As the cryptocurrency world continues to innovate and evolve, peer to peer crypto exchanges are at the forefront of this revolution. CoinReviews dives into the transformative potential of these platforms, which enable direct transactions between users without the need for intermediaries. This decentralization not only enhances security and transparency but also reduces costs and increases access for traders worldwide. In 2024, peer to peer crypto exchange is set to redefine how we engage with digital assets, offering unparalleled autonomy and control.

Join us at CoinReviews as we explore the most promising platforms and their impact on the future of cryptocurrency trading.

What Is Peer to Peer Crypto Exchange?

Peer-to-peer refers to the direct exchange or sharing of information, data, or assets between individuals without the involvement of a central authority. In the context of cryptocurrency, a peer-to-peer crypto exchange facilitates decentralized interactions between users, allowing them to trade virtual currencies directly. This method, commonly seen in file sharing and now virtual currency trading, enables transactions without a middleman.

How is P2P understood?

Main Points

- Peer-to-peer crypto exchanges enable the direct exchange of assets, such as cryptocurrencies, between individuals without relying on a central authority.

- The creation of Bitcoin, the most widely used cryptocurrency, was largely motivated by the goal of establishing a truly peer-to-peer digital currency.

- Transactions conducted through peer-to-peer crypto exchanges often provide greater privacy compared to traditional online transactions.

- While true peer-to-peer crypto exchanges exist, many users prefer centralized or decentralized platforms for added security unless they are familiar with the transaction party.

How Does a P2P Crypto Exchange Work?

To build a successful peer-to-peer crypto exchange, it’s crucial to master its core principles to create a platform that stands out and prospers.

Decentralization

At the heart of any peer-to-peer crypto exchange is decentralization. With no central authority governing transactions, users maintain full control over their assets, which appeals to traders who value privacy and autonomy.

Direct Trading

In a peer to peer crypto exchange, transactions happen directly between users on a blockchain network, eliminating the need for intermediaries. This structure simplifies cryptocurrency trading, often reducing fees and improving transaction speed. Users negotiate terms, execute trades, and finalize agreements without relying on a middleman.

Escrow Protection

A key feature of peer-to-peer crypto exchanges is escrow protection. Unlike typical decentralized exchanges, peer-to-peer platforms offer an escrow service to safeguard both buyers and sellers during the trade.

The escrow temporarily holds cryptocurrency until both parties agree on the transaction’s terms. Once the conditions are met, the assets are released, significantly lowering the risk of fraud. The use of blockchain ensures that all transfers are fast, transparent, and secure.

Multiple Payment Options

A major advantage of peer-to-peer crypto exchanges is their flexibility in payment methods, accommodating users worldwide. These exchanges offer various options, including local bank transfers, international wire transfers, and even cash for face-to-face transactions.

By providing multiple payment methods, peer-to-peer crypto exchanges attract a larger, more diverse user base, promoting wider adoption of the platform.

Understanding P2P for 2024

Are Peer to Peer Crypto exchanges trusted by people nowadays?

In a digital peer to peer crypto exchange, every user operates as both a participant and contributor within the network. This decentralized structure is not only applied to file-sharing but also to trading cryptocurrencies. One of the early, widespread applications of peer-to-peer networks was the music-sharing service Napster.

In the context of cryptocurrency, a peer-to-peer crypto exchange allows users to trade digital assets directly without the involvement of traditional financial institutions. Cryptocurrencies were specifically designed to facilitate anonymous peer-to-peer transactions, using encryption and blockchain technology to ensure safe exchanges between parties without the need for a trusted third party.

The use of blockchain provides a significant security advantage for peer-to-peer crypto exchanges. Since each transaction is recorded across multiple nodes in the network, altering or falsifying transaction data becomes nearly impossible on a well-established network. This decentralized verification process enhances the security of cryptocurrency transactions.

How to Choose a Peer to Peer Crypto Exchange?

Selecting the right peer to peer crypto exchange becomes easier when you focus on key factors. Are you mainly interested in trading popular cryptocurrencies like Bitcoin, or do you prefer a platform that supports a variety of altcoins? The best peer-to-peer crypto exchanges prioritize strong security, user-friendly interfaces, and responsive customer support to ensure a seamless trading experience.

Trading Fees

Understanding the fee structure is crucial when choosing a peer-to-peer crypto exchange, as it directly impacts your trading costs. It’s wise to compare fees across various platforms, ensuring that there are no hidden charges for deposits or withdrawals. This will help you find an exchange that fits your financial goals while minimizing costs.

Available Cryptocurrencies

The selection of available cryptocurrencies is an important consideration. Look for peer-to-peer crypto exchanges that offer a wide variety of digital assets, as this will give you greater flexibility in your trading strategies. Whether you’re focused on major cryptocurrencies or want access to a broad range of altcoins, a diverse offering enhances your trading options.

Find a reputable P2P exchange to invest in 2024

Payment Methods

Multiple payment methods are essential for smooth transactions on a peer-to-peer crypto exchange. The best platforms support a variety of options, such as bank transfers, credit cards, and e-wallets like PayPal, making the trading process more efficient and convenient.

Security

Security is paramount in peer-to-peer crypto exchanges. Opt for platforms that implement robust security measures such as two-factor authentication (2FA), cold storage, and strong encryption to safeguard your digital assets. These features are vital for protecting your investments and ensuring a secure trading environment.

Accessibility

An easy-to-use platform is key for successful trading. The best peer-to-peer crypto exchanges offer intuitive interfaces on both web and mobile devices, allowing you to trade from anywhere with ease. Additionally, platforms that support multiple languages and comply with local regulations provide an enhanced user experience.

