As we step into 2025, the cryptocurrency market continues to mature. With this growth comes an increasing emphasis on platform quality and integrity. In our comprehensive Uphold Review, brought to you by CoinReviews, we assess whether Uphold meets these heightened standards.

We examine the platform’s performance, security protocols, and customer support to determine if it remains a reliable choice for crypto investors in the new year.

What is Uphold?

Rather than focusing solely on cryptocurrencies like a typical crypto exchange, Uphold operates as a multi-asset trading platform. This allows users to buy, sell, and manage a range of assets all in one place, including:

- Cryptocurrencies: Popular options such as Bitcoin, Ethereum, Ripple, and more.

- Precious Metals: Gold and silver for those looking for a safeguard against inflation.

- FIAT Currencies: Trade familiar currencies like USD, GBP, and EUR.

Uphold was founded with the goal of making financial services more accessible, transparent, and efficient. Over time, it has grown into a versatile platform that enables users to buy, hold, convert, and transact across both traditional and digital currencies.

Is Uphold Exchange Trustworthy?

Uphold Review: Overall Rating

| Feature | Insider rating (out of 5) |

| Fees | 3.50 |

| Investment selection | 3.50 |

| Access | 4.50 |

| Ethics | 2.00 |

| Customer support | 4.00 |

| Security | 2.50 |

| Overall score | 3.35 |

How Uphold Works?

According to our Uphold Review, it’s evident that the platform offers extensive support for over 250 cryptocurrencies, along with various stablecoins like Tether and USD Coin. Uphold also provides access to unique environmental assets, including UPCO2, the first tradeable carbon credit token, and Bitcoin Zero. Additionally, users can purchase gold, silver, platinum, palladium, and over 20 different fiat currencies.

Personal Crypto Trading Account

With a Personal Crypto Trading Account on Uphold, retail traders gain access to essential features such as automatic recurring trades, integrated wallet storage, and basic stop orders. The platform also offers fast deposits, 0% deposit fees, and no withdrawal fees, enhancing its cost-effectiveness for users.

Uphold’s take-profit feature allows you to automatically sell assets when they reach a set profit percentage. Similarly, the trailing stop-loss feature helps minimize potential losses by selling an asset when it hits a predetermined stop price, adding an extra layer of security for traders.

Another notable advantage covered in this Uphold Review is the AutoPilot option, which leverages dollar-cost averaging (DCA) to mitigate volatility in crypto trading. Users can schedule automatic recurring trades and benefit from Uphold’s DCA calculator to optimize their strategies.

Uphold Vault

The Uphold Review also highlights the Vault, Uphold’s latest assisted self-custody solution, designed to provide enhanced security through a multi-signature framework. With Vault, users’ crypto assets can only be moved using their personal Vault key, plus a backup key. For added protection, Uphold offers assisted key recovery services and 24/7 trading access.

Currently, Vault supports only Bitcoin and XRP, but Uphold plans to extend this self-custody solution to other networks by 2024. Meanwhile, users can store additional assets either through Uphold’s full custody service or a traditional self-custody wallet.

Business Account

Business owners will find Uphold’s Business Account useful for securely transferring assets to employees worldwide with speed and ease. The account includes free asset storage, low-cost currency conversions between fiat currencies and precious metals, and robust asset and data protection.

Additionally, Uphold’s Business Account comes with built-in know-your-customer (KYC) verification, anti-money laundering (AML) features, and financial risk controls, ensuring compliance and security for businesses operating on the platform.

Company Overview

Founded in 2015, Uphold has grown into a well-established cryptocurrency exchange, serving users across 180 countries. What sets Uphold apart from other exchanges is its unique financial offering. Along with the ability to purchase cryptocurrency, users can also invest in precious metals, making it a more versatile platform.

One of Uphold’s standout features is the ability to trade between different currencies without needing to first convert assets back into cash. Additionally, the platform offers a cashback debit card, allowing users to make payments using the assets they hold on Uphold. For example, customers can choose to pay with cryptocurrency or fiat currency. However, this feature is currently only available to users in the United Kingdom. While the card can be used internationally, residents of other countries will need to wait until Uphold expands this service to their regions.

