couple of days.

Step 3: Deposit Funds into Your Account

After your identity is verified, you can deposit funds. Head to the “Buy Crypto” section in the menu and select either “Express Buy” or “P2P Trading.”

For this guide, we’ll use “Express Buy.” Choose your preferred fiat currency, the cryptocurrency you want to purchase, and your desired payment method. Depending on the method, it may take some time for the funds to appear in your OKX account.

Step 4: Begin Trading Cryptocurrency

With funds in your account, you’re ready to start trading. Go to the “Trade” section and click on “Spot.” This will display a list of cryptocurrencies offered by OKX. Select the trading pair you’d like to buy (e.g., BTC/USDT or ETH/USDT) and proceed.

On the trading screen, you’ll find charts and prices. Decide how much cryptocurrency to purchase and select your order type. A “market order” will buy your crypto at the current price instantly. Once you place your order, OKX will handle the transaction, and your purchased crypto will appear in your wallet.

OKX Review – Frequently Asked Questions

Who is OKX Best Suited For?

OKX caters to all levels of cryptocurrency users. Beginners will find its features like spot trading, fiat-to-crypto conversion, and the P2P market ideal for easy deposits and withdrawals.

For seasoned traders, OKX offers advanced tools, high leverage, and margin trading options. It’s also a solid choice for those seeking passive income opportunities through staking, savings, and DeFi features. Web3 enthusiasts will appreciate OKX’s non-custodial wallet, NFT marketplace, and decentralized swap functions.

Is OKX Safe and Legitimate?

OKX is widely regarded as a secure and legitimate exchange, serving over 50 million users across more than 100 countries. It is licensed in the Bahamas and has recently obtained a VARA registration in Dubai. OKX utilizes top-tier security protocols, including cold storage, multi-signature wallets, and publicly available Proof-of-Reserve (PoR) data, to maintain transparency.

Can US Users Access OKX?

Unfortunately, US residents cannot use the full OKX platform due to regulatory restrictions. However, they may explore decentralized services like the OKX Wallet and NFT platform.

Is OKX Suitable for Beginners?

OKX is a great option for new traders, offering user-friendly buy/sell features, educational resources, and a demo trading mode for risk-free practice. That said, more complex tools like margin and futures trading may be daunting for beginners, so it’s best to start with the basics and gradually move toward the platform’s advanced offerings.

Is OKX a Chinese Company?

OKX was founded in China by Star Xu in 2017. Due to regulatory changes in China’s stance on cryptocurrency, OKX relocated its headquarters and now operates from locations like Seychelles and Dubai.

Should I use the OKX exchange in 2025?

OKX is the best exchange today

As the cryptocurrency market continues to evolve, selecting the right exchange is critical for traders and investors alike. OKX has established itself as one of the leading cryptocurrency exchanges globally, offering a wide range of features and services. But is it the right platform for you in 2024? Let’s dive into an OKX Review to help you make an informed decision.

OKX stands out due to its comprehensive range of trading options, catering to both beginner and advanced traders. From spot trading to futures and derivatives, the platform provides flexibility for various trading strategies. Additionally, OKX offers margin trading for those looking to amplify their returns, though it comes with increased risk.

Security is another key factor when evaluating a crypto exchange, and OKX excels in this area. The platform uses advanced encryption, two-factor authentication (2FA), and cold storage to protect user assets. It also complies with regulatory standards in several jurisdictions, enhancing its credibility in an industry often scrutinized for security concerns. A strong security track record makes OKX a reliable choice for users concerned about protecting their investments.

One of the standout features of OKX is its native token, OKB. Holding OKB can unlock various benefits such as reduced trading fees, staking opportunities, and access to exclusive services on the platform. This makes OKB more than just a speculative asset—it can be a valuable tool for active traders looking to optimize their experience on the platform.

However, OKX is not without its challenges. For beginners, the user interface may be a bit overwhelming, particularly when exploring advanced trading options like futures or margin. That said, OKX offers extensive educational resources, including its OKX Academy, where users can learn how to navigate the platform and make informed trading decisions. The platform also supports multiple languages, making it accessible to users worldwide.

In terms of fees, OKX remains competitive. Its fee structure is tiered based on trading volume and whether users hold OKB. This makes it more affordable for high-volume traders or those who take advantage of OKB discounts. However, casual traders may find slightly higher fees compared to other exchanges like Binance.

Another consideration for 2024 is regulatory compliance. As governments around the world introduce stricter regulations on cryptocurrency exchanges, OKX has shown a commitment to adhering to local laws, which can give users peace of mind. That said, OKX is restricted in some countries, such as the United States, so it’s essential to check if the platform is available in your region.

[button url=”https://okx.com/join/98565217″ target=”blank” style=”3d” background=”#49ef2d” color=”#FFFFFF” size=”10″ wide=”no” center=”yes” radius=”auto” icon=”icon: mail-forward” icon_color=”#FFFFFF” text_shadow=”none”]Visit OKX[/button]OKX Review Conclusion

In conclusion, the OKX Review highlights why this exchange is a standout in 2024. With its robust features, enhanced security measures, and user-centric innovations, OKX continues to set new benchmarks in the crypto trading arena. CoinReviews acknowledges the exchange’s commitment to providing a seamless and reliable trading experience, making it a top choice for both novice and experienced traders. As the digital currency landscape evolves, OKX’s adaptability and forward-thinking approach ensure it remains at the forefront of the industry. Trust in CoinReviews to keep you informed on the best platforms for your trading needs.

Read more:

- Binance Review: Features, Supported Cryptos and Fees!

- Bybit Review: Pros, Cons and Key Features

- HTX Review: Fees, Security, Pros & Cons

- Bitget Review: Pros & Coins, Fees & More

- Bitfinex Review: Is It Secure or Scam?

- Kucoin Review: Social Trading, Fees, Pros & Cons

- Crypto.com Review: Is the Exchange Safe or Scam?

- BingX Review: Verified Reviews, Pros & Cons

- LBank Review: Should You Use It?

- bitFlyer Review: Pros & Cons and Ratings

- ProBit Review: Is It the Right Crypto Exchange for You?

- P2B Review: Fees, Features, Safety, Pros & Cons

- Pionex Review: Pros, Cons & All You Need to Know

- BitMEX Review: Fees, Trading, Staking & More

- Phemex Review: Is It a Good Crypto Exchange?

- BTSE Review: Is It Safe & Reliable?

- CoinEx Review: Is This Crypto Exchange Safe?

- Poloniex Review: Features, Regulation & Risks

- BITFLEX Review: Features, Safety, Pros & Cons

- CoinJar Review: Is It the Right Exchange for You?

- Paymium Review: Pros, Cons, Key Features & Fees

- LBank Review: Is It the Right Exchange for You?

- MEXC Review: Latest Pros, Cons, Key Features & Fees

- BitMart Review: Reviews, Trading Fees & Cryptos