Liquidity

Liquidity can vary in peer-to-peer crypto exchanges, but choosing a platform with a large user base ensures that you can complete trades efficiently and at competitive rates. This is especially important when executing high-volume transactions.

Customer Support

Reliable customer support is crucial for resolving issues quickly in peer-to-peer crypto exchanges. Look for platforms that provide 24/7 support through various channels such as live chat, email, and phone, ensuring you have access to assistance when you need it.

User Interface

A clear and intuitive interface is essential for both beginners and experienced traders. The best peer-to-peer crypto exchanges offer simple layouts that make it easy to navigate the platform, execute trades, and manage portfolios without confusion.

Reputation

The reputation of a peer-to-peer crypto exchange is a key indicator of its trustworthiness. Review user feedback and testimonials to gauge the experiences of other traders. A reputable platform typically offers excellent security, customer service, and user satisfaction, all of which are vital for a positive trading experience.

P2P Platforms vs. Traditional Crypto Exchanges

How are P2P platforms different from traditional cryptocurrency exchanges?

When navigating the world of cryptocurrency trading, you’ll come across two main types of exchanges: peer-to-peer (P2P) crypto exchanges and traditional crypto exchanges. Both offer unique advantages and cater to different needs within the crypto community.

Peer to Peer Crypto Exchanges

A peer to peer crypto exchange enables direct transactions between buyers and sellers without the involvement of a centralized authority. Privacy is a major advantage, as users are often not required to provide extensive personal information, making these platforms appealing to those who value anonymity. Peer-to-peer crypto exchanges also offer a wide variety of payment methods, including bank transfers, PayPal, and even cash, providing unmatched flexibility. To mitigate the risk of fraud, P2P exchanges typically use an escrow system, holding funds until both parties have confirmed the transaction.

Traditional Crypto Exchanges

In contrast, traditional crypto exchanges act as intermediaries in the trading process. These exchanges provide a more structured environment with advanced features such as charting tools and automated trading. Traditional platforms are known for their high liquidity, allowing users to execute large trades quickly and at stable prices. Security is generally robust, with advanced technologies in place to protect assets. However, these exchanges usually require more personal information, which may be a drawback for those seeking privacy.

Ultimately, the choice between a peer-to-peer crypto exchange and a traditional exchange depends on your priorities. If you value autonomy and privacy, a P2P crypto exchange may be the better option. If you prefer speed, high liquidity, and additional trading features, a traditional exchange might suit your needs. Both types of platforms play important roles in the crypto space, each catering to different preferences and trading styles.

How to Trade on a P2P Crypto Exchange?

Is it difficult to trade on P2P electronic platform?

Trading on a peer-to-peer crypto exchange may seem challenging at first, but it’s relatively simple once you understand the process. Here’s a step-by-step guide to help you navigate trading on a peer-to-peer crypto exchange.

Step 1: Select a Peer to Peer Crypto Exchange

Begin by choosing a peer-to-peer crypto exchange that meets your requirements. Consider factors like security, platform reputation, available cryptocurrencies, and supported payment methods. Each exchange offers unique features, so pick the one that aligns with your trading objectives.

Step 2: Create and Secure Your Account

After selecting an exchange, register your account. This usually involves verifying your identity for security purposes—an important step you shouldn’t skip. To further protect your account, enable security features like two-factor authentication (2FA).

Step 3: Explore Available Offers

Once your account is set up, browse the trading offers on the peer-to-peer crypto exchange. Sellers offer different prices and accept a range of payment methods. Search for offers that match the amount of cryptocurrency you want to trade and ensure the payment options suit your preferences.

Step 4: Initiate a Trade

When you find an offer that meets your needs, start the trade. The peer-to-peer crypto exchange will typically place the seller’s cryptocurrency into escrow, which secures the funds until the transaction is completed.

Step 5: Complete Payment

Follow the seller’s instructions for making the payment. Be timely and retain a copy of the payment proof, as it could be necessary if any disputes arise during the trade.

Step 6: Confirm the Trade

After making the payment, inform the seller and wait for them to confirm receipt. Once the seller verifies payment, the cryptocurrency held in escrow will be released to your account. Always double-check your wallet to ensure you’ve received the crypto.

Step 7: Provide Feedback

Most peer-to-peer crypto exchanges allow users to leave feedback for their trading partners. Rating the seller not only helps you build a trustworthy reputation but also assists other users in identifying reliable traders.

Trading on a peer-to-peer crypto exchange offers flexibility and direct interaction with other traders. By staying vigilant and engaging responsibly, you can have a successful trading experience. Keep learning and stay updated on market trends to further enhance your performance.

Top 18 Best P2P Crypto Exchanges in 2024

Choosing the ideal peer to peer crypto exchange depends on several factors. Some exchanges specialize in tokens based on Ethereum, while others focus on the Binance Smart Chain (BSC). It’s crucial to evaluate aspects like security, reputation, fees, and ease of use when selecting a platform. Below, we review the nine best peer to peer crypto exchanges available in 2024.