Uphold currently supports nearly 260 cryptocurrencies, including well-known options like Litecoin, Bitcoin, and Stellar Lumens. Headquartered in New York, the company now boasts over 10 million users and holds more than $2.7 billion in financial reserves.

Pros and Cons of Uphold

| Pros | Cons |

| Wide selection of cryptocurrencies to choose from. | High spread fees, particularly for cryptocurrencies with lower liquidity. |

| Supports trading of fiat currencies and precious metals. | No discounts for larger volume trades. |

| Quick and easy account setup with a low minimum deposit requirement. | Equity trading is unavailable for users in the U.S. and Europe. |

| Cashback debit card feature. | Customer support is somewhat limited. |

| No fees for deposits or withdrawals in most regions. |

Competitors of Uphold

Uphold Exchange Highlights Compared to Other Exchanges

Comparison with Popular Platforms (Coinbase, Binance, Kraken)

Coinbase

- User Experience: Coinbase is known for its simple, beginner-friendly interface, similar to Uphold. Both platforms offer easy registration, but Coinbase has more educational tools for new users.

- Supported Assets: Coinbase primarily focuses on cryptocurrencies and offers fewer asset types compared to Uphold, which supports fiat, commodities, and equities as well.

- Fees: Coinbase typically has higher fees than Uphold, especially for smaller trades. Uphold’s transparent fee structure can be more appealing for cost-conscious users.

- Security: Both platforms prioritize security, with features like 2FA, cold storage, and regulatory compliance. However, Coinbase’s size and regulatory framework (as a publicly traded company) may offer additional trust for users.

- Customer Support: Uphold and Coinbase both receive mixed reviews for customer support, with occasional complaints about slow responses.

Binance

- User Experience: Binance offers a more complex and advanced platform compared to Uphold. It’s geared towards experienced traders with features like margin trading, futures, and advanced charting tools, while Uphold is designed for simplicity.

- Supported Assets: Binance supports a wider range of cryptocurrencies than Uphold, but Uphold offers a more diverse asset selection (including metals and equities) beyond just crypto.

- Fees: Binance generally has lower fees than Uphold, especially for high-volume traders. Binance’s fee discounts via BNB token holdings make it a more cost-effective platform for heavy users.

- Security: Both Binance and Uphold offer strong security features, but Binance has experienced notable security breaches in the past. Uphold’s insurance policy and more conservative approach to risk management might offer additional peace of mind for some users.

- Customer Support: Binance offers 24/7 support and a more extensive help center. However, both platforms have similar issues when it comes to the speed and effectiveness of customer support.

Kraken

- User Experience: Kraken, like Binance, offers a more advanced trading experience, with features like margin and futures trading. Uphold’s platform is much more streamlined for users looking for simplicity.

- Supported Assets: Kraken primarily supports cryptocurrencies, while Uphold has a more diverse portfolio, including precious metals and fiat currencies.

- Fees: Kraken’s fee structure is generally more competitive for high-volume traders, but Uphold can offer better deals for smaller traders with its simple fee system.

- Security: Kraken has a strong reputation for security, with no major breaches in its history. Uphold also prioritizes security, but Kraken’s robust safety record gives it an edge here.

- Customer Support: Both platforms offer solid customer support, though Kraken is often praised for its more responsive service.

What Makes Uphold Different or Better Than Competitors?

- Diverse Asset Support: Unlike Coinbase, Binance, or Kraken, Uphold goes beyond just cryptocurrencies, offering trading in fiat currencies, commodities (like gold and silver), and equities. This makes Uphold a more versatile platform for users looking to diversify their portfolio.

- All-in-One Platform: Uphold’s ability to hold, convert, and trade between different asset classes (crypto, fiat, metals) in a single interface provides a unique edge over crypto-only exchanges. This makes it easier for users to manage their wealth across multiple types of assets without the need for multiple platforms.