Best Wallet – Top Peer to Peer Decentralized Exchange

Best Wallet is our top choice for the best peer-to-peer crypto exchange in 2024. As a non-custodial wallet, it offers an integrated decentralized exchange (DEX), Best DEX, allowing for a seamless peer-to-peer trading experience. Users can trade over 1,000 crypto tokens through the Best Wallet app, with no need for multiple wallets. This platform supports Ethereum and Binance Smart Chain tokens and offers real-time market insights with advanced charting tools like TradingView. With the native token, $BEST, traders can enjoy lower fees. Best Wallet also provides a mobile-friendly interface, making it easy to trade directly from your phone without any KYC requirements.

| Supported Coins | Trading Fee |

| More than 1,000 coins across the Ethereum and Binance Smart Chain | Determined by specific liquidity pools |

Exodus – Simplified Crypto Management with Peer to Peer Exchange

Exodus Wallet is another user-friendly peer-to-peer crypto exchange. With its built-in P2P exchange feature, users can trade cryptocurrencies without leaving the app. Exodus supports a wide range of tokens and allows staking for extra earnings. Security is a priority, with private keys encrypted on the device and additional protection options like hardware wallets. While the exchange fees are slightly higher, Exodus makes up for it with excellent security, customer support, and a simple interface.

| Supported Coins | Trading Fee |

| BTC, ETH, XRP, LTC, and other ERC-20 tokens | Varies |

MEXC – Popular P2P Crypto Exchange in Select Markets

MEXC is a peer-to-peer crypto exchange that caters specifically to users in Vietnam, South Korea, and Russia. It supports trading in four major cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and USD Coin (USDC). The platform offers user-friendly features such as zero-fee transactions, country-specific payment methods, and an escrow service for secure trades. MEXC also stands out for its localized payment options and competitive rates, making it a solid choice for users in its target regions.

| Supported Coins | Trading Fee |

| BTC, ETH, USDT, USDC | 0% (set by P2P sellers and built into the exchange rate) |

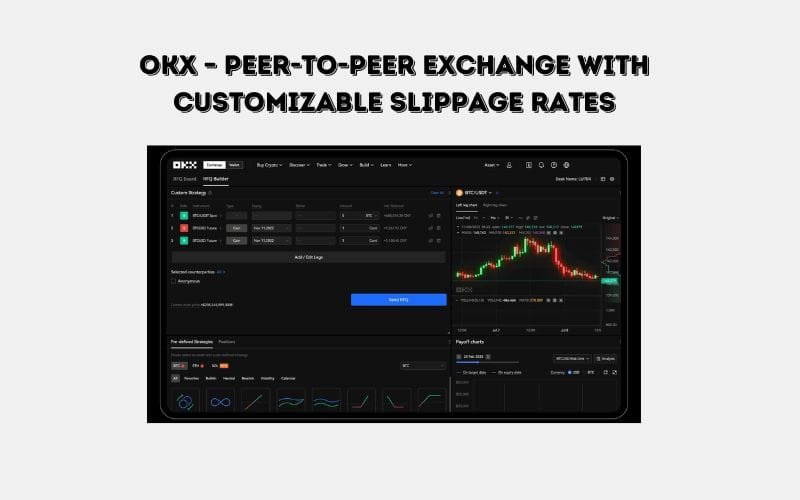

OKX – Peer-to-Peer Exchange with Customizable Slippage Rates

Source: OKX

OKX has expanded its services to include a peer-to-peer crypto exchange alongside its popular centralized exchange. The platform utilizes an aggregator algorithm to find the best prices across multiple DEXs, including Uniswap and SushiSwap. Users can set custom slippage rates and network fees, offering flexibility when swapping tokens. OKX supports a variety of wallets and coins across multiple networks, making it a versatile peer-to-peer crypto exchange.

| Supported Coins | Trading Fee |

| USDT, USDC, BTC, ETH, TUSD, and DAI on P2P exchange. 1,000+on the OKX DEX | Set by P2P sellers and built into the exchange rate. |

Binance – Comprehensive Peer to Peer Ecosystem

Binance is a leading player in the P2P exchange market, supporting over 300 payment methods across 70+ fiat currencies. The platform allows users to trade seven different crypto assets, including BTC, USDT, ETH, and ADA. Binance’s user-friendly interface and filtering options make it easy to find suitable peer-to-peer trades. Buyers enjoy zero transaction fees, while market makers pay up to 0.35%. Each trader has a profile with ratings and reviews to ensure transparency and trust.

| Supported Coins | Trading Fee |

| USDT, BTC, BUSC, BNB, ETH, ADA, and SHIB | Set by P2P sellers and built into the exchange rate. Market makers will pay up to 0.35%. |

Bybit – Derivatives Platform with Peer to Peer Crypto Exchange Option

Bybit, widely known for its high-leverage derivatives trading, has expanded its offerings to include a peer-to-peer crypto exchange. Though it doesn’t serve US clients, it’s accessible to most other regions. The platform allows users to trade four major digital currencies: USDT, USDC, BTC, and ETH, and supports multiple fiat currencies along with various payment methods.

Bybit’s peer-to-peer crypto exchange operates without charging any commissions, but the prices are set by individual sellers, so buyers need to assess deals carefully. Additionally, Bybit employs an escrow service to secure transactions, ensuring that both buyers and sellers can trade safely. Similar to the leading P2P crypto exchanges, Bybit also allows buyers to review the seller’s ratings from previous trades, promoting transparency and trust among its users.

| Supported Coins | Trading Fee |

| USDC, USDT, BTC, ETH | Exchange rates are set by sellers. 0% commission fee offered by Bybit. |

BingX – P2P Crypto Exchange Specializing in Tether

Source: BingX

BingX has carved a niche in the market by focusing its peer-to-peer crypto exchange primarily on Tether (USDT) transactions. With an intuitive platform, BingX supports over 300 payment methods including bank transfers, Wise, Google Pay, SEPA, Revolut, and Cash App, making USDT purchases via P2P both convenient and secure.

Although BingX’s P2P exchange is limited to USDT, it offers a vast array of fiat currencies and competitive exchange rates, sometimes even below the spot market. The platform doesn’t charge buyers any fees, but it requires users to complete KYC verification to enhance security, reducing the risk of scams. Furthermore, BingX employs an escrow system to further safeguard peer-to-peer transactions.

| Supported Coins | Trading Fee |

| USDT | \0% (set by P2P sellers and built into the exchange rate) |

Gemini – Trusted Exchange with Peer to Peer Crypto Trading

Gemini, founded by the Winklevoss twins in 2015, is a well-regarded crypto exchange that provides peer to peer crypto trading options. This feature allows users to trade directly with each other, offering flexibility in how trades are executed. Gemini supports a wide range of digital assets and has unique offerings like the Gemini Earn program, where users can earn interest on held cryptos.

Although Gemini’s fee structure can be higher and somewhat complex compared to other platforms, its strong security features, such as insurance for hot wallet assets, make it an attractive option for those prioritizing safety. Users should be mindful of fees, which vary based on trade size and platform usage, before engaging in peer-to-peer crypto exchange trades.

| Supported Coins | Trading Fee |

| 70+ | varies |

KuCoin – Global P2P Crypto Exchange for Emerging Markets

KuCoin is another leading peer to peer crypto exchange, catering to global users, especially in emerging markets where crypto trading restrictions are common. KuCoin supports a wide variety of local payment options like IMPS and UPI, as well as major currencies such as USD, GBP, and EUR, making it highly accessible.

KuCoin’s P2P platform is notable for charging no fees on peer-to-peer trades, with buyers simply paying the exchange rate set by sellers. The platform supports trading in popular cryptos like USDT, BTC, ETH, and USDC. Additionally, KuCoin offers over 700 cryptocurrencies across its entire platform and extends its services to more than 200 countries. Users can also benefit from staking, lending, and other earning opportunities, making KuCoin a comprehensive option for P2P trading.

| Supported Coins | Trading Fee |

| USDT, BTC, ETH, USDC | varies |

Bitget – Multifunctional Platform Offering Peer to Peer Crypto Exchange

Source: Bitget

Bitget, established in 2018, offers a versatile peer-to-peer crypto exchange where users can trade over 500 different cryptocurrencies. Its user-friendly interface makes it ideal for both beginners and experienced traders, offering flexible payment methods and the ability to set custom prices and trade terms.

In terms of security, Bitget incorporates two-factor authentication and a protection fund, ensuring that users are well-covered in the event of any issues. The platform charges a low basic trading fee of 0.1%, although there may be additional costs due to price differences or specific payment methods. Bitget’s peer-to-peer crypto exchange offers global currency support, making it a strong contender for traders seeking flexibility and security.

| Supported Coins | Trading Fee |

| 500+ | varies |

CoinEx – Global Peer to Peer Crypto Exchange with 1,000+ Cryptos and No Fees

CoinEx is one of the top peer to peer crypto exchanges, boasting a comprehensive platform that supports both spot and futures markets. It provides access to over 1,000 cryptocurrencies and more than 1,500 trading pairs, making it a go-to option for over 5 million users worldwide.

While some cryptocurrencies aren’t compatible, CoinEx enables Tether purchases through its peer to peer crypto exchange for account funding. Depending on the user’s location, different payment methods are available. The platform lists the most competitive P2P deals first, with no transaction fees charged to buyers regardless of trade volume. CoinEx uses an escrow system to ensure secure trades between buyers and sellers, making it suitable for both large and small trades alike.

| Supported Coins | Trading Fee |

| USDT | 0% (set by P2P sellers and built into the exchange rate) |

Gate.io – P2P Crypto Exchange with a Global User Base

Gate.io stands out as one of the leading peer to peer crypto exchanges, having been operational since 2013 and serving over 16 million users. This platform allows users to engage in P2P trading of popular cryptocurrencies such as Bitcoin, Ethereum, Tether, and Dogecoin. The peer to peer crypto exchange showcases real-time spot prices, giving buyers a clear view of market-competitive rates.

With support for over 100 payment methods, including bank transfers, e-wallets, and services like WeChat and Western Union, Gate.io makes transactions simple. Buyers on the peer to peer crypto exchange benefit from zero fees, while sellers face a modest fee of up to 0.2%, depending on trading volume.

| Supported Coins | Trading Fee |

| Bitcoin, Ethereum, Tether, Dogecoin | varies |

Coinbase – Access Peer to Peer Crypto Exchange through Coinbase Wallet

While Coinbase itself does not directly offer a peer to peer crypto exchange on its main platform, users can access P2P trading features via the Coinbase Wallet. This wallet supports peer to peer trading of thousands of cryptocurrency tokens, dApps, NFTs, and DAOs.

Coinbase Wallet is self-custody, meaning users retain full control over their assets. Despite Coinbase’s robust security, including two-factor authentication and recovery phrases, some traders may prefer lower-fee alternatives, as Coinbase charges a 1% fee for swaps and up to 3.99% for debit/credit card transactions.

| Supported Coins | Trading Fee |

| BTC, ETH, USDT, USDC, and 1,000 more cryptos. NFTs also supported. | 1% for swapping cryptos |

Uniswap – A Fully Decentralized P2P Crypto Exchange for Ethereum Tokens

Peer to Peer Crypto Exchange – don’t forget Uniswap

Uniswap revolutionizes peer to peer crypto exchanges with its entirely decentralized platform. Without the need for account registration, users can simply connect their wallet and trade thousands of Ethereum-based tokens. The exchange operates autonomously using an Automated Market Maker (AMM) model, which allows buyers to swap tokens without needing a direct counterparty.