- Uphold Card: Within this Uphold Review, the availability of the Uphold debit card allows users to spend their crypto and other assets in the real world, a feature that many competitors like Kraken and Binance are still developing or only partially offering.

- Transparent Fee Structure: Uphold offers a clear and simple fee structure that is easy to understand, in contrast to the sometimes complex tiered fees of Binance or Coinbase. There are no hidden fees, which can make it a more attractive option for casual users.

- Global Reach with Accessibility: Uphold is available in over 180 countries, allowing more users globally to access financial services. Its multi-asset support combined with a user-friendly interface makes it appealing to a wider audience, from beginners to international investors.

Use Cases Where Uphold Might Be a Better Option

- Diversified Portfolio Management: Users looking to invest in both cryptocurrencies and traditional assets (like gold or stocks) will benefit from Uphold’s wide range of supported assets. This makes it ideal for investors who want to manage various types of assets on a single platform.

- Casual or Beginner Traders: Uphold’s simple interface and transparent fee structure make it perfect for beginners who may find Binance or Kraken’s advanced trading options overwhelming.

- Frequent Asset Conversions: Users who regularly convert between cryptocurrencies, fiat currencies, and commodities may find Uphold more convenient due to its easy cross-asset conversions.

- Global Users Seeking a Debit Card: International users who want the convenience of a crypto debit card for daily purchases would find Uphold’s card to be an advantage. It’s ideal for those looking to use their crypto or metals holdings as real-world currency.

- Fee-Conscious Small Traders: For users who don’t trade large volumes, Uphold’s clear fee structure, with no hidden costs, can offer a better experience than platforms with complex fee schedules based on volume or token holdings.

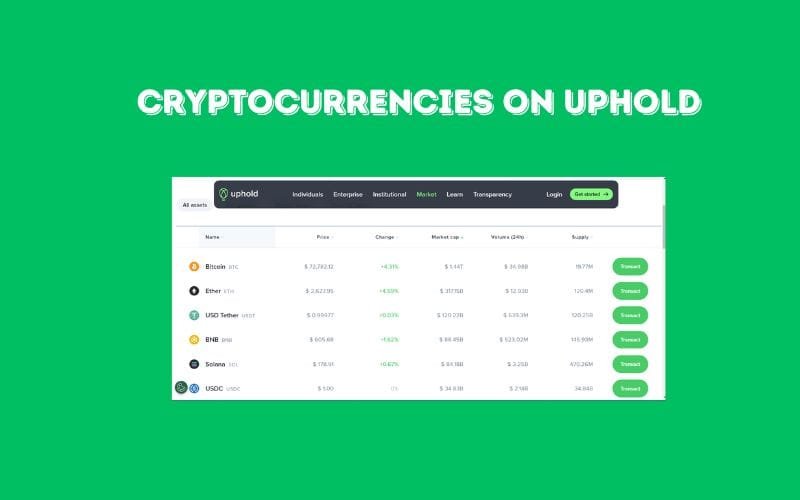

Cryptocurrencies on Uphold

Source: Uphold

Source: Uphold

At present, Uphold provides access to more than 260 currencies for users to buy, sell, and trade. The available cryptocurrencies include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Ripple (XRP)

- Chainlink (LINK)

- Stellar Lumens (XLM)

- Iota (MIOTA)

Trade Experience

Within this Uphold Review, the platform offers a user-friendly trading experience with the ability to trade through both its desktop platform and mobile apps, available on Android and iOS. The interface is designed to be intuitive, making it a great choice for beginners who are just starting with crypto trading. One standout feature appreciated by both novice and experienced traders is Uphold Baskets, a curated collection of cryptocurrencies selected by Uphold to simplify the trading process.

What makes Uphold different from many competitors is the option to trade within asset classes, a feature that enhances its platform’s versatility. Users can also take advantage of the AutoPilot feature, which facilitates recurring purchases and uses dollar-cost averaging to reduce the effects of market volatility. However, this Uphold Review also highlights some limitations: the platform only supports one order type—limit orders—so those seeking more advanced order types may need to explore other platforms. Additionally, Uphold lacks advanced charting tools and other features that more sophisticated traders often seek.

Uphold Review: Fees

While assessing this Uphold Review, while the platform offers 0% trading commissions, it applies spread fees on cryptocurrency transactions, which can be relatively high. These spread fees typically range from 0.25% to 2.65% for popular cryptocurrencies, with potentially higher fees for lower-liquidity assets. Additionally, during periods of market volatility, spread fees on Uphold may increase.

Users should also be aware of deposit, withdrawal, and other miscellaneous fees that may apply. For example, crypto network fees are charged when withdrawing to an external wallet, which is standard across most providers. As outlined in this Uphold Review, the platform also imposes varying spread fees for other asset classes, which can fluctuate based on market conditions.

| Action | Fee |

| Fiat currencies | 0.2% spread fee |

| Metals | 2% spread fee |

Uphold Wallets

Unlike many other platform wallets, the Uphold wallet offers features that allow users to not only store but also spend their existing crypto. With the Uphold wallet, users can:

Make payments to vendors directly.

Send money to friends or family.

Instantly convert crypto into other cryptocurrencies or local currencies.

Additionally, users can easily view and manage their individual digital wallets from the Portfolio page, streamlining the process of handling multiple assets. This functionality sets the Uphold Review apart in terms of versatility and user convenience.

Security of Uphold

Uphold’s security is highly regarded by many investors.

Uphold’s security is highly regarded by many investors.

Throughout this Uphold Review, the platform implements industry-standard security protocols, including KYC (Know Your Customer) verification and two-factor authentication. Most user funds are stored offline in cold storage, which is considered more secure than online hot wallets. Uphold also provides users with essential guidance on best security practices and tips for identifying and avoiding scams.

Additionally, Uphold runs a bug bounty program in collaboration with Intigriti, a third-party security firm, allowing users to report any bugs they encounter on the platform. Uphold’s staff members undergo background checks and participate in regular privacy training to further ensure the platform’s security.

Beyond these strong security measures, Uphold is a 100% reserved, regulated, and transparent platform. It openly displays its assets and liabilities to current and potential users, while complying with regulatory standards from various international agencies, such as:

- FinCEN in the U.S.

- FCA in the U.K.

- Fintrac in Canada

This level of transparency adds to Uphold’s credibility in the financial industry.

Opening an Account

Creating an account on Uphold is a straightforward process. To begin, simply click the “Sign Up” button in the upper right-hand corner of the Uphold website. You’ll be asked to provide basic information such as your email address, password, country of residence, and nationality. Afterward, additional details will be required for identity verification, including submitting a government-issued ID.

Once you’ve completed the information and reviewed Uphold’s terms of service, you’ll receive a confirmation email. After verifying your email address, your account will be ready to use.

For investors looking for different ways to store cryptocurrency, Uphold offers three distinct storage options:

UPHOLD: A self-custody wallet that enables you to store and manage Bitcoin, Ethereum, and NFTs.

Vault: Assisted self-custody, where users control the private keys and have access to over 260 assets.

Uphold Wallet: A fully reserved cryptocurrency wallet, where assets are held securely and never loaned out.

These storage methods provide flexibility, allowing investors to choose the option that best fits their needs.

Customer Service

Uphold provides limited customer service options. Users can utilize a live chat feature through the Uphold app. Additionally, support can be requested by filling out a help form on the Uphold website, or by reaching out to the company via its account on X (previously known as Twitter).

Customer Satisfaction

Customer feedback in the Uphold Review tends to be divided, with ratings frequently split between five-star and one-star reviews. Many users express dissatisfaction with issues such as poor communication, account lockouts, and delays in profile verification. While it’s common for no company to achieve a flawless satisfaction rating, these recurring problems are important to note for potential users.