Uniswap charges a 0.35% fee per transaction, and users who provide liquidity to the platform can also earn a portion of the fees. It’s one of the top peer to peer crypto exchanges for discovering new ERC-20 tokens and offers yield farming opportunities through its liquidity pools.

| Supported Coins | Trading Fee |

| Most ERC – 20 tokens | Exchange rates set by AMM. 0.35% trading fee charged by Uniswap. |

PancakeSwap – Leading Peer to Peer Crypto Exchange for Binance Smart Chain Tokens

PancakeSwap is the preferred peer to peer crypto exchange for Binance Smart Chain tokens. Like Uniswap, it’s decentralized and doesn’t require users to open accounts. By leveraging the AMM model, users can trade tokens directly from liquidity pools. PancakeSwap is favored for its lower transaction fees of 0.25%, making it a more cost-effective option than some Ethereum-based alternatives.

The platform also offers high-yield farming opportunities, where users can earn rewards by staking tokens. Additionally, PancakeSwap hosts lottery draws, further incentivizing user participation.

| Supported Coins | Trading Fee |

| Most BSc tokens | Exchange rates set by AMM. 0.25% trading fee charged by PancakeSwap. |

Huobi – Peer to Peer Crypto Exchange for USDT, BTC, and ETH

Huobi offers a P2P crypto exchange alongside its low-cost centralized trading platform. Supporting USDT, Bitcoin, and Ethereum, Huobi allows users to trade directly with each other using various payment methods, including TransferWise, Paypal, and SEPA.

Although all users must complete KYC verification before trading on the peer to peer crypto exchange, the platform ensures safety with no commission fees and a 24/7 customer support system. Buyers can browse seller profiles to find the best deals and enjoy a secure trading environment with optional two-factor authentication.

| Supported Coins | Trading Fee |

| HT, USDT, BTC, ETH | Exchange rates are set by sellers. 0% commission fee offered by Huobi. |

LocalBitcoins – Zero Fees on Peer to Peer Crypto Exchange for 30 Days

LocalBitcoins, founded in 2012, is one of the original P2P crypto exchanges, focused entirely on Bitcoin. Users can register and verify their account within minutes to start trading. For the first 30 days, buyers and sellers enjoy zero fees, but note that exchange rates are determined by the seller.

Payment methods like bank transfers typically offer the best rates, while e-wallets and TransferWise might carry additional costs.

| Supported Coins | Trading Fee |

| Bitcoin only | Exchange rates are set by sellers. 0% commission fee is offered by LocalBitcoins for the first 30 days after registering. |

DeFi Swap – Decentralized P2P Crypto Exchange Set to Launch

DeFi Swap is preparing to launch its decentralized peer to peer crypto exchange, offering users a seamless interface for anonymous crypto trades. Without requiring KYC or account registration, DeFi Swap users can simply connect their wallet and start buying and selling BSc tokens through the platform’s AMM model.

With features like yield farming, staking, and a future NFT marketplace, DeFi Swap is set to become a dynamic peer to peer crypto exchange in 2024, offering its own DeFi Coin for trading and investment.

| Supported Coins | Trading Fee |

| Most BSc tokens. Cross-chain compatibility will launch in 2023. | Exchange rates set by AMM. |

Advantages and Risks of Trading Bitcoin and Altcoins on P2P Crypto Exchanges

Trading Bitcoin and other cryptocurrencies on peer-to-peer (P2P) crypto exchanges offers a unique set of opportunities and challenges, as these platforms embrace the decentralized nature of cryptocurrency trading.

Advantages of Peer-to-Peer Crypto Exchanges

- Enhanced Privacy and Control: Peer to peer crypto exchanges generally demand less personal information from users, making them attractive for those who prioritize privacy. Traders can select their trading partners, set their own terms, and choose payment methods, providing a highly customized trading experience.

- Wide Range of Payment Methods: P2P platforms offer flexibility by supporting multiple payment options, such as bank transfers, e-wallets, and even cash transactions. This variety ensures global access and allows users to trade in ways that fit their personal needs.

- No Intermediaries: Direct transactions on P2P crypto exchanges eliminate the need for middlemen, reducing intermediary fees and potentially lowering transaction costs.

- User Empowerment: By facilitating direct interactions between buyers and sellers, peer-to-peer crypto exchanges give users more influence over trading terms, fostering a more balanced trading environment.

Risks Associated with Peer to Peer Crypto Exchanges

- Risk of Scams: Without the oversight of a centralized authority, users face the possibility of encountering fraudulent traders. It is essential to thoroughly vet trading partners to mitigate this risk.

- Price Fluctuations: Prices can vary widely between sellers on P2P crypto exchanges. Traders must have a solid understanding of the market to secure a fair deal.

- Payment Disputes: Since transactions occur directly between individuals, disputes over payments or fund receipts may arise. While escrow services are often available, they are not completely fail-safe.

- Regulatory Uncertainty: The evolving regulatory framework surrounding P2P exchanges poses a risk, as changes in law could affect the legality or operation of these platforms in certain regions.

- Technical Complexity: Peer-to-peer crypto exchanges may be less intuitive than traditional platforms, which could create difficulties for beginners and lead to potential transaction errors.

In summary, while peer-to-peer crypto exchanges provide a more personalized and potentially cost-effective approach to trading, they demand greater vigilance and responsibility from users. For those seeking more advanced trading options, margin trading on other platforms may offer the chance to trade with leverage and potentially increase profits. However, it’s essential to fully understand the risks involved. By being aware of both the benefits and challenges, traders can enjoy a more secure and rewarding experience on P2P platforms.

Crypto and Bitcoin P2P Exchange Fees

How are P2P Cryptocurrency and Bitcoin Transaction Fees Different?

Understanding the fee structure on a peer to peer crypto exchange is essential for efficient trading, as it can differ significantly from traditional exchanges.