On the flip side, Uphold also garners a significant number of 5-star reviews. Customers who praise the platform often highlight its wide range of products and the ease of use. One consistently praised aspect of the Uphold Review is the mobile experience, with the Android app receiving a solid 4.4 out of 5 rating, and the iOS app an impressive 4.7 out of 5. These high ratings reflect strong user satisfaction with Uphold’s mobile platform.

Account Management

In the Uphold Review, users can manage their accounts through the company’s website or mobile apps. Once logged in, they can utilize the online dashboard or app to buy, sell, and trade assets, as well as monitor their portfolio and perform other activities. However, due to the platform’s limited customer support options, users may find themselves largely self-reliant when it comes to managing their accounts and resolving issues independently.

Features of Uphold App

Within this Uphold Review, the platform’s mobile app offers a user-friendly experience, with an interface that mirrors the desktop version and provides all the same features. Available for free download on both Android and iOS stores, the app maintains a clean and straightforward design. The simplicity of the layout makes it particularly appealing to users who prefer a non-complicated platform, ensuring that even beginners can navigate it with ease.

Uphold’s app is very user-friendly.

Uphold’s app is very user-friendly.

Uphold Review – Frequently Asked Questions

Is Uphold a secure platform?

Uphold employs several security measures, including encryption technology, due diligence on third-party providers, regular security audits, and its BugBounty program. However, the platform is currently facing a class-action lawsuit that claims a failure in its two-factor authentication system led to the theft of users’ cryptocurrency.

What are the fees on Uphold?

Uphold charges relatively high fees, ranging from 0.25% to 2.95%, depending on the asset class, liquidity, and trading volume. Cryptocurrencies with lower liquidity often incur higher spread fees. Additionally, the Uphold Vault service is available for $4.99 per month or $49.99 annually.

Can I purchase stocks on Uphold?

As of 2023, U.S.-based users can no longer trade stocks on Uphold, as the company discontinued its equity trading services in the U.S. If you’re looking to invest in traditional stocks, you may want to explore other top-rated stock trading platforms.

Is Uphold more affordable than Coinbase?

While Coinbase offers a broader range of tradable cryptocurrencies compared to Uphold, it doesn’t support precious metals or as many national currencies. On Uphold, users can trade assets across different classes—such as exchanging Bitcoin for platinum—which is a unique feature that Coinbase doesn’t provide.

Does Uphold accept users from the United States?

Yes, Uphold accepts customers from the USA. However, staking services are currently unavailable for U.S. users.

Is Uphold a safe and legitimate platform?

Uphold is considered a safe and legitimate platform, with millions of users and regulatory oversight. The platform conducts regular stress tests, security audits, and even offers a public bug bounty program to maintain its security standards.

Is Uphold Exchange Reliable in 2025?

Should you trade on Uphold in the future?

When considering cryptocurrency exchanges, reliability is one of the key factors users look for, especially as the market continues to grow in complexity. In this Uphold Review, we’ll assess the platform’s reliability and whether it remains a top choice in 2025.

Uphold has established itself as a versatile exchange that supports a wide range of assets beyond just cryptocurrencies. It offers access to fiat currencies, precious metals, and equities, all within one platform. This unique feature sets it apart from many other exchanges, making it attractive to users who want to diversify their investments. But is Uphold still reliable in 2025?

One of the most important aspects of an exchange’s reliability is security. Uphold continues to maintain strong security measures such as two-factor authentication (2FA), encryption, and cold storage for its users’ assets. These features have kept Uphold free from major security breaches, which is a critical indicator of trustworthiness in the crypto space. Moreover, in 2025, Uphold remains fully compliant with various financial regulations across the regions it operates in. This regulatory compliance not only protects users but also adds a layer of legitimacy to the platform.