- Transaction Fees: P2P crypto exchanges typically impose a small transaction fee, often a percentage of the trade amount, which may be shared between the buyer and seller.

- Escrow Fees: Many P2P platforms offer escrow services to safeguard transactions, adding a minimal fee to ensure security during the trade.

- Withdrawal Fees: When moving cryptocurrency to external wallets, withdrawal fees apply, which can fluctuate based on the congestion of the blockchain network.

- Advertisement Fees: If you frequently post trade advertisements or operate commercially on the platform, there may be additional fees for promoting your offers.

- Currency Conversion Fees: Trades involving different currencies may come with conversion fees, often embedded within the exchange rate itself.

Being aware of these costs allows traders to manage their expenses and optimize their trading strategies on peer-to-peer crypto exchanges. Always review the fee structure of the platform before starting a trade.

How to Stay Safe While Using P2P Crypto Exchanges?

Tips for Avoiding Scams

Scams are a significant concern when using a peer to peer crypto exchange. However, by following these safety practices, you can greatly reduce the risk:

- Research the counterparty: Before initiating a trade on a peer-to-peer crypto exchange, make sure to review the reputation and feedback of the buyer or seller. Many P2P platforms allow users to leave reviews, and you should avoid trading with individuals who have negative reviews or no trading history.

- Communicate only through the platform: Always use the communication features provided by the peer-to-peer crypto exchange to discuss the trade. Avoid sharing personal information or conducting discussions off-platform, as it can make resolving disputes more challenging.

- Verify trade terms carefully: Ensure you fully understand the trade terms and feel comfortable with the payment method. Some scammers may attempt to confuse or take advantage of you with complex or unusual terms.

- Double-check transaction details: When sending cryptocurrency or fiat money, make sure all transaction details are correct before confirming the transfer. Sending funds to the wrong address on a peer-to-peer crypto exchange can result in irreversible losses.

Verifying the Identity of the Counterparty

Verifying the identity of the counterparty is important in cryptocurrency investing

Trust is vital in peer to peer crypto exchange transactions, and many platforms offer tools to help verify the identity and reputation of the counterparty:

- KYC and AML requirements: Some peer-to-peer crypto exchanges require identity verification through Know Your Customer (KYC) and Anti-Money Laundering (AML) processes. These measures help ensure the counterparty is a legitimate entity or individual. Always opt for platforms offering these services if identity verification is important to you.

- User ratings and feedback: Before proceeding with a transaction, take time to review the counterparty’s ratings, feedback, and transaction history on the peer-to-peer crypto exchange. Reputable traders with positive feedback are less likely to engage in fraudulent behavior.

- Verify payment methods: When using fiat payment methods (e.g., bank transfers, PayPal), confirm that the account details match the counterparty’s name. If something seems suspicious, it’s safer to cancel the transaction.

Choosing Reputable Platforms

The safety of your transactions heavily relies on the peer to peer crypto exchange platform you choose. Here’s how to select a secure platform:

- Look for platform reviews and ratings: Check online reviews, forums, and ratings for the peer-to-peer crypto exchange. Reputable platforms usually have a history of positive user feedback.

- Security features: Choose peer-to-peer crypto exchanges with built-in security features such as escrow services, two-factor authentication (2FA), and dispute resolution mechanisms.

- Active customer support: In case of issues, having access to responsive customer support is crucial for resolving disputes and addressing platform reliability concerns.

- Regulatory compliance: Opt for peer-to-peer crypto exchanges that comply with local and international regulations regarding crypto trading. Platforms that follow legal and regulatory standards are more likely to be secure.

Utilizing Escrow Services Effectively

Escrow services are a key feature on most peer to peer crypto exchanges, acting as a neutral third party that holds the cryptocurrency during a trade until both parties fulfill their obligations.

- Ensure escrow is used: Always use the escrow service provided by the peer-to-peer crypto exchange for your transactions. This will safeguard your funds until the trade is successfully completed.

- Check the escrow release: Do not release cryptocurrency from escrow until you’ve received payment or goods. Some scammers may try to pressure you into releasing funds early, which can result in losses.

- Review dispute resolution terms: Each peer-to-peer crypto exchange has its own process for handling disputes. Make sure you understand the platform’s dispute resolution policies and under what circumstances escrow funds are released.

Common Mistakes to Avoid

What are the common mistakes to avoid when investing in P2P exchanges?

Even experienced traders can make errors when using peer to peer crypto exchanges. Avoid these common mistakes:

- Skipping research on counterparties: Failing to properly research who you are trading with can increase the risk of falling victim to scams on peer-to-peer crypto exchanges.

- Not using escrow: Some traders may offer incentives to bypass the platform’s escrow service, but doing so significantly increases your risk of losing funds.

- Trusting off-platform communications: Scammers often try to lure traders off the peer-to-peer crypto exchange by offering better deals through direct messaging. These trades cannot be protected by the platform’s security features.

- Rushing through transactions: Take your time to carefully review trade terms, payment details, and the release of funds. Hasty decisions can lead to errors or fraud.

Best Practices for Securing Your Cryptocurrency

Finally, it’s essential to secure your cryptocurrency during and after trading on a peer to peer crypto exchange to prevent theft or loss:

- Use a hardware wallet: Store your cryptocurrency in a hardware wallet, which provides more security than hot wallets (connected to the internet). Only transfer the necessary amount to your hot wallet when trading on a peer-to-peer crypto exchange.

- Enable two-factor authentication (2FA): Activate 2FA on the peer-to-peer crypto exchange platform to add an extra layer of security to your account.

- Regularly update passwords: Use strong, unique passwords for your accounts on crypto exchanges, and update them frequently to enhance security.

- Be cautious with public Wi-Fi: Avoid making cryptocurrency transactions over unsecured public Wi-Fi networks, as these are vulnerable to cyberattacks that could compromise your account information on peer-to-peer crypto exchanges.

Peer to Peer Crypto Exchange – Frequently Asked Questions

What Is Peer to Peer Crypto Exchange Lending?

Peer to peer crypto exchange lending involves loaning your cryptocurrency to another individual under agreed-upon terms and conditions. Typically, lenders can set the interest rates they wish to charge and deposit their crypto into a lending pool on a peer-to-peer crypto exchange platform.

Is Peer to Peer Crypto Exchange Good for Crypto?

Peer-to-peer crypto exchanges reflect the original vision behind cryptocurrency—removing third parties and financial institutions from transactions. Although intermediaries eventually became involved due to the technical complexity of early crypto, P2P exchanges preserve the core goal of decentralized, direct trading.

Is P2P Crypto Exchange Safe?

While trading crypto directly with someone on a peer to peer crypto exchange can be safe, it requires trust that the other party will fulfill their obligations. In some cases, knowing the counterparty personally can enhance security and reduce risks.

What Is Peer to Peer Lending in Crypto?

Peer-to-peer (P2P) lending in cryptocurrency involves lending your crypto assets directly to another individual, under agreed-upon terms and conditions. Typically, lenders can set their preferred interest rates and deposit their digital assets into a lending pool. Unlike the structure found in the best centralized exchange, P2P lending eliminates the need for a middleman, giving users more control over their lending process.

Is P2P Good for Crypto?

P2P lending is fundamental to the original vision of cryptocurrency, which aimed to cut out third parties like banks and financial institutions from transactions. Despite this, centralized institutions, including the best centralized exchanges, became involved due to the complexity of crypto for many users in its early stages. While P2P lending still honors the decentralized roots of crypto, centralized platforms can offer more accessible alternatives for new investors.

Is Peer to Peer Crypto Safe?

Engaging in P2P transactions can be safe, but it depends largely on the trust you place in the other party. While platforms like the best centralized exchanges provide additional layers of security and buyer protection, P2P lending requires users to ensure they trust the borrower or know them personally to avoid risks.

Are Peer to Peer Crypto Exchanges Safe?

Peer-to-peer (P2P) crypto exchanges often implement escrow systems to bolster transaction security. In this setup, the cryptocurrency is held in escrow until both parties confirm that the transaction has been satisfactorily completed. However, users should exercise due diligence when selecting trading partners and prioritize platforms that offer robust security features.

Can I Use Fiat Currency on P2P Crypto Exchanges?

Yes, most peer to peer crypto exchanges accommodate various fiat currencies and provide multiple payment options, including bank transfers, online wallets, and sometimes even cash. This flexibility allows traders from diverse geographic locations to participate with ease.

How Are Disputes Resolved on Peer to Peer Crypto Exchanges?

Most peer to peer crypto exchanges have a dispute resolution mechanism in place. If a disagreement arises between the buyer and seller, the platform’s support team steps in to review the transaction details based on submitted evidence, such as payment receipts, to make an informed decision.

Are Earnings from Peer to Peer Crypto Trading Taxable?

Yes, in many regions, profits from crypto trading are subject to taxation. This can include capital gains tax or income tax, depending on trading frequency and transaction volume. It’s advisable to consult with a tax professional to understand your specific tax obligations related to peer-to-peer crypto exchange activities.

What Should I Look for in a Trader’s Profile Before Transacting on a Peer to Peer Crypto Exchange?

Before initiating a transaction, review the trader’s reputation score, feedback from prior transactions, and their transaction history. Opt for traders with high positive feedback and a significant history of completed trades to reduce risks associated with peer-to-peer crypto exchanges.

How Is Price Determination Handled on Peer to Peer Crypto Exchanges?

On peer-to-peer crypto exchanges, prices are set by the sellers themselves. This can result in a broad spectrum of prices for the same cryptocurrency. Buyers should compare various offers and consider market trends to ensure they receive a fair deal.

Can I Trade Anonymously on Peer to Peer Crypto Exchanges?

While peer-to-peer crypto exchanges provide more privacy than traditional exchanges, complete anonymity is uncommon. Most reputable platforms require some form of identity verification to enhance security and comply with regulatory requirements, such as anti-money laundering (AML) laws.

Should You Join a Peer to Peer Crypto Exchange in 2024?

What should P2P exchanges change to attract more investors?

What should P2P exchanges change to attract more investors?

Peer-to-peer (P2P) crypto exchanges have gained significant traction in recent years due to their decentralized nature and user-centric approach. As the cryptocurrency landscape continues to evolve, the future of P2P crypto exchanges looks increasingly promising, with several factors driving their growth.

Growing Interest in Decentralized Trading

The demand for decentralized trading solutions has been growing rapidly as more users seek alternatives to traditional centralized exchanges. Peer-to-peer crypto exchanges align with this trend, offering greater privacy, control, and freedom over assets. As cryptocurrency adoption increases globally, P2P exchanges are expected to play a pivotal role in promoting decentralized finance.

- Increased privacy: Many users prefer P2P exchanges because they offer more anonymity compared to centralized exchanges that require extensive identity verification.

- Greater control: P2P exchanges empower users by giving them full control over their funds and trades, without relying on a third-party intermediary to hold or manage their assets.

- Global reach: Peer-to-peer crypto exchanges can facilitate cross-border transactions without the need for banks or traditional financial systems, expanding access to underbanked populations.

Innovations in P2P Exchange Technology

As technology evolves, peer to peer crypto exchanges are expected to see several innovations aimed at improving user experience, security, and efficiency.