Another key factor in reliability is platform uptime and transaction processing. Throughout its history, Uphold has consistently maintained good operational performance with minimal downtime, ensuring that users can access their assets and trade without interruptions. In this Uphold Review, it’s worth noting that the platform has implemented further upgrades to enhance transaction speeds and ensure scalability as more users join the platform in 2025. The user experience remains smooth, whether through the web or mobile app.

The Uphold Review also highlights the platform’s transparency with fees. Unlike many exchanges that have hidden or complex fee structures, Uphold maintains a straightforward approach. This transparency builds user trust and contributes to its reliability. By offering clear, predictable fees, Uphold helps users avoid unexpected costs, which is a major pain point with many other platforms.

Customer support is another essential aspect of an exchange’s reliability. Uphold has made improvements to its customer service in 2025, with faster response times and additional support channels. This change addresses one of the main criticisms from previous years and adds to the platform’s growing reliability.

In conclusion, this Uphold Review shows that the platform remains highly reliable in 2025, thanks to its strong security measures, regulatory compliance, consistent performance, and user-focused improvements. For users looking for a trustworthy exchange that offers more than just cryptocurrency trading, Uphold continues to be a solid option. Whether you’re a beginner or an experienced investor, Uphold’s reliability in 2025 ensures a smooth and secure trading experience.

Final thoughts on Uphold

Throughout this Uphold Review, it’s clear that Uphold stands out as one of the few platforms that offer a wide range of assets in one place. This feature allows customers to easily exchange between cryptocurrencies, national currencies, and even precious metals, making it a versatile tool. The platform’s fee structure is generally reasonable, with low deposit and withdrawal fees, making it a cost-effective option for most users.

Uphold excels as a multi-asset trading platform, much like a Swiss Army knife that handles multiple tasks efficiently but doesn’t specialize in any one area. As a result, Uphold can be seen as a “jack of all trades, master of none” platform, providing basic functionality across different asset types without offering the advanced tools some users may seek.

However, as this CoinReviews analysis points out, Uphold’s limitations become apparent for more active traders. The lack of advanced charting features, specialized order types, and other sophisticated tools, such as crypto bots, copy trading, or Earn programs, may not satisfy experienced users. Additionally, with the discontinuation of stock and ETF trading, Uphold has lost some competitive advantages.

In summary, Uphold is ideal for investors looking for an easy-to-use platform to trade assets across different classes, but advanced traders might find it lacking. For those seeking a more feature-rich experience, exchanges like Binance, OKX, or Kraken—especially for U.S.-based users—might be better alternatives, while equity traders could prefer platforms like eToro.

Read more:

- Binance Review: Features, Supported Cryptos and Fees!

- Bybit Review: Pros, Cons and Key Features

- OKX Review: Pros, Cons, Future Potential & More

- HTX Review: Fees, Security, Pros & Cons

- Bitget Review: Pros & Coins, Fees & More

- Bitfinex Review: Is It Secure or Scam?

- Kucoin Review: Social Trading, Fees, Pros & Cons

- Crypto.com Review: Is the Exchange Safe or Scam?

- BingX Review: Verified Reviews, Pros & Cons

- LBank Review: Should You Use It?

- bitFlyer Review: Pros & Cons and Ratings

- ProBit Review: Is It the Right Crypto Exchange for You?

- P2B Review: Fees, Features, Safety, Pros & Cons

- Pionex Review: Pros, Cons & All You Need to Know

- BitMEX Review: Fees, Trading, Staking & More

- Phemex Review: Is It a Good Crypto Exchange?

- BTSE Review: Is It Safe & Reliable?

- CoinEx Review: Is This Crypto Exchange Safe?

- Poloniex Review: Features, Regulation & Risks

- BITFLEX Review: Features, Safety, Pros & Cons

- CoinJar Review: Is It the Right Exchange for You?

- Paymium Review: Pros, Cons, Key Features & Fees

- LBank Review: Is It the Right Exchange for You?

- MEXC Review: Latest Pros, Cons, Key Features & Fees

- BitMart Review: Reviews, Trading Fees & Cryptos

- Margex Review 2025: Is the Exchange Safe or Scam?