- Smart contracts and automation: The integration of smart contracts on P2P crypto exchanges can automate the execution of trades, minimizing the risk of fraud and disputes. Smart contracts ensure that transactions are only completed when both parties meet agreed-upon conditions, adding a layer of security.

- AI-powered fraud detection: Artificial intelligence (AI) is being increasingly used to detect and prevent fraudulent activities on P2P platforms. By analyzing user behavior, AI algorithms can identify suspicious patterns and flag potential scams.

- Improved escrow services: Innovations in escrow systems will enhance trust in P2P crypto exchanges. Some platforms are exploring multi-signature escrow solutions that require approval from multiple parties before releasing funds, providing added security for users.

Integration of DeFi (Decentralized Finance) Features

One of the most exciting developments in the world of peer to peer crypto exchanges is the integration of DeFi features. As the lines between P2P exchanges and decentralized finance blur, users will benefit from a wide array of financial services that were previously exclusive to traditional financial institutions.

- Lending and borrowing: Many peer-to-peer crypto exchanges are beginning to incorporate decentralized lending and borrowing platforms, allowing users to lend their crypto assets or take out loans directly from other users without the need for intermediaries.

- Yield farming: Users of P2P exchanges could also take advantage of DeFi-based yield farming mechanisms, where they earn interest or rewards by staking their cryptocurrency in liquidity pools.

- Stablecoin integration: Stablecoins, which are pegged to traditional fiat currencies, are becoming increasingly integrated into P2P exchanges. This provides a more stable trading environment, allowing users to hedge against market volatility.

Trends in Regulatory Frameworks Affecting P2P Exchanges

As peer to peer crypto exchanges grow in popularity, governments and regulatory bodies are starting to pay closer attention to how these platforms operate. While regulations are still evolving, several trends are likely to shape the regulatory landscape for P2P crypto exchanges.

- Stricter KYC and AML regulations: Governments worldwide are pushing for stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements on P2P exchanges to prevent illegal activities, such as money laundering and terrorism financing. While this may affect the decentralized nature of P2P platforms, it could also increase trust and legitimacy.

- Licensing and compliance: Some countries are implementing licensing requirements for P2P exchanges, ensuring they meet certain legal standards. This can lead to more transparency and protection for users while making it harder for fraudulent platforms to operate.

- Cross-border regulation: As P2P exchanges facilitate international transactions, regulatory challenges arise concerning cross-border trade. Governments are working on creating global frameworks to regulate these transactions, ensuring compliance with international standards.

Predictions for the Next 5-10 Years

Looking ahead, peer to peer crypto exchanges are poised to undergo significant transformation. Over the next 5-10 years, we can expect several key developments:

- Wider adoption: As the global cryptocurrency user base continues to expand, more people will turn to peer-to-peer crypto exchanges for secure, private, and decentralized trading.

- Increased integration with traditional financial systems: As P2P crypto exchanges gain legitimacy, we may see more integration with traditional financial services, such as banking institutions offering services tailored to crypto traders or using blockchain for cross-border payments.

- Maturation of regulatory frameworks: Regulatory frameworks around P2P exchanges are expected to mature, creating a balance between user privacy and compliance with international laws. This will likely lead to a safer and more secure environment for trading on P2P platforms.

- Greater emphasis on security: As the threat of hacking and scams persists, future P2P exchanges will place even greater emphasis on user security, with advances in encryption, AI, and multi-layer authentication systems.

- Rise of hybrid exchanges: We could see the rise of hybrid exchanges that combine the benefits of peer-to-peer and centralized exchanges, offering both decentralized trading and the liquidity and efficiency of traditional platforms.

Conclusion

The rise of peer to peer crypto exchanges marks a significant shift in the cryptocurrency landscape. CoinReviews believes that these platforms will continue to gain momentum, driving a new era of trading characterized by increased security, transparency, and user empowerment. As we move forward, the emphasis on direct transactions without intermediaries will reshape the way digital assets are exchanged, fostering a more inclusive and decentralized financial ecosystem. Embrace the future with the best peer to peer crypto exchange solutions, and stay ahead in the dynamic world of cryptocurrency with CoinReviews.

Read more:

- Binance Review: Features, Supported Cryptos and Fees!

- Bybit Review: Pros, Cons and Key Features

- OKX Review: Pros, Cons, Future Potential & More

- HTX Review: Fees, Security, Pros & Cons

- Bitget Review: Pros & Coins, Fees & More

- Bitfinex Review: Is It Secure or Scam?

- Kucoin Review: Social Trading, Fees, Pros & Cons

- Crypto.com Review: Is the Exchange Safe or Scam?

- BingX Review: Verified Reviews, Pros & Cons

- LBank Review: Should You Use It?

- bitFlyer Review: Pros & Cons and Ratings

- ProBit Review: Is It the Right Crypto Exchange for You?

- P2B Review: Fees, Features, Safety, Pros & Cons

- Pionex Review: Pros, Cons & All You Need to Know

- BitMEX Review: Fees, Trading, Staking & More

- Phemex Review: Is It a Good Crypto Exchange?

- BTSE Review: Is It Safe & Reliable?

- CoinEx Review: Is This Crypto Exchange Safe?

- Poloniex Review: Features, Regulation & Risks

- BITFLEX Review: Features, Safety, Pros & Cons

- CoinJar Review: Is It the Right Exchange for You?

- Paymium Review: Pros, Cons, Key Features & Fees

- LBank Review: Is It the Right Exchange for You?

- MEXC Review: Latest Pros, Cons, Key Features & Fees

- BitMart Review: Reviews, Trading Fees & Cryptos